Ricardo Ricote Rodríguez/Flickr World's biggest fast-food chain seeks new ketchup for its famous french fries. McDonald's Corp (MCD) on Friday said it plans to end its 40-year relationship with ketchup maker H.J. Heinz Co, since that company is now led by Bernardo Hees, the former chief executive of hamburger rival Burger King Worldwide Inc. "As a result of recent management changes at Heinz, we have decided to transition our business to other suppliers over time," McDonald's said in a statement. "We have spoken to Heinz and plan to work together to ensure a smooth and orderly transition," said McDonald's, which has more than 34,000 restaurants around the globe. Heinz declined to comment. "As a matter of policy, Heinz does not comment on relationships with customers," company spokesman Michael Mullen said. The switch will be more apparent overseas than in the United States, as McDonald's only serves Heinz ketchup in two domestic markets - Pittsburgh and Minneapolis, the Pittsburgh Post-Gazette reported on Friday. Indeed, ketchup packages handed out at McDonald's restaurants in the United States often say only "fancy ketchup." Most in-store ketchup dispensers are not branded. The move from McDonald's could benefit Heinz ketchup rivals Hunt's, owned by ConAgra Foods Inc, and Del Monte. Warren Buffett's Berkshire Hathaway and an investment fund affiliated with 3G Capital bought Heinz for $28 billion in June and immediately named Hees CEO. Burger King went public in June 2012, less than two years after it was taken private by 3G Capital Management LLC, which retains a stake in the fast-food chain.

Ricardo Ricote Rodríguez/Flickr World's biggest fast-food chain seeks new ketchup for its famous french fries. McDonald's Corp (MCD) on Friday said it plans to end its 40-year relationship with ketchup maker H.J. Heinz Co, since that company is now led by Bernardo Hees, the former chief executive of hamburger rival Burger King Worldwide Inc. "As a result of recent management changes at Heinz, we have decided to transition our business to other suppliers over time," McDonald's said in a statement. "We have spoken to Heinz and plan to work together to ensure a smooth and orderly transition," said McDonald's, which has more than 34,000 restaurants around the globe. Heinz declined to comment. "As a matter of policy, Heinz does not comment on relationships with customers," company spokesman Michael Mullen said. The switch will be more apparent overseas than in the United States, as McDonald's only serves Heinz ketchup in two domestic markets - Pittsburgh and Minneapolis, the Pittsburgh Post-Gazette reported on Friday. Indeed, ketchup packages handed out at McDonald's restaurants in the United States often say only "fancy ketchup." Most in-store ketchup dispensers are not branded. The move from McDonald's could benefit Heinz ketchup rivals Hunt's, owned by ConAgra Foods Inc, and Del Monte. Warren Buffett's Berkshire Hathaway and an investment fund affiliated with 3G Capital bought Heinz for $28 billion in June and immediately named Hees CEO. Burger King went public in June 2012, less than two years after it was taken private by 3G Capital Management LLC, which retains a stake in the fast-food chain.

McDonald's Dropping Heinz for Hiring Former Burger King CEO

Electronic Arts Inc. (EA): Shift In Release Schedule Should Alleviate Risk To FY14 View

Electronic Arts, Inc. (NASDAQ: EA) plans to release Titan Fall slightly earlier than expected, but Sims 4 will be pushed out to fall of 2014. The changes to the release schedule should alleviate risk to fiscal 2014 guidance.

Electronic Arts, or EA, is a global leader in digital interactive entertainment. The company's game franchises are offered as both packaged goods products and online services delivered through Internet-connected consoles, personal computers, mobile phones and tablets. EA has more than 300 million registered players and operates in 75 countries.

Headquartered in Redwood City, California, EA is recognized for blockbuster franchises such as The Sims, Madden NFL, FIFA Soccer, Need for Speed, Battlefield, and Mass Effect.

The company announced that Titan Fall, the debut game from videogame developer Respawn Entertainment, will be landing on store shelves beginning March 11, 2014 exclusively for Xbox One, the all-in-one games and entertainment system from Microsoft, Xbox 360 games and entertainment system and PC.

Titan Fall was previously expected to be released sometime in the June quarter of 2014. The new date for Titan Fall is March 11th in the U.S. and March 13th in Europe. Titan Fall is one of the most anticipated titles currently and has been generating strong buzz for some time.

