Investopedia defines risk as:

The chance that an investment's actual return will be different than expected. Risk includes the possibility of losing some or all of the original investment.

To address risk in a modern sense, the noted "margin of safety" author and investor, Howard Marks (in his book, The Most Important Thing) wrote:

Great investing requires both generating returns and controlling risk. And recognizing risk is an absolute prerequisite for controlling it.

Marks went on to explain:

When you boil it all down, it's the investor's job to intelligently bear risk for profit. Doing it well separates the best from the rest.

The Intelligent REIT Investor Recognizes Mispriced Risk

Two weeks days I wrote a Seeking Alpha article (3 Healthcare REITs With Mispriced Risk) in which I warned that several REITs were becoming risky based in underlying income fundamentals. As I explained:

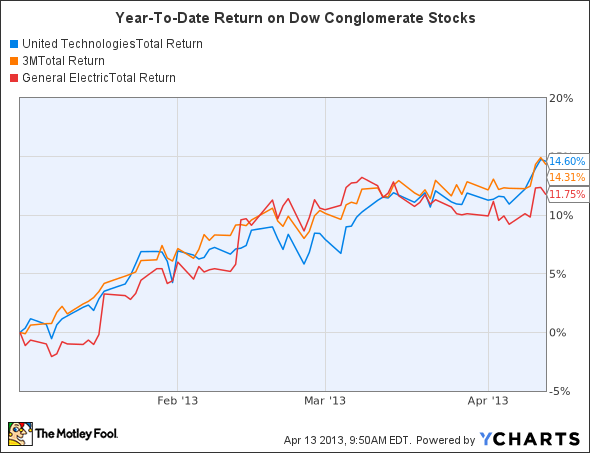

It's clear to see that these "higher risk" assets are also driving the returns, and it's important for investors to understand the risks and the value proposition of investing in lower quality vs. higher quality assets. Simply said, OHI, MPW, and AVIV have all turned in outstanding total returns in recent months; however, there is reason to believe there is a lower margin of safety when there is mispriced risk.

I went on to explain:

I'm not a trader. I'm an investor and I claim to be an "Intelligent REIT Investor." I have written detailed articles on both MPW and OHI and I have loved watching the performance records of both REITs. However, I am feeling like the risk of owning lower quality assets (that means higher cap rates) does not adequately reflect the premium of the risk-adjusted shares, especially when compared with the higher quality peers.

In a follow-up article I warned about mispriced risk again when I wrote:

Often mispriced risk can be a signal that it's time to rebalance your portfolio. That process ! of selling your winners can be driven by instinct or analytics, or a combination of both. For some, rebalancing can be as simple as a gut check since nobody wants to sell stocks when they're soaring or buy them when they're plunging.

It's wise to resist the urge to plow money taken from mispriced REIT stocks into higher-yielding REITs since the mispriced REITs have already had a big run, and investors should consider rebalancing out of the riskier holdings. Conversely, intelligent investors should consider a safer strategy of taking advantage of the mispriced risks of the REIT preferred sector.

Last Friday, Seeking Alpha reported the following:

A Bank of America (BOA) downgrade sends Medical Properties Trust (MPW) tumbling. The bank cut the shares to Underperform from Neutral citing the REIT's YTD outperformance relative to the sector overall (it has outpaced healthcare REITs two to one). Put simply, funds from operations "multiple expansion has exceeded fundamental trends." SA contributor Brad Thomas claims MPW is an example of mispriced risk.

As Howard Marks wrote (in The Most Important Thing):

Successful investors manage to acquire that necessary "trace of wisdom" that Benjamin Graham calls for.

What Caused the Recent Medical Properties Trust Pullback?

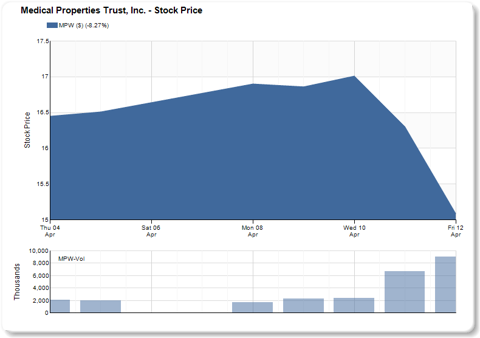

Back in November (2012) I wrote an article on Medical Properties Trust (or MPW) and I recommended the stock at a price of $11.40 per share. Since that time and up until my article (on April 4th), the shares grew by 41.57%.

