Alamy The year in its final quarter (and when did happen?), but you still have a couple of months to adjust your financial picture for 2014. Right now is actually an excellent time to get your tax planning in order, so that you can keep yourself out of trouble with the Internal Revenue Service when you file next April. The ideal situation would be for you to finish each year having paid exactly what you owe in taxes via timely estimated payments or withholding. By avoiding a huge refund, you keep your money in your control instead of giving Uncle Sam an interest-free loan. By not having to write a huge check in April, you protect yourself both from having to come up with the money to write that check, and from potential underpayment penalties. Tax Planning for People Without a Crystal Ball Of course, the odds are pretty good that you won't really know your total financial picture for 2014 down to the penny until the year is completely over. In fact, if you use some financial tools, such as a Traditional IRA, you can reduce your taxable income for 2014 by several thousand dollars, even after the calendar turns to 2015. Fortunately, the IRS realizes that it's nearly impossible to get your taxes squared away perfectly in advance. You do have until April 15, 2015, to get it right for 2014, and as long as you get your tax picture close enough with the time you've got left in 2014, the IRS won't penalize you, even if you do ultimately owe it money. The IRS uses a series of "safe harbor" tests to help determine if the taxes you pay throughout the year are close enough to what you ultimately owe to protect you from getting penalized for underpaying. As long as you meet any of the tests for the year through timely estimated payments or withholdings, you won't owe a penalty when you file and pay your 2014 taxes by April 15, 2015. The key tests: If you owe less than $1,000. If you've paid at least 90 percent of your taxes for 2014 (or 66 2/3 percent if you're a farmer or fisherman). If you've paid at least as much for 2014 as 100 percent of your taxes for 2013 (110 percent if your 2013 adjusted gross income was $150,000 or higher -- $75,000 if your 2014 filing status is married filing separately) Get Covered

Alamy The year in its final quarter (and when did happen?), but you still have a couple of months to adjust your financial picture for 2014. Right now is actually an excellent time to get your tax planning in order, so that you can keep yourself out of trouble with the Internal Revenue Service when you file next April. The ideal situation would be for you to finish each year having paid exactly what you owe in taxes via timely estimated payments or withholding. By avoiding a huge refund, you keep your money in your control instead of giving Uncle Sam an interest-free loan. By not having to write a huge check in April, you protect yourself both from having to come up with the money to write that check, and from potential underpayment penalties. Tax Planning for People Without a Crystal Ball Of course, the odds are pretty good that you won't really know your total financial picture for 2014 down to the penny until the year is completely over. In fact, if you use some financial tools, such as a Traditional IRA, you can reduce your taxable income for 2014 by several thousand dollars, even after the calendar turns to 2015. Fortunately, the IRS realizes that it's nearly impossible to get your taxes squared away perfectly in advance. You do have until April 15, 2015, to get it right for 2014, and as long as you get your tax picture close enough with the time you've got left in 2014, the IRS won't penalize you, even if you do ultimately owe it money. The IRS uses a series of "safe harbor" tests to help determine if the taxes you pay throughout the year are close enough to what you ultimately owe to protect you from getting penalized for underpaying. As long as you meet any of the tests for the year through timely estimated payments or withholdings, you won't owe a penalty when you file and pay your 2014 taxes by April 15, 2015. The key tests: If you owe less than $1,000. If you've paid at least 90 percent of your taxes for 2014 (or 66 2/3 percent if you're a farmer or fisherman). If you've paid at least as much for 2014 as 100 percent of your taxes for 2013 (110 percent if your 2013 adjusted gross income was $150,000 or higher -- $75,000 if your 2014 filing status is married filing separately) Get Covered

Tips to Get Your Taxes in Order Now, So You Can Relax in April

Makers of KitKat and MilkyWay join Ebola fight

Health workers in Liberia dress in protective clothing before taking the body of an Ebola victim. NEW YORK (CNNMoney) The world's largest chocolate companies are joining the fight against Ebola.

Health workers in Liberia dress in protective clothing before taking the body of an Ebola victim. NEW YORK (CNNMoney) The world's largest chocolate companies are joining the fight against Ebola. Much of their production comes in West Africa, and the companies are worried the virus will disrupt production Already, prices for cocoa beans have been soaring in recent weeks.

Nestlé and Mars say they have already responded to a call from the World Cocoa Foundation, a non-profit that helps small cocoa farmers. The group plans to disclose Wednesday how much it has raised. Others in the group include Hershey (HSY), Godiva, Ghirardelli, General Mills (GIS) and Mondelez International (MDLZ).

Donations will go to the International Federation of Red Cross, the Red Crescent Societies, and Caritas, a charity affiliated with the Catholic Church.