"We believe this (change in schedule) is being done to take advantage of the open window created by Ubisoft delaying the release of its highly anticipated title Watch Dogs," Sterne Agee analyst Arvind Bhatia said in a client note.

EA expects the net effect of the changes to its release schedule to be neutral. Although, these changes reduce guidance risk that investors were beginning to factor in due to the slower-than-expected start to FIFA 14.

With EA's recently released key title FIFA 14 starting off slower than expected, investors were beginning to factor in some risk to fiscal 2014 earnings. The changes in the release schedule announced would reduce that p! otential risk.

In July, EA guided fiscal 2014 GAAP net revenue of approximately $3.50 billion. Non-GAAP net revenue is expected to be about $4.00 billion. GAAP loss per share is expected to be approximately 98 cents while non-GAAP diluted earnings per share is expected to be approximately $1.20. Wall Street expects earnings of $1.23 a share on revenue of $4.01 billion, according to analysts polled by Thomson Reuters.

"We think EA remains well positioned for the upcoming console cycle and can grow EPS at a 20% CAGR in the foreseeable future. This should be driven by mid single-digit top-line growth combined with 150 bps to 200 bps of operating margin expansion annually for the next several years," Bhatia noted.

With next-generation consoles from Microsoft and Sony as key catalysts, EA is well positioned for a period of sustained growth with an impressive slate of core titles, strong digital growth and focused on cost control. This, in turn, would ultimately lead to a return in top-line growth and continued margin expansion for profitable growth.

EA shares trade at approximately 17 times its consensus 2014 EPS estimate. There are approximately 17.3 million shares short on EA, reflecting 6 percent of its diluted shares outstanding, flat from 17.1 million a year ago and a peak of 27.2 million at the end of January 2013.

"At current valuations and a robust portfolio of content, we believe Electronic Arts is an attractive investment opportunity," BMO Capital Markets analyst Edward Williams wrote in a client note.

Short interest in EA has remained flat over the past three months even with a significant rise in share price as investor confidence in the company's growth prospects solidified with the start of a new console cycle and the company's margin expansion story. Shares of EA have climbed about 98 percent in the last year and traded between $11.80 and $28.13 during the past 52-weeks.

EA is set to release its financial results for the second quarter fiscal year 2014! after th! e close of market on Tuesday, Oct. 29, 2013. The street expects earnings of 12 cents a share on revenue of $979.06 million.

Metallica to rock Antarctica in Coke show

Kirk Hammett (right) may want to wear a shirt with sleeves when Metallica plays in Antarctica this December.

NEW YORK (CNNMoney) Metallica will play a concert at its remotest location yet -- Antarctica -- as part of a promotional stunt sponsored by Coca Cola."After over 30 years as a band, we have been unbelievably fortunate to visit just about every corner of the earth . . . except for one," announced the band on its web site. "That is all about to change as we are set travel to Antarctica, the only continent that Metallica has never played on until now!!"

The heavy metal band, known for such classics as "Trapped Under Ice," said it is partnering with Coca Cola Zero for a performance on Dec. 8 near a heliport at the Carlini Station in the South Pole. The base is located on King George Island, also known as Isla 25 de Mayo, and controlled by Argentina.

Coca Cola (KO, Fortune 500) and the band are inviting fans from Argentina, Chile, Colombia, Costa Rica and Mexico to enter a contest via Twitter. A total of 10 winners will be chosen to take an eight-day cruise from Tierra del Fuego to Antarctica to attend the concert, which features the band's frontman James Hetfield and drummer Lars Ulrich as well as Kirk Hammett and Robert Trujillo.

The band and Coca Cola did not explain why only five countries are covered by the promo.

December is the peak of summer in the Southern Hemisphere, so Metallica is playing during the warmest time of the year. However, anticipating some inclement weather at the frigid pole, they're planning to perform under a dome.

The band didn't respond to CNNMoney's inquiry as to whether they'll be playing "Trapped Under Ice." ![]()

Halloween Means Treats for Investors

Forget Washington's paralysis. Stop worrying that the market is "too high." Put aside concerns that third-quarter earnings are tepid. Instead, brighten up: Halloween is here, and that means Wall Street, if history is any guide, is about to stage a six-month-long party.

