DELAFIELD, Wis. (Stockpickr) -- Professional traders running mutual funds and hedge funds don't just look at a stock's price moves; they also track big changes in volume activity. Often when above-average volume moves into an equity, it precedes a large spike in volatility.

>>5 Toxic Stocks You Should Sell Now

Major moves in volume can signal unusual activity, such as insider buying or selling -- or buying or selling by "superinvestors."

Unusual volume can also be a major signal that hedge funds and momentum traders are piling into a stock ahead of a catalyst. These types of traders like to get in well before a large spike, so it's always a smart move to monitor unusual volume. That said, remember to combine trend and price action with unusual volume. Put them all together to help you decipher the next big trend for any stock.

>>5 Stocks Under $10 Set to Soar

With that in mind, let's take a look at several stocks rising on unusual volume recently.

Qihoo 360 Technology

Qihoo 360 Technology (QIHU) provides Internet and mobile security products and services in the People's Republic of China. This stock closed up 3.7% to $99.15 in Friday's trading session.

Friday's Volume: 5.66 million

Three-Month Average Volume: 2.73 million

Volume % Change: 123%

From a technical perspective, QIHU jumped higher here right above some near-term support at $95 with above-average volume. This spike higher on Friday briefly pushed shares of QIHU into breakout territory, since this stock flirted with some near-term overhead resistance at $99.57. Shares of QIHU tagged an intraday high of $101.60, before closing just below that level at $99.15. Market players should now look for a continuation move to the upside in the near-term if QIHU manages to take out Friday's intraday high of $101.60 with strong volume.

Traders should now look for long-biased trades in QIHU as long as it's trending above Friday's intraday low of $96.04 and then once it sustains a move or close above $101.60 with volume that hits near or above 2.73 million shares. If that move gets underway soon, the QIHU will set up to re-test or possibly take out its next major overhead resistance levels at $105.49 to around $110, or even $115.

HomeAway

HomeAway (AWAY), together with its subsidiaries, operates an online vacation rental property marketplace that enables property owners and managers to market properties for rental to vacation travelers. This stock closed up 8.9% to $35.57 in Friday's trading session.

Friday's Volume: 5.16 million

Three-Month Average Volume: 1.67 million

Volume % Change: 226%

From a technical perspective, AWAY gapped sharply higher here right off its 50-day moving average of $32.30 with strong upside volume flows. This big gap to the upside on Friday pushed shares of AWAY into breakout territory, since the stock took out some near-term overhead resistance levels at around $34 to $35.39, and briefly above its 200-day moving average of $36.27. Market players should now look for a continuation move to the upside in the short-term if AWAY manages to take out Friday's intraday high of $36.90 to some past overhead resistance at $37.75 with high volume.

Traders should now look for long-biased trades in AWAY as long as it's trending above Friday's intraday low of $34 and then once it sustains a move or close above those $36.90 to $37.75 with volume that hits near or above 1.67 million shares. If that move begins soon, then AWAY will set up to re-test or possibly take out its next major overhead resistance levels at $42 to $44.

Zoe's Kitchen

Zoe's Kitchen (ZOES), through its subsidiaries, develops and operates fast casual Mediterranean cuisine restaurants in the U.S. This stock closed up 2.7% at $31.52 in Friday's trading session.

Friday's Volume: 594,000

Three-Month Average Volume: 279,876

Volume % Change: 85%

From a technical perspective, ZOES bounced notably higher here right off its 50-day moving average of $30.33 with above-average volume. This bounce higher on Friday is starting to push shares of ZOES within range of triggering a near-term breakout trade. That trade will hit if ZOES manages to take out Friday's intraday high of $31.94 to around $33 with high volume.

Traders should now look for long-biased trades in ZOES as long as it's trending above Friday's intraday low of $30.26 and then once it sustains a move or close above those breakout levels with volume that hits near or above 279,876 shares. If that breakout begins soon, then ZOES will set up to re-test or possibly take out its all-time high at $35.59.

To see more stocks rising on unusual volume, check out the Stocks Rising on Unusual Volume portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>4 Big Stocks Getting Big Attention

>>Hedge Funds Hate These 5 Stocks -- Should You?

>>5 Defense Stocks to Trade for Gains

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

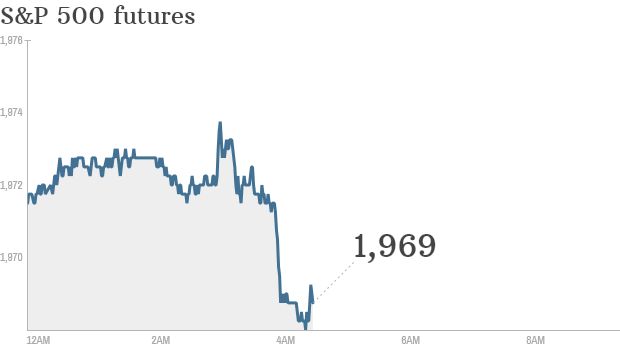

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24. Click chart for in-depth premarket data. LONDON (CNNMoney) Quarterly earnings continue to come in thick and fast on Wall Street, but that's not the only thing happening Tuesday.

Click chart for in-depth premarket data. LONDON (CNNMoney) Quarterly earnings continue to come in thick and fast on Wall Street, but that's not the only thing happening Tuesday.

Popular Posts: Hottest Healthcare Stocks Now – INO CNC WCG MNKD7 Biotechnology Stocks to Buy NowHottest Healthcare Stocks Now – INO VRX EXAS AGN Recent Posts: Biggest Movers in Healthcare Stocks Now – ARIA KERX INCY HAE Biggest Movers in Technology Stocks Now – DWRE YHOO CERN BRKR Hottest Financial Stocks Now – TPL CG AGII CIB View All Posts 10 Insurance Stocks to Sell Now

Popular Posts: Hottest Healthcare Stocks Now – INO CNC WCG MNKD7 Biotechnology Stocks to Buy NowHottest Healthcare Stocks Now – INO VRX EXAS AGN Recent Posts: Biggest Movers in Healthcare Stocks Now – ARIA KERX INCY HAE Biggest Movers in Technology Stocks Now – DWRE YHOO CERN BRKR Hottest Financial Stocks Now – TPL CG AGII CIB View All Posts 10 Insurance Stocks to Sell Now