Image source: The Motley Fool.

Tilray Inc (NASDAQ:TLRY)Q4 2018 Earnings Conference CallMarch 18, 2019, 5:00 p.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:Operator

Good day, ladies and gentlemen, and thank you for standing by. Welcome to the Tilray's Fourth Quarter and Full Year 2018 Earnings Conference Call. At this time, all participants are in a listen-only mode. (Operator Instructions) Later, we'll have a question-and-answer session. And as a reminder, this conference is being recorded.

Now it's my pleasure to turn to call to Katie Turner from IR.

Katie Turner -- Investor Relations

Good afternoon and thank you for joining us on Tilray's fourth quarter and full fiscal year 2018 earnings conference call. On today's call are Brendan Kennedy, President and Chief Executive Officer and Mark Castaneda, Chief Financial Officer.

Before we begin, please remember that during the course of this call, management may make forward-looking statements within the meaning of the federal securities laws. These statements are based on management's current expectations and beliefs and involves risk and uncertainties that could differ materially from actual event and those described in these forward-looking statements. Please refer to Tilray's report filed from time to time with the Securities and Exchange Commission and its press release issued today for a detailed discussion of the risks that could cause actual results to differ materially from those expressed or implied in any forward-looking statements made today.

Finally, please note on today's call, management will refer to adjusted EBITDA,which is a non-GAAP financial measure. While the company believes adjusted EBITDA will provide useful information for investors, the presentation of this information is not intended to be considered in isolation or as a substitute for the financial information presented in accordance with GAAP. Please refer to today's release for the reconciliation of adjusted EBITDA to net loss, the most comparable measure prepared in accordance with GAAP.

Now I would like to turn the call over to Brendan.

Brendan Kennedy -- President and Chief Executive Officer

Thank you, Katie. Good afternoon, everyone, and thanks for joining us. On today's call, I will review the progress we have made on executing on our global growth strategy, including our recently announced strategic partnerships and acquisitions, and provide an update on our opportunities for long-term growth in the global medical and adult-use cannabis markets. Mark will then review our fourth quarter and full year 2018 financial results in more detail and discuss our long-term financial targets. After that, we will open up the call for your questions.

We are still in the early stages of the global transformation of $150 billion worldwide industry. We believe that over the long term, companies such as Tilray, with a portfolio of trusted brands powered by multinational supply chains, who win the market by earning, the confidence of patients, consumers, and governments around the world. Taking advantage of Tilray's best-in-class global platform, our team continues to focus on being a leader in defining the future of the industry, and delivering on the potential we see to be a multi-billion dollar consumer packaged goods company.

Focusing on our full year results, we are pleased with our growth and momentum. Revenue increased by 110% year-over-year to $43.1 million. In total, the kilogram equivalents sold increased both sequentially and on a year-over-year basis. We achieved this growth despite supply chain constraints across Canada, that have created pricing pressure for cannabis that meets our quality standards, forcing us to source from other suppliers.

Over the next 18 months, we believe there will be oversupply, just as we have seen in certain US states as operators in new legal markets race and government regulators catch up to find an equilibrium between supply and demand. To capitalize on global growth opportunities on both medical and adult use cannabis, Tilray will deploy capital in most promising markets, where we see the greatest potential to pursue multiple paths to grow.

The United States and European markets are orders of magnitude larger than Canada. So, while Canada will continue to be an important market for us, we expect to focus the majority of future investments on the US and Europe. We will not purchase or invest in what we believe to be overpriced supply assets in Canada, which we believe will erode in value in the medium to long term, as the market normalizes.

As we have communicated previously, our global growth strategy remains focused on six top-line performance drivers that we expect to generate strong returns, as the business continues to grow. First, increase our production capacity and inventory to serve the rapidly growing global market. Second, maintain a rigorous focus on quality as we scale. Third, partner with established distributors and retailers to scale distribution of our products further and faster. Fourth, for the differentiated portfolio brands and products that appeal to a diverse set of patients and consumers. Fifth, expand the addressable medical market by fostering mainstream acceptance with the medical community and governments. And finally six, pioneer the future of our industry by investing in innovation, research and development in clinical research. In line with this strategy, our recent strategic partnerships include a global alliance with Sandoz, a division of Novartis, one of the world's leading pharmaceutical companies.