See Also: The 7 Deadly Sins of Investing

The "Halloween Indicator" is one of the few stock market patterns with a substantial body of research behind it. The most comprehensive study, published last year, found that stocks worldwide rose 6.9%, on average, from November through April, and only 2.4% from May through October. Authored by Ben Jacobsen, a finance professor at Massey University in New Zealand, and graduate student Cherry Zhang, "The Halloween Indicator: Everywhere and All the Time" examined price changes in 108 countries stretching back as far as 319 years. (The researchers used price-only returns rather than total returns because it was impossible to obtain old dividend data in some markets.)

The Halloween Indicator is the flip side of "sell in May and go away" -- a Wall Street saw that in effect suggests staying out of the stock market from start of May through the end of October. But although the New Zealand study finds that markets aren't as strong in the May-October period as they are in the November-April period, stocks in many countries still show gains, on average, from May through October.

Selling in May didn't prove to be a fruitful strategy this year. From May 1 through October 21, Standard & Poor's 500-stock index returned 11.4%. That was a little less than the market's 13.2% return from November 2012 through last April, but that's cold comfort to those who headed for the sidelines last spring.

Jacobsen says he has no idea why the sell-in-May strategy failed this year. "I wish I knew why the strategy works in some years and doesn't in others," he said in an e-mail. The same, of course, holds for the Halloween Indicator. It may not work every year, but the strategy, Jacobsen says, is "as good as it gets."

In the U.S., Jacobsen and Zhang found, the November-April period beat the May-October period by 5.7 percentage points, on average, from 2001 through 2011. From 1991 through 2000, November-April outperformed the other half of the year by 4.2 points, on average. In the 1980s, it was ahead by 6.6 points; in the 1970s, by 6.7 points; in the 1960s, by 5.5 points; and in the 1950s, by 5.0 points.

Overall, the authors found, the strategy worked in 81 of the 108 countries they tracked. It worked best in Western Europe, but the pattern was strong in the U.S., too.

What's more, in the United Kingdom, which the authors studied most closely, the strategy worked better the more years you employed it. Compared with buying and holding, selling in May and buying back November 1 worked only 63% of the time over one year. But over five years, it worked 82% of the time, and over ten years, it worked 92% of the time.

No one knows why the strategy has worked. The authors call it a "puzzling anomaly."

Jacobsen says he has been employing the strategy with his own money "for over 20 years with a lot of success." He holds cash from May through October.

I worry about any market-timing strategy, particularly one that has no clear rationale for why it works. But the amount of data on this anomaly is too massive to ignore. My biggest problem with it is that the market tends to rise from May through October, too, so why sell?

If I were going to employ the strategy, I'd do so only in a tax-deferred account -- and I'd use it only to raise and lower my stock allocation by, say, five to ten percentage points. If you do it with a bigger part of your portfolio, I think you're setting yourself up for failure because you're likely to give it up after a bad stretch or two.

Finally, the stock market has already enjoyed a terrific year (year to date through October 21, the S&P 500 has returned 24.4%), and a pullback is inevitable at some point. But we don't know when the retreat will occur, or how deep it will be.

However, there are reasons to be bullish -- aside from Halloween. The economy is growing, albeit at a slow pace. The Federal Reserve may taper its bond buying, but it's committed to keeping short-term interest rates near zero until the economy strengthens. Most Republicans sound unwilling to go through another Perils of Pauline experience anytime soon, so we may avoid debt and budget crises early next year. Finally, although the market isn't cheap, I don't think it's overpriced, either.

Steven T. Goldberg is an investment adviser in the Washington, D.C. area.

Why Monarch Casino Shares Tumbled

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of Monarch Casino & Resort (NASDAQ: MCRI ) were cooling off today, falling as much as 20% after the company's earnings report failed to impress.

So what: The owner of the Atlantis Casino in Reno and the Monarch Casino Black Hawk in Colorado said earnings per share were in line with estimates at $0.32, and that revenue of $48.9 million was slightly below estimates of $49.3 million. Monarch's Colorado casino was affected by flooding in the state, forcing the property to be closed for four days and disrupting key feeder markets for the location. Because of the flooding, EBITDA growth at the Monarch casino was flat, while it improved 8.9% for Atlantis. Monarch also received a downgrade from Brean Capital, from buy to hold, based on valuation.

Now what: Brean analyst Justin Sebastiano seemed to echo the market's sentiment, saying, "Our positive FY 14 outlook appears to already be in the stock." Monarch shares had gained 131% since April before today's drop thanks to huge earnings beats, so investors may have been expecting more of the same. With only modest growth expected next year, the stock seems fully priced at a P/E of 18.