(click to enlarge)

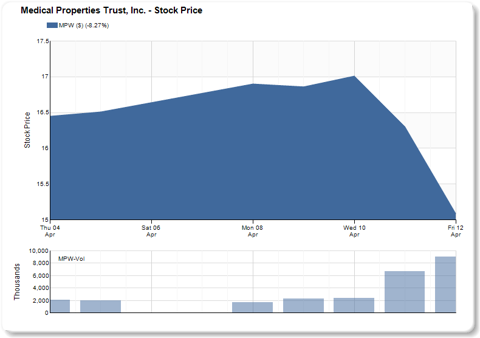

Then last week, shares of MPW fell from a high of $17.00 to a Friday close of $15.00 - a 12% pullback.

(click to enlarge)

Clearly, BofA analyst Jana Galan felt that MPW! had beco! me a riskier priced stock as her downgrade from Neutral to Underperform was reflected in her report (source: benzinga.com):

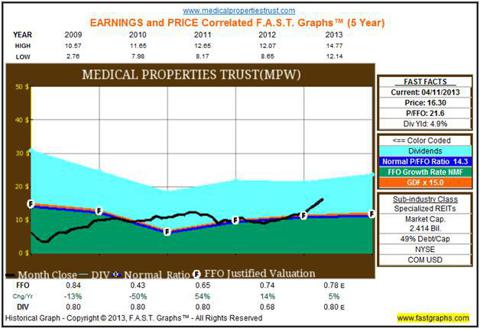

We are downgrading MPW to an Underperform rating from a Neutral rating based on valuation. Year to date, MPW has been one of the best performing stocks in the REIT sector, returning +38% compared to +19% for health care REITs and +13% for all REITs. We now expect 0% total return from our $16 price objective. We think FFO multiple expansion has exceeded fundamental trends. MPW is now trading at 14.8x for 2013 FFOx, near its peak FFO multiple, compared to its 5-year and 10-year averages of 10.7x. In addition, expectations for accretive acquisitions are very high for the stock.

Also, MPW had some tough news later in the day when one of its tenants, Florence Hospital at Anthem, filed for Chapter 11 reorganization. The 96,000 square foot hospital facility has 36 beds and was built by MPW for around $30 million in 2010 (source: SNL Financial). The Florence facility represents around 1.3% of MPW's total assets.

The Florence Hospital at Anthem facility, owned by MPW and operated by Visionary Health, filed bankruptcy reorganization (in early March) and it appears that all rents have been paid up to filing and is seems that rents are still being paid. In addition, MPW has several months collateral if rents are halted or if company needs to transition to new tenant.

The troubled hospital's CEO David Wanger explained (source: Casa Grande Disptach) that the hospital has never missed a payment on its secured debt nor has it missed a payment to its landlord and he added that

We've never been an hour late paying the landlord.

Florence Hospital at Anthem is hoping to control costs and increase its profit margins; however, this is a "black eye for MPW as the Arizona facility - used by prisoners and civilians - was built just around 2 ½ years ago and has barely produced a return on investment.

Let's Dig Deeper Into MPW

As noted above, I prev! iously wr! ote an article on MPW so there is no need to provide a detailed analysis on the company. However, I want to take a closer look at some of the latest trends.

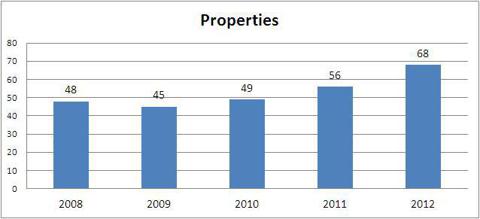

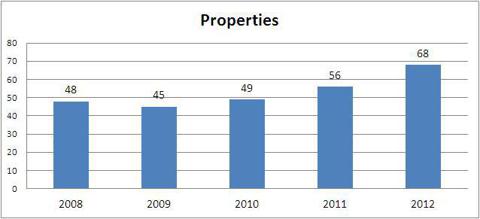

Let's start with properties. As of the latest quarter (Q4-12), MPW owned 68 properties.

