TransDigm Group Incorporated (NYSE:TDG) has a solid history of growth, which is expected to continue into 2020. The company generates its growth inorganically having acquired 10 companies over the last four years.

The company has ample working capital and operates with high profit margins. However, its debt has worked its way higher over the last decade, and the company now owes more than what its assets are worth.

TransDigm is an electrical and mechanical components supplier to the aviation industry. Due to its strong growth, the stock is reasonably priced with a forward PE multiple of 22x.

Personally, I think this is a great growth stock, but a high-risk, buy-and-hold investment due to its increasing debt. I think that TransDigm would make a great stock for traders when it pulls back (due to its strong uptrend). It could also suit investors who actively manage their portfolios, but I don't think it's suitable for buy-and-hold investors.

FinancialsTransDigm has reported financial results for the first quarter ending December 31 (data from Seeking Alpha and Yahoo). Note: Fiscal year ends September 30.

The company's first quarter revenue increased 4.2% over the first quarter from a year ago. TransDigm reported diluted earnings per share of $3.05, which was down from the $4.60 reported in the first quarter of the previous fiscal year. The company's reported EBIT increased 22% over the first quarter of the previous fiscal year. The EBIT (Earnings Before Tax and Interest) gives an indication of the company's profitability at an operational level.

On an annual basis, revenue for 2018 full fiscal year (ending September 2018) was up 92% over the previous fiscal year. The company's diluted earnings per share for the same period was up 92%, and its EBIT was up 77%.

TransDigm's current ratio is 4.1, meaning that its current assets exceed its current liabilities. TransDigm has a history of operating with a decent amount of working capital. The current ratio has ranged from 2.5 to 5.2 over the last decade. Working capital is the company's short-term finances such as cash and short-term deposits. With such a generous amount of working capital, TransDigm will have no problems with paying their bills.

TransDigm's balance sheet carries a lot of long-term debt which has reached $12.53 billion. This represents 90% of its total liabilities, which has reached $14.06 billion. In fact, the company's long-term debt is more than its total assets of $12.39 billion (note that the asset value is not the liquidated value of its assets which is probably even less). The long-term debt has risen from $1.36 billion ten years ago.

The asset ratio (total liabilities to total assets) is 113%, which means that TransDigm's total debt is more than the value of everything the company owns (note that the asset value is the book value and not the liquidated value of its assets). Over the last decade, TransDigm's asset ratio has worked its way up to 113% from 67% in 2009.

The company's book value is not applicable due to the company's negative net assets value.

Similarly, the return on equity is not applicable due to the company's negative net assets value.

The profit margin is currently 21%. The company has a history of operating with decent profit margins. Over the last ten years, its profit margin has ranged from 7% to 23%, and its profit margin was above 16% for eight of those years.

The analysts' consensus forecast is for revenue to increase 39% in 2019 and increase 25% in 2020. Earnings are forecast to increase 5% in 2019 and increase 20% in 2020. The 2020 PE ratio is 22x, and the trailing PE ratio is 31x.

The financials reveal that TransDigm is a profitable company that operates with a generous amount of working capital. The working capital is the company's short-term finances such as cash and deposits. The generous working capital allows the company to pay its bills without difficulty.

However, the company's long-term debt is a major concern. Its total debt (long term and short term) has increased significantly over the last decade. In fact, the company's asset ratio (which measures total debt to assets) has increased from a reasonable 67% up to a whopping 113%.

The problem here is that TransDigm now owes more in its debt than what its assets are worth. If the company were liquidated, it cannot repay all the money it owes. Another issue with this enormous debt level is that the company will find it extremely difficult obtaining any further finances as the company has nothing it can offer as security.

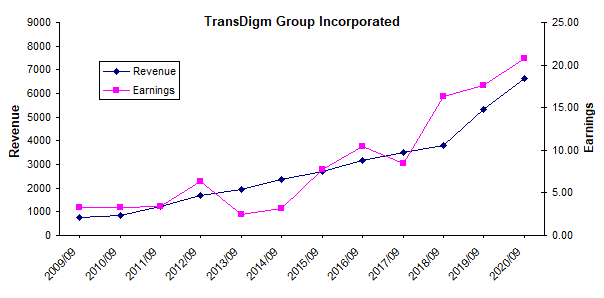

Revenue and EarningsAs an investor, I personally like to examine the company's revenue and earnings history. To make this task easier and more convenient, I like to visually present the data on a chart.

TransDigm data by ADVFN

The above chart visually shows TransDigm's historical revenue and earnings trend along with the next two years of consensus forecasts.

Examining the chart shows that TransDigm's revenue has steadily increased over the last decade with a consistent upward. The forecast shows that the company's revenue is expected to increase more strongly in the next two years with a steepening of the trend. The earnings have generally increased with an upwards trend even though it has shown some minor volatility. The earnings did decline in 2013 and 2017. The forecast earnings show a continuation of the company's historical earnings growth trend.

The company certainly has a solid history of growth, but it also has a nasty history of escalating debt. Its asset ratio (total liabilities to total assets) has increased from 67% to 113% over the last ten years. In fact, the company now owes more than what its assets are worth. TransDigm's long-term debt has risen from $1.36 billion ten years ago to $12.39 billion, which now represents 90% of its total liabilities.

The company's impressive growth is largely fueled by acquisitions. Since July 2015, TransDigm has acquired 10 companies ranging in value from $50 million to $4 billion.