Invest like a boss

The best investing approach is to choose great companies and stick with them for the long term. The Motley Fool's free report "3 Stocks That Will Help You Retire Rich" names stocks that could help you build long-term wealth and retire well, along with some winning wealth-building strategies that every investor should be aware of. Click here now to keep reading.

SAC to close London office, cuts 6 U.S. money managers

Steven A. Cohen Bloomberg

Steven A. Cohen Bloomberg SAC Capital Advisors plans to shut down its London office as the $14 billion hedge fund firm founded by Steven A. Cohen scales back in the face of insider-trading allegations by U.S. prosecutors.

SAC will close down the U.K. office by the end of the year, President Tom Conheeney wrote in a memo sent to employees Tuesday. SAC employs more than 50 people in London, according to a person with direct knowledge of the matter. The firm this week cut six investment professionals in the U.S., Mr. Conheeney wrote.

“As our negotiations with the government have unfolded, it has become clear to us that the outcome the government is demanding is likely to have a greater-than-first-anticipated impact on the firm,” he wrote. “We have concluded that we must operate as a simpler firm and reduce our capital allocations.”

Money managers have been leaving SAC's U.K. office after a U.S. grand jury indicted the firm in July

Unemployment falls but hiring slows

NEW YORK (CNNMoney) The unemployment rate fell to its lowest level since November 2008, but the government's latest jobs report still shows a muddled picture of the economy.

NEW YORK (CNNMoney) The unemployment rate fell to its lowest level since November 2008, but the government's latest jobs report still shows a muddled picture of the economy. According to the September jobs report, which was delayed 18 days by the government shutdown, hiring slowed last month. But the unemployment rate fell as more workers said they got jobs and joined the labor force.

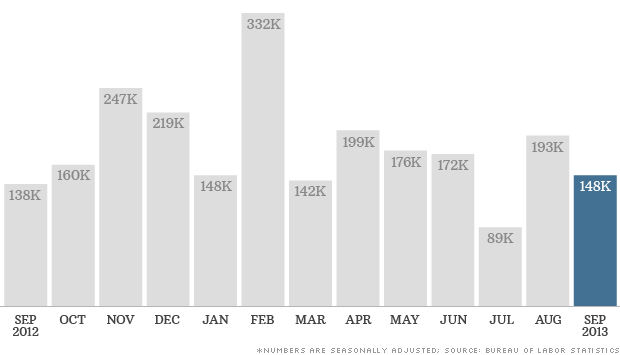

Employers added 148,000 jobs in September, fewer than the 193,000 jobs added in August, the Department of Labor reported.

But the good news is the unemployment rate fell to 7.2% as 73,000 people joined the labor force and 133,000 people said they got jobs. That's considered encouraging, after months in which thousands of Americans were dropping out of the workforce.

Still, 11.3 million jobless people continued to look for work.

Economists called the report a "mixed bag," "underwhelming" and "disappointing."

The conflicting picture comes from two separate surveys conducted each month, which don't always match up. The first survey asks businesses and government agencies about their hiring, while the second survey covers employment status of individual households.

The cloudy picture of the job market isn't likely to clear anytime soon. The economic impact from the shutdown is expected to show up in the October jobs report. Its release will also be delayed until November 8.

That makes it unlikely that the Federal Reserve will start cutting back on stimulus this month.

Pre-shutdown jobs report: More of the same

Pre-shutdown jobs report: More of the same The Fed meets next week to reevaluate its plan for winding down its bond-buying program. But independent economists expect policymakers will want to see more data on how the shutdown impacted the economy before they start cutting back on the $85 billion a month in bond purchases.

"The economy is too fragile for the Federal Reserve to touch," said Sung Won Sohn, economist at California State University Channel Islands. "The latest job numbers indicate that the economy is growing at a modest pace at best."

Economists at Goldman Sachs, Barclays, Credit Suisse, BNP Paribas, Deutsche Bank! and Capital Economics agree: The Fed probably won't slow its asset purchases until January or March of next year.

Stocks rose Tuesday as investors also interpreted the lower unemployment rate as a sign that the Fed will continue stimulating the economy in the months ahead.

Share your story: Are you delaying your start in the workforce?

Construction firms added 20,000 jobs in September, more than the previous five months combined. Temp agencies hired 20,000 workers and state governments added 20,000 education jobs.