(click to enlarge)

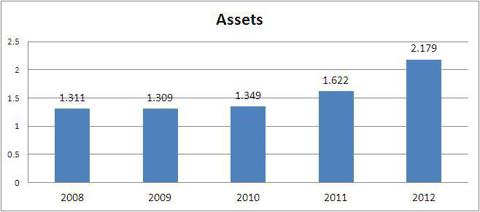

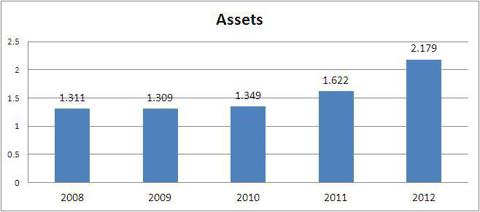

In previous years, MPW had never acquired more than $425 million in any one year (and averaged around $300 million a year) however, in 2012, MPW's acquisitions and commitments exceeded $800 million - producing a 34% increase in assets from 2011 to 2012. (snapshot below in $US billions):

(click to enlarge)

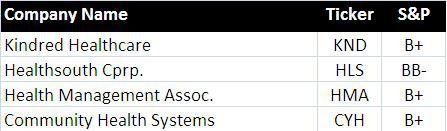

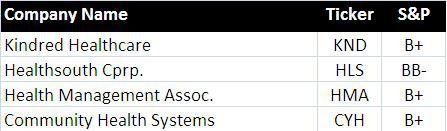

As the only health care REIT with a "hospital-focused" platform, MPW is a relatively new REIT that was formed (in 2004) to lease from many of the nation's leading hospital operators, including Prime Healthcare Services, Kindred Healthcare (KND), HealthSouth (HLS), Health Management Associates (HMA), Community Health Systems (CYH), Vibra Healthcare, Ernest Health Inc., and IASIS Healthcare.

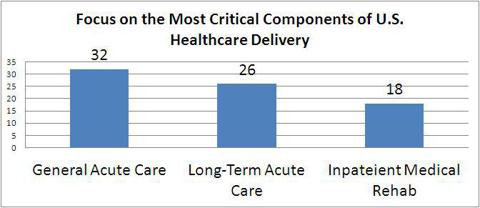

(click to enlarge)

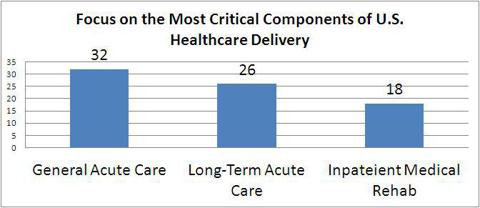

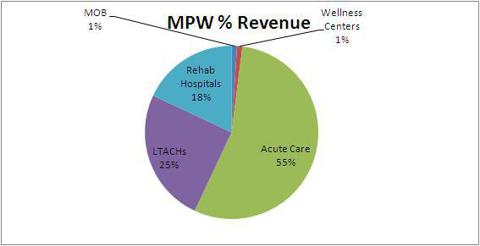

MPW's focus is its differentiated platform on the most critical components of U.S. healthcare delivery - general acute care, long-term acute care, and inpatient medical rehabilitation. Accordingly, the "pure play" investment strategy produces recession resistant income that provides durable predictability of cash flows and dividends.

(click to enlarge)

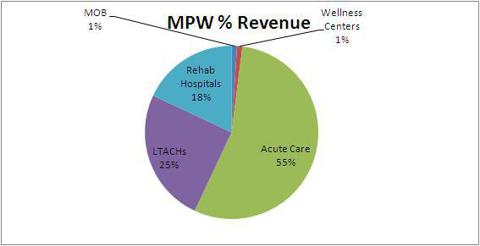

Here is a snapshot of MPW's "pure" hospital exposure compared with its peer group:

(click to enla! rge)![]()