Nestlé, the Swiss company that makes KitKat, Butterfinger and Crunch said it is "deeply concerned" about the spread of Ebola in West Africa, where many of its 6,300 African employees are based.

Ebola crisis: World Bank pledges $400M

Ebola crisis: World Bank pledges $400M Mars Chocolate -- maker of MilkyWay, Twix and M&Ms -- said it was "happy to support" the initiative. Hershey (HSY) did not immediately respond to a request for comment.

West Africa produces 70% of the world's cocoa supply. The largest cocoa producer in the world is the Ivory Coast, which has so far avoided contamination. But there is concern that migrant workers may not be allowed into the country to help with this year's harvest. The Ivory Coast, also called Côte D'Ivoire, closed off its borders with Guinea and Liberia in August.

!

More than 4,000 people have died from Ebola in Guinea, Liberia and Sierra Leone, according to the latest figures from the World Health Organization. If it is not contained, the Centers for Disease Control and Prevention estimates there could be hundreds of thousands of Ebola cases in coming months.

The United States and other governments have pledged tens of millions of dollars to pay for everything from medicine and protective clothing for aid workers to safe burials for the deceased. Last month, the Bill and Melinda Gates Foundation announced Wednesday it will donate $50 million to help fight the Ebola outbreak.

Melinda Gates on Ebola: 'Vast inequities'

Melinda Gates on Ebola: 'Vast inequities'

Why women are losing the retirement savings game

Planning young: a retirement roadmap NEW YORK (CNNMoney) When it comes to putting money away for retirement, women outmatch men:

Planning young: a retirement roadmap NEW YORK (CNNMoney) When it comes to putting money away for retirement, women outmatch men: They are more diligent savers and more likely to put a bigger percentage of their paycheck into a savings plan.

Ultimate Guide to Retirement Getting started401(k)s & company plansInvestingAnnuitiesIRAsSelf-employment plansPensions and benefit plansSocial SecurityInsuranceEstate planningLiving in retirementGetting helpBut when it comes to the final savings tally, women are falling far behind.

According to a Vanguard analysis of more than 1 million 401(k) savers, women are 10% more likely to enroll in their workplace savings plan and save a bigger chunk of their paychecks.

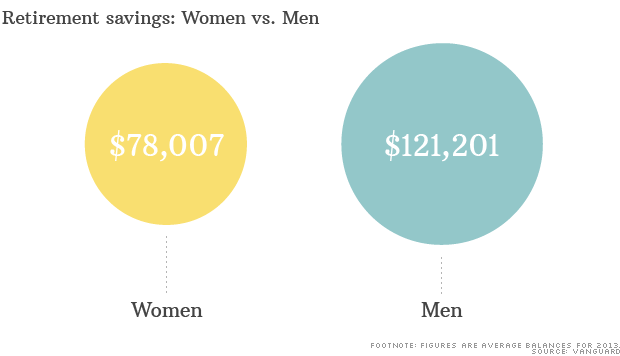

Yet Vanguard's analysis found that female savers have an average balance of $78,000 -- far below the male average balance of $121,000.

What gives?

You can blame some of it on the wage gap, says Jean Young, a Vanguard senior research analyst.

Overall, men in the survey earned an average of 40% more than women.

When Vanguard compared men and women of comparable incomes, women tended to have similar average savings to their male counterparts in most income brackets.

But a big disparity appeared among the highest earners, where there were far more male workers bringing in much higher income, explained Young.

"Put simply, wages help determine how much people save," she wrote recently.

But there are other factors at play as well. On average, women work 12 years less than men do over the course of their careers, according to the AARP Public Policy Institute.

A major reason: Women are more likely to take time off work to raise kids or to care for a sick spouse or aging parents.

In addition, Young cautioned that 401(k) balances only provide part of a worker's overall retirement picture since savers often have multiple retirement accounts and may have a spouse's savings as well.

Will you have enough to retire?

Retired women: 'How I'm getting by'

Finding the Blockbuster That Will Make You Rich

In the pharmaceutical industry, a "blockbuster" is any drug that brings in $1 billion or more in revenue per year.

It's the prize that every biotech hopes to win - and every biotech investor hopes to cash in on.

So how do you spot one in the making? If the market suspects a drug candidate has blockbuster potential, catalysts (events like positive clinical study results and regulatory milestones) will give its manufacturer's share price a big, big boost.

There is no crystal ball that's 100% accurate when experimental drugs are concerned, but here are some telling questions that can narrow your search.

Questions to Answer Before You Buy In Does the drug fulfill an unmet need?Alexion Pharmaceuticals Inc.'s (Nasdaq: ALXN) Soliris (eculizumab) is the only drug approved to treat paroxysmal nocturnal hemoglobinuria (PNH), an extremely rare, lethal blood disorder. It is also the only therapy approved to treat atypical hemolytic uremic syndrome (aHUS), a genetic condition that can result in sudden and progressive damage to vital organs, leading to stroke, heart attack, and kidney failure. Five years ago, ALXN shares were selling for about $18.50. They recently hit a high of $180.51 - thanks to Soliris, and Soliris alone. Is it a "breakthrough" drug?