Retailers hired 21,000 workers, marking six straight months of strong hiring for the sector.

Meanwhile, restaurants and bars suddenly cut 7,000 jobs -- the first job loss in the industry in three-and-a-half years.

The average American employee worked 34.5 hours a week and earned $24.09 an hour in September, up 49 cents, or 2.1% from a year ago. ![]()

Vanguard hits reset button on its managed-payout funds

The Vanguard Group Inc. is giving its managed-payout strategy a fresh start.

The indexing giant last week said that it will merge its three managed-payout funds, which are designed to build the principal investment along with inflation while making monthly payouts, into a single fund, in part to simplify the strategy for investors.

It also will give the strategy a fresh start with a new target after five years of struggling to meet its goal of keeping up with inflation.

Vanguard is eliminating the $110 million Vanguard Managed Payout Growth Focus Fund (VPGFX), which targets a 3% distribution, and the $804 million Vanguard Managed Payout Distribution Focus Fund (VPDFX), which targets a 7% distribution.

Both funds will be merged into the $531 million Vanguard Managed Payout Growth and Distribution Fund (VPGDX), which targets a 5% distribution.

After the mergers, it will be renamed the Vanguard Managed Payout Fund, and its target distribution will be lowered to 4%, which puts it more in sync with the so-called 4% rule for retirement spending.

The lowered distribution target also gives the fund a better chance for success than its predecessors had.

All three of Vanguard's managed-payout funds have struggled to keep payouts in line with inflation over their five-plus years of life. A big part of that has to do with the very unlucky timing of the funds' launch, which came in the spring of 2008.

“We got hit right out of the gates with the worst-case scenario,” said John Ameriks, head of active equity at Vanguard, referring to the financial crisis.

The payouts on all three funds still haven't recovered from the market's collapse.

The Managed Payout Growth Focus Fund, for example, had a monthly payout of $67 in June 2008 but paid out just $57 this past June, a 15% decrease, according to the Independent Adviser for Vanguard Investors newsletter.

The new 4% targeted distribution rate is a reflection of Vanguard's outlook for interest rates, which it expects to remain low, Mr. Ameriks said.

“We haven't set ourselves a hugely easier task at 4%,” he said. “The objective is achievable, but we're still going to have to add a little bit of value to achieve it.”

If the newly merged fund is able to keep up with inflation, it could help financial advisers in their search for retirement income options, said Josh Charlson, a fund analyst at Morningstar Inc.

“It's a good idea,” he said. “It could be one pi! ece of a possible solution for generating the income needed in retirement.”

Buy Walgreen Stock After the Q3 Miss?

Ouch. If you own Walgreen (NYSE: WAG ) stock, you're likely feeling some pain after Tuesday's drop of nearly 6%. Shares fell the most in months on news that the big pharmacy chain missed the consensus earnings estimates for its fiscal 2013 third quarter. Does the pullback present a good opportunity to buy the stock? Let's take a look.

Behind the miss

Analysts expected adjusted earnings of $0.91 per share. Walgreen actually reported $0.85 per share.

CEO Greg Wasson said that "front-end sales are still not up to our expectations." This was borne out in Walgreen reporting a 3.9% decline in customer traffic in stores open at least for a year. Total sales in these stores increased by a meager 1.4% year over year.

Wasson attributes some of the disappointment to weather, which affected sales negatively during the quarter. He also noted continuing effects of the sluggish economy. Economic woes particularly affected Walgreen stores in lower-income areas, which have generally performed below the levels of its stores in middle- and higher-income communities.

The aftermath of the dispute with Express Scripts (NASDAQ: ESRX ) also continues to play a factor for Walgreen. After the two sides couldn't come to an agreement, Walgreen allowed its contract with Express Scripts to expire at the end of 2011.

That move didn't go so well for the pharmacy chain, though. The companies ended up signing a new multiyear agreement by mid-2012. However, many customers left Walgreen during the first half of the year. Not all have come back.

Rest of the results

Outside of the earnings miss, how do Walgreen's quarterly results look? The company posted sales of $18.3 billion, an increase of 3.2% compared to the same quarter in the prior year.

GAAP diluted earnings came in at $0.65 per share. That reflects improvement over the $0.62 per share reported in the fiscal 2012 third quarter. Walgreen reported GAAP net income of $1.79 billion, up 1.1% year-over-year.