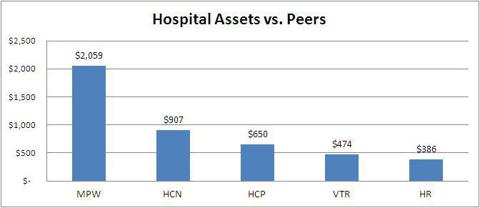

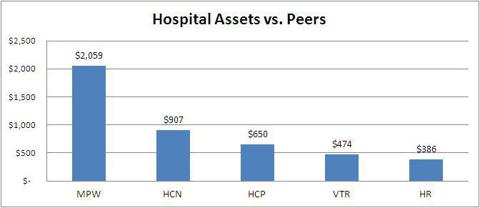

Here is a snapshot of MPW's "pure" hospital assets compared with its peer group (in $US millions):

(click to enlarge)

In a previous article I explained MPW's "wide moat" investment strategy:

A critical component for every community is an area hospital which provides essential services. There are over 5,000 hospitals in the U.S. and less than 1% closes in any year (source: MPW Oct. 2012 Investor Presentation). In addition, hospitals have exceptionally long life spans - many decades old. Accordingly, hospitals have tremendous "barriers to entry" as a new hospital today requires various regulatory approvals, permits, certificate-of-need, and of course, funding.

One other unique characteristic with hospital properties is that the license goes with the facility, not the operator. Consequently, other service providers and doctors cluster near the facility making relocation extremely difficult. Conclusively, MPW's lease structure provides for a "wide moat" protection of earnings and dividends.

Although we have seen tremendous cap rate compression among most asset sectors (see my article here in triple net cap rate compression), the hospital sector has not seen much compression in rates. The reason is that there is less demand for owning hospitals simply because the facilities involve substantial risk related to permitting and highly intensive capital allocation.

Last year MPW acquired several facilities leased to subsidiaries of Ernest Health, Inc. pursuant to a master lease agreement. These leases had 20-year terms with three five-year extension options and were acquired for an initial cap rate of 9%, with consumer price-indexed increases, limited to a 2% floor and 5% ceiling ann! ually the! reafter.

So, in a nutshell, we have seen MPW grow in less than ten years from around $300 million to around $2.179 billion (Q4-12). So let's see how the earnings have grown…

You Are Right Because the Data and Reasoning are Right

The prominence of overall income risk for MPW boils down to the company's tenant-level risk. Specifically, I believe that MPW's tenants pose the greatest risk associated with reimbursements in long term acute care hospitals (or LTACHs).

LTACHs appear to be the most vulnerable due to changes in Medicare reimbursements because they typically generate about 60% of revenue from Medicare. Consequently, the uncertainty of federal efforts to reduce health care spending subjects several of MPW's tenants to federal regulatory risk.

Although many of MPW's tenants are private, I did look over several of the publicly-traded tenants to assess balance sheet risk. Here are a few of the individual company S&P ratings that I located:

During the company's recent earnings call (Q4-12), MPW's CFO, Steven Hamner, explains:

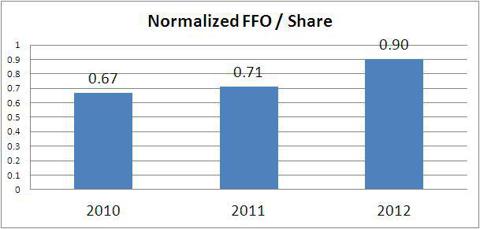

We think it's important to point out what maybe obviously and that is because we are continuing to make significant amounts of acquisitions at average cash rates of return between 9% and 11%. And because our cost of capital is substantially lower than that, each dollar we invest in new assets immediately increases our per share results and improves our dividend payout ratio even further. We made a single small RIDEA-type investment in the fourth quarter, our only such investment in 2012, other than the Ernest investment. That brings to eight the number of these investments in operations that we have made including Ernest.

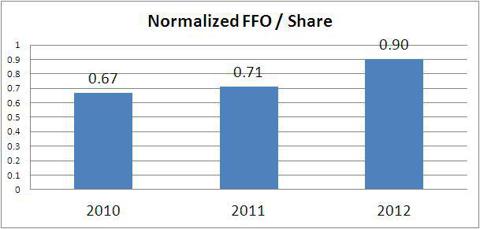

So now you can see how MPW has been able to increase its funds from operations. The leading hospital landlord is continuing to building up a consistent earnings machine o! f acquiri! ng sub-investment grade hospitals and leasing them back at some attractive risk-adjusted yields.