A "Breakthrough Therapy" (BT) is actually a designation awarded by the FDA for a drug that "...is intended alone or in combination with one or more other drugs to treat a serious or life-threatening disease or condition and [has] preliminary clinical evidence [that] indicates the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development." In 2012, the FDA granted Roche/Genetech's Gasyva a BT designation and then approved it for marketing in 2013. It treats chronic lymphocytic leukemia (CLL) and is expected to be a big blockbuster - as are the other three breakthrough therapies that were approved last year. Can its market produce blockbuster income?

This can mean a huge market, such as patients with high cholesterol - think Pfizer Inc.'s (NYSE: PFE) Lipitor (atorvastatin calcium), the bestselling drug of all time - or a small market that will pay for highly priced orphan drugs for rare diseases. BioMarin Pharmaceutical Inc. (Nasdaq: BMRN), a company that specializes in the development of drugs for rare diseases, for example, has increased its share price 460% over the past five years by following this strategy. Where to Find These Big Winners

One great place to look for potential blockbuster drugs is in the pediatric market. Drugs for children with serious medical problems seem to have a special attraction for investors. For example:

Aegerion PharmaceuticalsInc. (Nasdaq: AEGR) developed a drug, Juxtapid, for a rare genetic condition called homozygous familial hypercholesterolemia, or HoFH, that can raise a person's cholesterol levels to more than 1,000 mg/dL. A healthful level is considered to be less than 200 mg/dL. The disease largely affects kids, who can die of heart attack by age 2. Most are dead by age 11. When Juxtapid hit the market, it was the only therapy available. ISIS Pharmaceuticals Inc. (Nasdaq: ISIS) would soon join in the competition with its less expensive injectable drug, Kynamro, but Juxtapid had fewer side effects and could be administered orally.

There are only about 2,000 cases of HoFH in the United States, but Aegerion charged $250,000 per year for its medication.

Within about a year of the time I first discovered this stock, AEGR shares shot up from $13 per share to a high of $101 per share. (Due to other market variables, including some unfortunate statements made by the company's CEO that ended in a warning letter from the FDA, the share price has since fallen back quite a bit.)

Sarepta Therapeutics Inc. (Nasdaq: SRPT)is developing a drug for Duchenne muscular dystrophy (remember all those Jerry Lewis Telethons?). The CDC estimates the disease affects about one out of every 5,600 to 7,700 males age 5 to 24 in the United States. By age 24, about 9 out of 10 of the 58% still alive at age 24 are wheelchair-bound. Not a pretty picture.

The potential for this drug to potentially become a blockbuster so whetted the appetite of investors that between the end of July 2012 and the beginning of October 2012, the stock price jumped nearly 1,200% - with a substantial part of that pop taking place in a single day, when the price tripled after a positive data release from a phase 2 clinical study. The stock has had its ups and downs since then, but if you had invested two years ago, you would still be up by 286%.

Take Advantage of the Huge PotentialI particularly like the pediatric space because it's so wide open - there is so much room for new drugs in every category of disease. In cancer, for example, only a handful of drugs have been approved for pediatric use over the past 30 years. I do expect that trend to change, as the FDA is now offering incentives for companies to pursue this type of research.

There are also conditions that affect a large number of children but have no current treatment whatsoever. Autism spectrum disorders fall into this category. About one in 68 children have some form of autism. There are currently no drugs to treat it.

One biotech hard at work developing drugs for this indication is Alcobra Ltd. (Nasdaq: ADHD), a biotech specializing in treatments for cognitive disorders. In particular, they're working on a drug to treat fragile X syndrome, the most common single-gene cause of autism and inherited cause of intellectual disability among boys.

They're still a long way from marketing their drug, metadoxine extended release, for this indication. In fact, they completed animal studies last year and are just beginning clinical studies in 2014. But in the meantime, they're further along in studies of the same drug for other indications.

For example, a phase 3 clinical trial on metadoxine extended release as a treatment for adult attention deficit hyperactivity disorder (ADHD) will be finishing up at the end of this year. Positive data could give the stock a huge boost.

So what I see is a company with huge potential, a strong drug candidate with several possible indications - including autism, and lots of catalysts down the road to give the share value boosts along the way.

I'd look into this one.

Editor's Note: Ernie has developed a secret "calendar" that lets him know the specific dates that certain stocks are likely to go higher - much higher. We've put together a special presentation about it, and we're offering a few of his readers a special sneak preview on Monday, April 7. Click here to RSVP