Our original agreement was focused on Canada, and this new global deal legitimizes medical cannabis on a global scale and increases access for patients in need across the world. In the next year, we anticipate distributing medical cannabis to at least a half a dozen more countries globally through this partnership with Sandoz. We also formed a strategic partnership with AB InBev to research non-alcohol beverages containing THC and CBD. The 50/50 joint venture combined AB InBev's deep experience and beverages with our expertise in cannabis products. And each company intends to invest up to $50 million for a total of up to $100 million. We're pleased to report that we have appointed a CEO for the JV and our leveraging the research that Tilray has already performed for duration and time the onset on beverages.

Our revenue sharing agreement with Authentic Brands Group ABG is a long term partnership designed to leverage ABG's portfolio of more than 50 of the world's most iconic brands, as well as their extensive distribution network across North America. The partnership will initially focus on CBD products in the United States, and THC and CBD products in Canada, and we will expand globally as regulations permit.

The branding opportunities in the US and Europe around the retail and OTC consumer products are far more interesting than the branding opportunity today in Canada due to packaging and branding restrictions. Additionally, when we look at net new consumers at CBD and THC, distributors and retailers mark relationships with brands that they already know and trust, which is why we're so excited to partner with ABG.

Strategic mergers and acquisitions remain a core focus of our global growth strategy. Last month, we closed the acquisition of Manitoba Harvest, the world's largest hemp natural foods producer for approximately $317 million. Manitoba Harvest has nearly CAD100 million in gross revenues, distributes its products to more than 16,000 retail locations in the US and Canada, and is the leading hemp foods company, with seed-to-shelf capabilities, maintaining control over quality, production, manufacturing, marketing and distribution of its products.

The acquisition of Manitoba Harvest is Tilray access to relationships with farmers, who plant more than 30,000 acres of hemp, as well as some of the largest distributors in retailers across Canada and the US. We look forward to distributing hemp-derived CBD products across North America under the Manitoba Harvest brand as well as other brands by leveraging Manitoba Harvest's established supply chain going forward.

We also recently acquired Natura Naturals Holdings Inc., a federally licensed cannabis cultivation company based in Leamington, Ontario for approximately CAD70 million. The increased supply from Natura, which we have rebranded as High Park Gardens, will allow us to further expand our market share in the Canadian adult-use market with high-quality branded cannabis products.

Finally, in December, we invested CAD7.5 million in ROSE Life Sciences, a Quebec based cannabis producer, and have an exclusive sale, supply, distribution and marketing agreement to deliver adult-use products under our portfolio of brands in Quebec. We believe our recent strategic global partnerships and acquisitions demonstrate our emphasis, on the diversification of our global opportunities for long-term growth and our disruption of critical industries as we expand our addressable market.

Our team remains disciplined in our approach, making key strategic investments to support the sustainable growth we expect to achieve over the next several years. Last week, we announced that Andrew Pucher has joined us, as our Chief Corporate Development Officer, overseeing M&A and corporate investments. Andrew previously served as the Managing Director at Goldman Sachs, where he most recently covered the Canadian cannabis industry. We are excited about the contributions he will make as we accelerate our growth.

Going forward, we will continue to pursue strategic M&A that opens new territories, increases our capacity, increases our brand offerings through innovative farm factors, brings us R&D technologies and we expect this selectively invest in retail distribution.

As I said earlier, our increased focus on the US and Europe, among other international markets, is tied to the fact that we believe they represent a significantly larger opportunity for Tilray long term, where we can extend beyond our potential in Canada. Simply put, we are building a company for the long term. We believe that the field of battle has changed and that the US and Europe are going to be more important over the long term.

In the US, Tilray is building a portfolio of brands and products with the goal of making them industry leaders in every market, where cannabis is legal. I believe we are a lot closer to federal legalization in the US than most people realize.

The Farm Bill presents an excellent opportunity for Tilray to capitalize on an estimated US$22 billion hemp-derived CBD industry in the US. We have US CBD supply chain in place through the acquisition of Manitoba Harvest in a deal to produce hemp-derived CBD infused products for authentic brands group as regulations permit.

We have also finalized the CBD supply agreement to source CBD from LiveWell Canada, and the United States for wellness and medical Tilray branded CBD products across North America. We expect LiveWell to begin shipping product to us during the second quarter of 2019. In the coming months, we expect to make additional announcements about strategic investments and partnerships in the US to position Tilray for long term leadership in the market.