Although the company missed estimates, the adjusted earnings of $812 million. That reflects a 29.3% increased compared to the same quarter last year.

Walgreen also opened or acquired 39 new stores during the quarter. During the third quarter of fiscal 2012, the company counted 52 new stores.

Looking ahead

Walgreen has several things going for it. The company, along with partner Alliance Boots, announced a 10-year agreement with AmerisourceBergen (NYSE: ABC ) in March. Under the terms of the deal, AmerisourceBergen will distribute branded pharmaceutical products to Walgreen stores and eventually generic drugs.

This arrangement, on top of the current partnership with Alliance Boots, should enable Walgreen to achieve operational efficiencies that it couldn't do on its own. It also allows Walgreen and Alliance Boots to pick up a minority stake in AmerisourceBergen.

The real key for Walgreen, though, is regaining more of the customers lost with the Express Scripts debacle. To that end, the company has signed up 75 million people in its Balance Rewards loyalty program. Around 60% of purchases in its stores are now made using the loyalty card. Walgreen is just beginning to realize the fruit from the program and should be able to customize its marketing more effectively going forward to keep existing customers and gain (or regain) others.

Analysts following the company expect that it will grow earnings more quickly in the next few years than it has over recent years. I suspect they'll prove to be right. Walgreen isn't likely to make further missteps with contractual agreements and should benefit from its renewed customer focus.

Over the long run, I think Walgreen stock should do well for investors. And its 2.3% dividend yield should help assuage at least a little bit of the pain felt with the occasional earnings miss.

If you're on the lookout for other solid dividend stocks, The Motley Fool has compiled a special free report outlining our nine top dependable high-yielding stocks. It's called "Secure Your Future With 9 Rock-Solid Dividend Stocks." You can access your copy today at no cost! Just click here.

Should inflation-indexed bonds be linked to WPI?

A: It is a fabulous instrument for savers. Since independence there have been very few rare periods in which the real interest rate has been positive, almost the entire period barring few occasions where we had negative real rate of interest. So having inflation indexed bonds which gives you positive real interest is a breath of fresh air and that will bring in hoards of people wanting to invest in risk free framework.

Second thing is the structure of the instrument, whether it is linked to a particular type of index, whether the index characteristics correct or not, so that is more of a structuring part of it. So principle is very good. How do we execute it and then if by chance we fail somewhere how do we reiterate, continue to comeback till the time we succeed? That requires courage, conviction and humility saying that I have failed, so let me change and ask people what failed and then make it actually useful for people so that it is a win-win for both.

It helps us raise funds either for the government or for the private sector even and on other side it meets genuine need of the savers in all these areas. But overall it is a very, very impressive thought and the execution, even if you fail once, I have seen it in derivatives, internationally almost 95 out of 100 products fail, but that does not mean you stop trying. So idea is India is now sophisticated enough. People have needs which are varying. People are now becoming financially much more literate.

The processing part of it which used to be the largest problem of getting bad deliveries, not having correct prices, more transparency; all of that is gone. So for me now is the right time to introduce newer mass market products, because you can get carried away, create very complex, very niche leveraged products and you can create some more issues later on, but if you are able to create mass market investment products, we would be doing a great job going forward.

The cities where consumers chat most about brands

If you're a financial service brand, Jacksonville is where folks are likely to chat you up.

And if you're some sort of travel services company, Miami is the hub for brand chatter.

Talk creates sales. Marketers are just beginning to discover that consumers in some cities are far more talkative about their brands than folks living in other cities.

For that matter, residents of these same three cities — Houston, Jacksonville and Miami — are more likely than residents of any other major U.S. cities to have verbal or online conversations about brands of any kind.

"Marketers recognize that consumers trust each other more than anyone else," says Ed Keller, CEO of Keller Fay Group, the market research specialist behind the new study to be released Monday, America's Most Talkative Cities. "Every brand wants to be a brand that people are talking about."

Now, marketers are starting to recognize that they may be able to regionally target their brands to those cities and towns where folks are more receptive to talking about brands in general, and, more specifically, the very kinds of products that they specifically market or sell. This is no small matter.

Some 2.1 billion brand impressions are made daily on consumers from word of mouth marketing, says Keller.

The TalkTrack study is based on 75,000 consumer interviews conducted over the past two years in the nation's 50 largest cities.