TransDigm has a current market cap of $24 billion and its largest acquisition was Esterline Technologies (ESL) for $4 billion, which was just completed this year. The shareholders of Esterline will receive $122.50 per share in cash. The deal is valued at about $4 billion, including the assumption of debt. The surge in forecast growth is attributed to the Esterline acquisition.

Esterline posted revenue of $2 billion for fiscal year 2018 with diluted earnings per share of $2.32 and net income of $69.5 million. This gives a 3.4% profit margin and a PE multiple of 52x. Esterline's asset ratio is 39%, with $587.8 in long-term debt representing 49% of its total liabilities.

The $122.50 takeover price represents a 38% premium to Esterline's closing stock price of $88.79 on October 9, 2018, the day before the deal was announced. Companies offering to pay more than the takeover company's recent stock price is normal - that's how they get the takeover company to accept and recommend the deal to their shareholders. The big question is whether the price offered is a reasonable price or a ridiculously high price.

In the case of the Esterline deal, TransDigm paid a whopping 52x for Esterline's earnings. While it's true that companies need to pay a premium to take over another company, especially if that company has strategic value. The problem here is that TransDigm paid a ridiculously high price for a company that it could not afford to buy - as TransDigm was already drowning in debt.

Granted its long-term debt is not due to mature for some years, but here's the problem. When the debt matures, what happens if interest rates escalate by then and TransDigm is forced to renew its massive debt at higher interest rates? At present, we're still in a low interest rate period, but these periods cycle from low interest rate periods to high interest rate periods.

It makes me wonder how TransDigm will handle a 10% or higher interest rate. With its $12.5 billion debt, TransDigm currently paid $663 million in interest which left the company a net income of $957 for the 2018 fiscal year. Paying 10% would lead to a $1.25 billion interest bill (lowering its really good 2018 net income down to $370 million).

The big problem I think is that TransDigm does not make enough profits from its acquisitions in order to pay for them. The idea is that, over time, the profits generated from the acquired company pays back the capital that was used to buy it.

I think that management is too focused on trying to build the world's best inorganic growth story that they have lost sight of the most basic business rule and that is to keep your debt under control while generating a profit. Companies that do not do so are the ones that typically wind up in bankruptcy sooner or later.

Stock ValuationTransDigm has a history of growth with its revenue increasing 14% per year and its earnings increasing 16% per year since 2012. An appropriate method for valuing growth stocks is the PEG (PE divided by the earnings growth rate).

The earnings growth heading into 2020 is 20%. Including the historical growth rate helps average out the growth rate. The earnings growth from 2012 to 2020 is 16% per year which gives a forward PEG is 1.3 with a 2020 PE multiple of 22x.

It's commonly accepted that a stock is fairly valued when its forward PEG is 1.0, which means that TransDigm is slightly overvalued with a stock price of $454. Its fair value would be around $350.

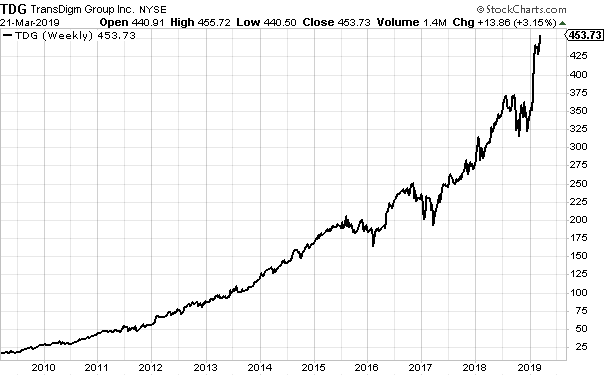

Stock PriceAs an active investor, I personally like to determine some likely price targets. This gives me a feel for how high the stock price could go in the short term and how soon it could get there.

TransDigm chart by StockCharts.com

The stock chart reveals that TransDigm's stock price has traded up over the last decade with a strong trend and little volatility. When the stock market pulled back late last year, TransDigm essentially traded sideways and when the stock market rallied this year the stock took off like a rocket.

From a technical viewpoint, the stock is overbought and due for a pullback. If the stock market continues to rally, TransDigm could rally some more, but personally, I think it's due for a pullback. After a pullback, the stock could well resume its upwards trajectory.

Over the longer term, TransDigm has the potential to continue trading higher and will probably do so as long as it continues to generate future earnings growth. The stock is not that expensive, but its escalating debt could become an issue and potentially hinder the stocks advance at some point in the future.

ConclusionTransDigm is a company with a solid history of growth and this growth is expected to continue heading into 2020. The company's strong growth is largely inorganic with the acquisition of 10 companies over the last four years. TransDigm has ample working capital and operates with high profit margins. However, the financials reveal a disturbing trend of escalating debt. The company now owes more than what its assets are worth.

The stock is reasonably priced, thanks to its strong growth. The stock has a forward PEG of 1.3 with a 2020 PE multiple of 22x.

Personally, I think this is a great growth stock, but a high-risk, buy-and-hold investment due to its ever-increasing debt. It's always great when the stock price just goes up and up, but in the future, the stock price can get hammered if something happens that the market doesn't like. I have been around the stock market for a long time, and I've seen this happen plenty of times.

In my opinion, TransDigm would make a great trade for active stock traders when it pulls back. The stock could also suit investors who actively manage their portfolios, but it's not a stock to buy and hold.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.