Focusing on Europe, just last month, the European Parliament passed a resolution similar to the World Health Organization's recommendation to increase access to medical cannabis. Further legitimizing the industry, and we believe this decision will encourage other states and countries to legalize. We began 2018 with 28 countries having legalized medical use globally and ended the year with 41. And we can easily see how that number grows to 50 or 60 by the end of 2019.

Our EU Campus in Portugal completed a successful medical harvest earlier this month and we are well positioned to serve the EU market, as more countries legalize. We expect the EU Campus to produce and distribute cannabis in the EU for the EU and believe that having a local vertically integrated supply chain presence is an important differentiator for us to reduce costs and hedge against regulatory risk. Our campus includes indoor, outdoor and greenhouse cultivation sites, as well as research labs, processing, packaging and distribution sites for medical products.

This first harvest was a significant milestone for the company and we expect multiple harvests in the coming months. By the end of 2019, we expect to increase our production space to 2.2 million square feet, approximately double compared to the end of 2018. On our existing properties, we have the ability to expand our total production space to 4.5 million square feet. Our seven production facilities around the world are significantly increasing our global production output compared to 2018.

While the Canadian market remains challenged with quality supply, we are confident the supply demand will become more balanced over time, as additional supply becomes available. Longer term, we do not believe Tilray will be in the farming business, so we're not allowing the near-term supply disruption to change our strategy for growth over the next two years.

From a retail perspective, we've have taken small steps in Canada including minority investments in Fire & Flower, Inner Spirit and Westleaf, and expect to invest more aggressively in the months to come. To aiding our global expansion, we have formed an International Advisory Board to provide strategic perspective to our executive team and Board of Directors. The Advisory Board consists of 10 internationally renowned business and government leaders, who continue to provide us with strategic insights, as we pioneer the future of our industry.

As mentioned earlier, we have also expanded our global senior leadership team with six strategic executive hires from world-class organizations to help our existing teams spearhead our future growth and development internationally. In addition to Andrew Pucher, as our new Chief Corporate Development Officer from Goldman Sachs, we hired Greg Christopher, who joined from Nestle to be our Executive Vice President of Operations. Rita Seguin joined from Diageo as Executive Vice President of Human Resources.

Dara Redler, our General Counsel, joined from Coca-Cola. Charlie Cain , our Vice President of Retail, joined from Starbucks and Sascha Mielcarek, our Managing Director Europe joined us from Grunenthal . At the same time, our team remains deeply committed to clinical research. This is important for the future of medicine, as well as being a competitive differentiator in the industry and has accelerated awareness, very positive awareness in international medical cannabis market.

Most recently in the fourth quarter, we partnered with researchers at the Lambert Initiative for Cannabinoid Therapeutics at the University to Sydney to complete a study examining the effects of cannabis on driving and cognitive function. The trial phase of the study culminated in 2018 and results are expected to be published sometime this year.

Looking ahead to the balance of the year and into 2020, we continue to anticipate the following corporate milestones: Launching Tilray and Manitoba Harvest CBD products in the US, as regulations permit, signing additional adult-use supply agreements in Canada, shipping Tilray products to pharmacy chains in Canada, exporting Tilray medical products to new countries, expanding Tilray's medical cannabis product offerings in the international markets we currently serve, extending our existing pharmaceutical partnerships to additional countries and regions, obtaining a sales license for High Park's processing facility in London, Ontario; additional clinical trials; recruiting additional executives from outside of the industry to further strengthen our management team; and finally, adding strategic partnerships and acquisitions in the United States and Europe.

In summary, we are incredibly proud of our achievements in 2018 and are excited about our growth potential over the next several years. We will continue to execute on our strategic initiatives and take actions that will fuel long term value for our shareholders as well as our customers, consumers, patients, and employees around the world.

With that, I would like to turn the call over to Mark.

Mark Castaneda -- Chief Financial Officer, Secretary and Treasurer

Thanks, Brendan. Good afternoon to those of you joining us on the today's call and webcast. It is a pleasure to be speaking with you today. Please note all the financial information we discussed today is prepared in accordance with US GAAP that is in US dollars unless otherwise indicated. We are pleased to report the fourth quarter financial results and the significant growth opportunities that lie ahead.