It also tracked the most talkative — and least talkative — cities. The average consumer nationally has 79 conversations about one brand or another every week. But in Houston, where brand talk is king, the typical consumer has 95 brand conversations a week. Jacksonville and Miami ranked two and three, in that arena, with 94 and 93 brand conversations, respectively.

The seven others, in order: Salt Lake City, Atlanta, New Orleans, Los Angeles, San Diego, Norfolk, Va.; and West Palm Beach, Fla. Seven of th! e 10 cities ranked as America's "most talkative" were in the South, notes Keller.

Nationally, the most talked about brand topics are media, entertainment, food and dining, says Keller. The study did not track specific brands by name.

Among the study's other findings:

• Car talk. If you live in Houston, you're 37% more likely to talk about auto brands than other consumers.

• Money talk. If you live in Jacksonville, you're 56% more likely to chat about financial service brands than others.

• Trip talk. If you live in Miami, you're 75% more likely to discuss travel services than other folks.

Despite the explosive growth of social media, more than 90% of brand-related conversations still take place off-line, says Keller.

Best Heal Care Companies To Own For 2014

Just as Las Vegas boomed years ago, Macau is booming today for the same reason; it�� the only place in China where gambling is legal.

All the big names in the industry are there, including Las Vegas Sands, Wynn Resorts and MGM Resorts. And Melco Crown Entertainment (MPEL) -- our latest stock of the month pick -- is thriving right along with them.

The big driver of revenue for Melco is its City of Dreams resort casino complex, a massive conglomeration of casinos, hotels, theaters, 20 restaurants and bars, 175,000 square feet of high-end shopping venues and 550 gambling tables and 1,500 gaming machines.

Best Heal Care Companies To Own For 2014: Outback Metals Ltd (OUM)

Outback Metals Limited is a company engaged in the exploration for gold and other economic mineral deposits. The Company holds 100% interest in the Wingates Gold Project, which is located approximately 250 kilometers (km) south of Darwin and 120 km east of the Wadeye township. Its Mt Wells poly-metallic project (tin/copper/tungsten/gold) is located approximately 200 km south of Darwin and has both granted mining tenements (MLN 164, 165, 196 to 200, 463, 465 to 467, 658, 672, 679 and MCN 723 and 2631) and, apart from a joint venture with Australasia Gold Limited on exploration license EL22301, ELA 28549 is 100% owned by the Company. The Company also holds 100% interest in the Maranboy and Yeuralba tin field projects, which are located approximately 64 km south east of Katherine. As of June 30, 2011, the Company's wholly owned subsidiaries included Corporate Developments Pty Ltd, Softwood Plantations Pty Ltd and Victory Polymetallic Pty Ltd, among others.Best Heal Care Companies To Own For 2014: The NASDAQ OMX Group Inc.(NDAQ)

The NASDAQ OMX Group, Inc. provides trading, clearing, exchange technology, securities listing, and public company services worldwide. It offers trading across various asset classes, including cash equities, derivatives, debt, commodities, structured products, and exchange traded funds; capital formation solutions; financial services and exchanges technology; market data products; and financial indexes, as well as clearing, settlement, and depository services. The company also provides broker services comprising technology and customized securities administration solutions, such as back-office systems to financial participants. In addition, it offers global listing services; technology solutions for trading, clearing, settlement, and information dissemination; and facility management integration, surveillance solutions, and advisory services, as well as develops and licenses NASDAQ OMX branded indexes, associated derivatives, and financial products. As of December 31, 2010 , a total of 2,778 companies listed securities on The NASDAQ Stock Market. The NASDAQ OMX Group supports the operations of approximately 70 exchanges, clearing organizations, and central securities depositories. The company was formerly known as The Nasdaq Stock Market, Inc. and changed its name to The NASDAQ OMX Group, Inc. in February 2008. The NASDAQ OMX Group, Inc. was founded in 1971 and is based in New York, New York.