(click to enlarge)

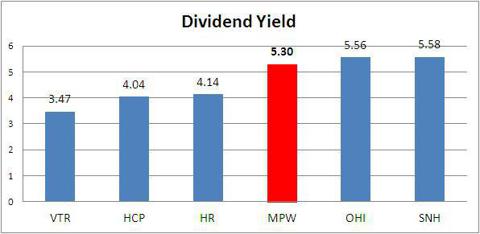

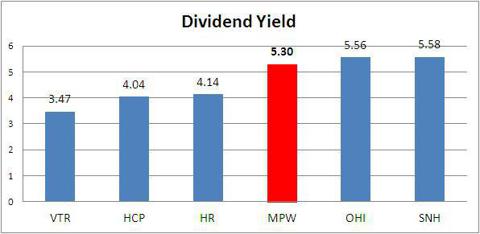

But what about dividend increases? MPW has a current dividend yield of 5.3%. How does that compare with the peer group?

(click to enlarge)

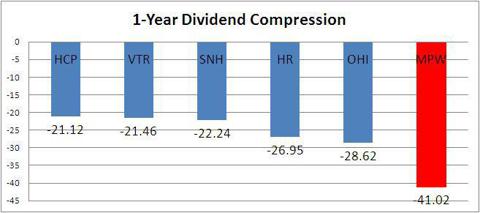

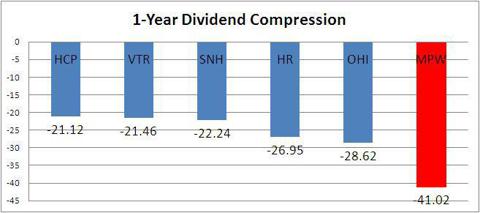

But this time last year MPW was paying an 8.99% dividend yield. That is a 41% compression in yield. As I mentioned earlier, MPW shares have increased substantially over the last twelve months - but so have many other health care REITs. Let's compare the dividend compression of the peer group:

(click to enlarge)

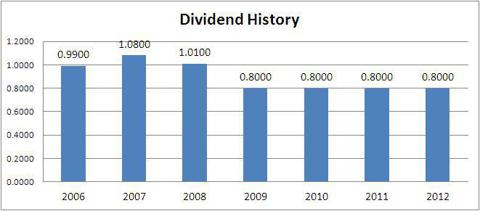

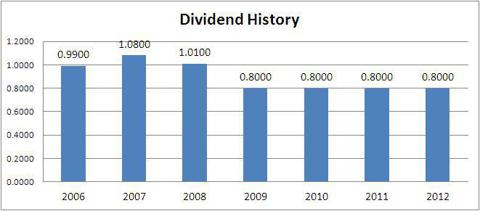

The above chart is a clear indicator that MPW's shares are mispriced. The dividend yield fell by over 41% (in a year) and the cap rates for the properties haven't. Also, MPW has not increased its dividend in a long time…

(click to enlarge)