Focusing on fourth quarter results in more detail; Q4 revenue was $15.5 million, representing an increase of 204%, as compared to the fourth quarter last year. Revenue growth is driven by the inaugural sales for the Canadian adult-use market, bulk sales and accelerated wholesale distribution in export markets.

Extract products represented a greater mix at approximately 54% of revenue for the fourth quarter of 2018, compared to 24% of revenue for the same period last year. We are pleased with the performance in adult-use market so far and expect adult-use to be a growth driver for 2019, as we continue to ramp up supply and with additional form factors that are expected to be included in our results later this year.

Moving on to operational metrics. Total kilogram equivalents sold increased more than threefold to 2053 kilograms from 694 kg in the same quarter of 2017. The overall average net selling price per gram increased to $7.52 from $7.13 in the prior year. The increase is primarily due to an increase in mix of higher priced extract products with improved price per gram, as a percentage of total revenue compared to the prior year.

Looking at the Canadian direct to patient sales, our average selling price per gram increase 9.4%to $7.43 compared to $6.79 per gram. Again, primarily due to product mix. Drilling into adult-use, our average and selling price per gram was $5.40 per gram, which we expect to increase over the longer term, as higher price value-added products become available in Q4. On the production side, we continue to expect significant increase throughout 2019, as we expand our capacity to 90 metric tonnes, as we bring our Ontario greenhouse and Portugal facilities fully online. As Brendan mentioned, we've recently completed successful harvest at our EU Campus in Portugal and has a multiple harvest in the coming months.

Gross margin for Q4 decreased to 20% from 57% in the same period last year. As a result, the procurement of third-party supply, costs related to ramping up our production and absorbing the tax for medical patients. We expect to see margin pressure during the ramp up of our production facilities and during the temporary lack of industry supply.

Longer term, we continue to expect 50% plus gross margins, as we lower our costs through greenhouse and outdoor cultivation and as we ramp those facilities past the start-up phase. We also expect reduced revenue per unit, as selling wholesale in the adult-use market becomes a bigger mix of our revenues.

Our total operating expenses increased to $26 million, which includes $4.1 million in non-cash stock compensation expense, excluding that operating expenses increased to $21.9 million from $5.5 million in the prior year. The increase was primarily due to $12.3 million increase in G&A associated with higher professional fees and increased resources that support our growth and expansion for the start up of operations for adult-use.

Net loss for the quarter was $31 million or $0.33 per share compared to $3 million or $0.04 per share in the fourth quarter of 2017. Net loss included non-cash stock compensation charge of $4.1 million compared to $34000 charged in the prior year. Adjusted EBITDA was a loss of $17.8 million compared to a loss of $2.1 million in the fourth quarter of last year. The increase in net loss and adjusted EBITDA was primarily due to the expected increase in operating expenses related to driving our expansion forward, such as investing on continued growth, expansion of international teams and costs related to M&A and public company costs.

Turning to the balance sheet. We ended the quarter with cash and short-term investments of approximately $517 million. As a reminder, in October we announced the pricing of a $475 million convertible debt private placement, resulting a net proceeds before expenses of about $460 million. We intend to use the proceeds for working capital, future acquisitions, and general corporate purposes. We believe we have sufficient capital to execute our CapEx and offer an expansion plans for the next 12 to 18 months.

On a longer term basis, we intend to further build on our early leadership in the global cannabis industry and to achieve growth for years to come. We see an opportunity to capture a sizable portion of this market with estimated gross margins of 50% plus and adjusted EBITDA margins of 25% to 30%.

The EBITDA margins are based on the legal markets that exist today, and as new markets are added, we will invest to develop those markets, which could have

Data by YCharts

Data by YCharts

Source: Shutterstock

Source: Shutterstock

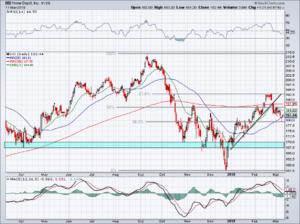

The S&P 500 is once again probing critical resistance at $2,820. This marks the sixth such test since October and a successful break will signal a major victory for bulls.

The S&P 500 is once again probing critical resistance at $2,820. This marks the sixth such test since October and a successful break will signal a major victory for bulls.