Advisors' Opinion:- [By DailyFinance Staff]

Scott Eells/Bloomberg via Getty Images Stocks ended Friday trading higher, despite a report showing a big drop in sales of newly built homes, which prompted a selloff earlier in the session. The Dow Jones industrial average (^DJI) rose 46 points, or 0.3 percent, to 15,010, building on Thursday's gains. The Standard & Poor's 500 index (^GPSC) added six points, or 0.4 percent, to 1,663. and the Nasdaq composite index (^IXIC) gained 19 points, or 0.5 percent, to 3,657, a day after the exchange was shutdown for three hours because of technical troubles. Data from the Commerce Department showed sales of new single-family homes in the U.S. fell by 13.4 percent in July to an annual rate of 394,000 units, well below expectations of 490,000 units. The data weighed on homebuilder stocks, with PulteGroup (PHM) down 1.6 percent to $16.06, Toll Brothers (TOL) off 3.9 percent to $31.19 and D.R. Horton (DHI) off 2.9 to $18.73. After a technological problem shut down trading in Nasdaq securities Thursday, Nasdaq OMX Group (NDAQ) Chief Executive Officer Robert Greifeld said the exchange resolved the technical issues that led to Thursday's trading halt but can't guarantee there would be no future problems. Time Warner Cable (TWC) is offering free antennas to allow customers to watch CBS (CBS) during a blackout that's in its third week. The companies have been unable to reach a new programming deal since their agreement expired in June. Customers in New York, Los Angeles and Dallas can get a free indoor antenna at their local Time Warner Cable store, or receive a $20 voucher, good for the purchase of an antenna at Best Buy (BBY).

- [By Dave Michaels]

Such systems, or SIPs, are owned by the two major exchange operators -- The Nasdaq OMX Group Inc. (NDAQ) and NYSE Euronext. (NYX)

The SEC�� rule proposal, known as Regulation SCI, would require exchanges, SIPs and clearing firms to adopt policies to prevent failures, stress test their systems to ensure trading continues through a disruption, such as a software glitch or natural disaster, and report the disruptions to the SEC. The rule also would cover exchange competitors known as alternative trading systems, including dark pools. The SEC has said 10 dark pools are large enough to be subject to the regulation, based on data from 2012.

Top 10 Cheap Companies To Watch For 2014: Cobar Consolidated Resources Ltd(CCU.AX)

Cobar Consolidated Resources Limited engages in the exploration and development of base and precious metals in Australia. It has 1,371 square kilometers of tenement interests on the western margin of the Cobar basin in western New South Wales. The company primarily focuses on developing the Wonawinta silver project in the Cobar basin in western New South Wales. It also has exploration projects, including the Gundaroo project, the Winduck Super project, the McKinnons gold deposit, and the Goldwing project. The company is based in Melbourne, Australia.

Best Heal Care Companies To Own For 2014: Waterman Group Ord 10p(WTM.L)

Waterman Group plc operates as an engineering and environmental consultancy company worldwide. It engages in the provision of design services and advice in the fields of civil, structural, mechanical, electrical, and power engineering; and environmental, and health and safety consultancy services. The company?s principal services include building services, civil engineering, energy and environmental services, secondment and outsourcing, structural engineering, and transportation. It serves aviation, commercial, communication and technology, conservation/historic, education, energy, government and defense, healthcare, highways, hotels, industrial, marine, rail, residential, retail, sports and leisure, transportation, urban regeneration, power, waste, and water sectors. The company was founded in 1952 and is headquartered in London, the United Kingdom.

Best Heal Care Companies To Own For 2014: Tyler Technologies Inc. (TYL)

Tyler Technologies, Inc. provides integrated information management solutions and services for the public sector with a focus on local governments in the United States and internationally. The company offers financial management solutions, including modular fund accounting systems for government agencies and not-for-profit entities; and utility billing systems to support the billing and collection of metered and non-metered services. It also provides financial management systems, such as specialized products to automate various city functions, including municipal courts, parking tickets, equipment and project costing, animal and business licenses, permits and inspections, code enforcement, citizen complaint tracking, ambulance billing, fleet maintenance, and cemetery records management; and student information systems and transportation solutions to K-12 schools, as well as software applications to manage public sector pension funds. In addition, the company offers integra ted suite of judicial solutions comprising court case management, court and law enforcement, prosecutor, and supervision systems to handle complex, multi-jurisdictional county, statewide implementations, and single county systems; systems and software to automate the appraisal and assessment of real and personal properties; tax applications for agencies that bill and collect taxes; and software applications that enable county governments to enhance and automate courthouse operations. Further, it provides subscription-based services, such as application service provider arrangements and other hosted service offerings, software subscriptions, and disaster recovery services; electronic document filing solutions for courts and law offices; professional IT services, including software and hardware installation, data conversion, training, and product modifications; and outsourced property appraisal services for taxing jurisdictions. The company was founded in 1966 and is headquart ered in Dallas, Texas.