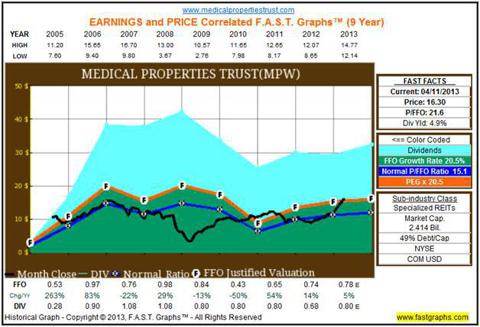

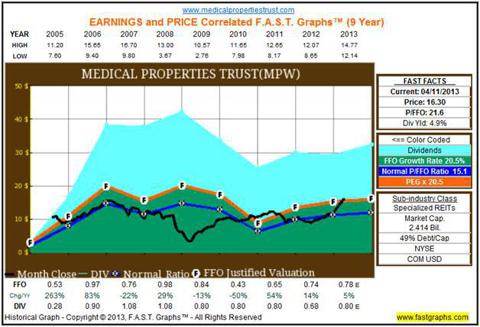

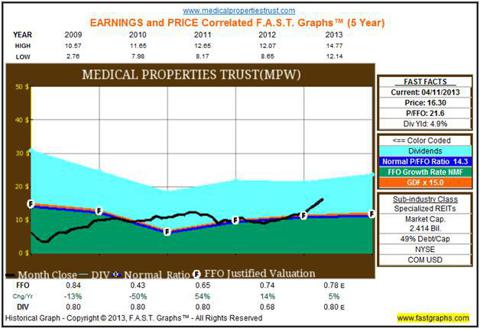

As the FAST Graphs™ below demonstrates, MPW cut its dividend (shaded blue area) from $1.08 per share to $.80 in 2009 and since that time the company has NEVER increased its dividend. However, the share price (solid black line) began to accelerate in 2012 as the company began to ramp up its acquisition pipeline (and FFO - the orange line marked "F").

(click to enlarge)

During 2012 it became apparent that Mr. Market was warming up too and that is reflected in the current 16.3 P/FFO multiple. Although! MPW was ! acquiring lower credit quality properties, the market began to accept the fact that hospital-based income was durable and that owning hospitals with "high barrier to entry" characteristics could generate sound earnings.

(click to enlarge)

Does MPW Have More Room To Run?

As Steven Hamner, CFO of MPW explained during the recent (Q4-12) earnings call:

We have positioned MPW from our inception over nine years ago to take advantage of high real estate returns from hospital real estate, assets which are truly critical necessary assets to the communities they serve, very similar to other infrastructure assets that a population cannot live without and additionally to earn incremental outsized returns from limited, prudent investments in operations.

It seems that Mr. Market has seen the mispriced risk associated with MPW's differentiated higher risk value proposition. Simply said, it makes no sense to invest in a REIT that pays out a dividend yield of 5.3% when its acquiring properties at 9%. In other words, I can buy shares in Realty Income (O) today ($47.73) and get a 4.7% dividend yield with much less risk.

MPW shares are off around 10% (from last week), but at an implied yield of 5.8% versus the 9%-12% yields that MPW acquires or builds hospital assets for remains considerably expensive. (The implied yield essentially values MPW hospital assets on par with and in some cases above assets at healthcare REITs). In addition, compared with MPW's implied yield and 10-year treasuries, MPW shares trade at a spread of 400bps, or about 260bps narrow of its historical spread. This signals that MPW shares are overpriced and are possibly the most overpriced small cap healthcare REIT today.

As Ben Graham believed, when selecting sound securities, one needed some kind of buffer to protect against market fluctuations. That buffer is the margin of ! safety - ! the difference between the real or intrinsic value of the business underlying the security and the price assigned to that security at the moment.

As I weigh in on the risk-adjusted pricing for MPW, I believe that a dividend yield of 7% is more prudent given the underlying credit characteristics of the portfolio. In addition, I believe that the MPW's management team has been stingy with increasing its dividend and that is evident with the fact that the company has not increased its dividend since 2007. For potential new investors, I recommend a target entry price of $13.50 per share. My justification for that price is based upon the risk-adjusted dividend yield of MPW's portfolio compared with the peer group.

For current investors, I still think the recent 10% price reduction still represents a premium valuation - of mispriced risk - and I would consider a rotation into a more risk-aligned heath care REIT like Healthcare Trust of America (HTA) yielding 4.82% or Ventas, Inc. (VTR) yielding 3.47%. (See my HTA article here and my VTR article here).

Ben Graham said:

We all know that if we follow the speculative crowd we are going to lose money in the long run.

As Warren Buffett believed, understanding mispriced risk means that an investor should "not be swayed by what other people thought or how the world was feeling that day or anything of the sort." It simply comes down to pursuing a risk-averse investment decision based on sound facts. I'm not a fortune teller; however, it was good that I was able to forecast the mispriced risk of Medical Properties Trust. The secret to investing is simple and I will sum it up with these select words from my mentor investor (Benjamin Graham):

An investment operation is one which, upon thorough analysis, promises safety of principal and satisfactory return. Operations not meeting these requirements are speculative.

Sources: SNL Financial, FAST Graphs, MPW Investor Presentation

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)