Among the companies with shares expected to actively trade in Tuesday’s session are Forest Laboratories Inc.(FRX), Coca-Cola Co.(KO) and Waste Management Inc.(WM)

Actavis(ACT) PLC confirmed plans to acquire rival drug maker Forest Labs in a cash-and-stock deal that values Forest at about $25 billion. Shares of Forest Labs rose 30% to $93.06 premarket. Actavis shares rose 8.2% to $207.70.

Coca-Cola said it is looking for ways to “restore momentum” as it posted lower fourth-quarter results that concluded a challenging year for the soft-drink giant. Coke’s revenue for the quarter missed Wall Street expectations, while profit declined. Shares dropped 1.6% to $38.32 premarket.

Waste Management swung to a fourth-quarter loss as the waste-disposal company posted high asset impairment charges and reported higher accruals from incentive compensation. Adjusted bottom-line results missed estimates, and the company offered a disappointing earnings outlook for 2014. Shares dropped 3.4% to $42.20 premarket.

Navidea Biopharmaceuticals Inc.(NAVB) said the U.S. Food and Drug Administration has granted a priority review for an expanded use of its Lymphoseek drug for some patients with head and neck cancer. Shares dropped 5.4% to $1.97 premarket.

Prana Biotechnology Ltd.(PBT.AU) said its experimental treatment for Huntington disease met its primary goals of safety as well as significant improvement in cognitive function in a Phase II study. Shares rose 17% to $8.45 in recent premarket trading.

Ameren Corp.(AEE) named Warner L. Baxter as its new chief executive, replacing Thomas R. Voss, who is retiring from the utility operator. Mr. Baxter will take on the new position on April 24, at which time Mr. Voss will become executive chairman.

Duke Energy Corp.(DUK) said its fourth-quarter earnings rose a bigger-than-expected 58%, helped by strength in its regulated utilities and international businesses.

Fresh Del Monte Produce Inc.(FDP) said sales rose in the fourth quarter, driven by a surge in its banana business. The company, however, posted a wider net loss due to higher impairment charges and costs.

Medtronic Inc.(MDT) said its fiscal third-quarter earnings fell 23% on a big write-down related to the medical-device maker’s renal denervation program that masked revenue growth. The company narrowed its earnings forecast for the year.

Rothesay Life Ltd. agreed to buy MetLife Inc.'s(MET) U.K.-based annuity pension unit as it continues to build out its annuity portfolio. Financial terms of the deal, which is expected to close in the second quarter, weren’t disclosed.

NiSource Inc.(NI) said its fourth-quarter profit rose 13% as all three of the utility company’s segments posted revenue growth. But the top line missed estimates.

Stryker Corp.(SYK) agreed to acquire privately held surgical-equipment company Berchtold Holding AG for an enterprise value of $172 million. Berchtold, which has operations in Germany and the U.S., generated sales of roughly $125 million last year. The company’s products include surgical tables, equipment booms and surgical lighting systems.

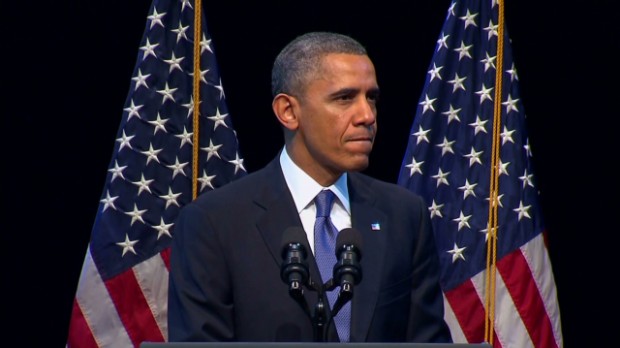

Plight of the fast food worker

Plight of the fast food worker  Obama on social mobility in America

Obama on social mobility in America  AP On Monday, investors learned that Amazon.com (AMZN) is beefing up its shipment schedules in key markets by offering Sunday deliveries to its Amazon Prime customers. The Postal Service was a surprising choice given that FedEx (FDX) and UPS (UPS) were also in the running for Amazon's extended parcel delivery service business. While the new plan nice for customers, the biggest beneficiary may be the United States Postal Service. So now let's get into what this could mean for the struggling Postal Service. Dead Letters It wasn't that long ago that the U.S. Postal Service system was doing so badly that it was entertaining massive layoffs and ending Saturday deliveries. Things are starting to get better for it as the economic recovery shows signs of strengthening, but the Post Office is still losing a lot of money. The Postal Service generated $16.2 billion in revenue in its quarter ending in June, but that was more than offset by $16.9 billion in expenses. The $740 million loss is actually a dramatic improvement, and it would have been an actual profit if it wasn't for Congress-mandated health fund payments. (And who knows what its P&L statement might look like if Congress allowed the Post Office to charge enough for postage to cover its costs?) It may surprise some to see that revenue actually increased by nearly 4 percent during the period, but the growth isn't coming from traditional first-class mail. That business continues to slide as folks use e-mail, smartphones, and faxes to communicate without having to deal with postage stamped communiques. However, if the lines at the Post Office don't seem to be getting any shorter, it's because e-commerce is keeping postal workers busy. Less Mail in Our Boxes, More Mailed Boxes Revenue from package deliveries climbed nearly 9 percent during the June quarter, and at $2.9 billion now accounts for 18 percent of the Postal Service's total revenue. Amazon's move to start to sending Sunday deliveries through the Postal Service will generate it some serious revenue. It will also likely improve the agency's employment picture, as the Postal Service had only limited Sunday operations in the past. Amazon's a leader, and it wouldn't be a surprise if smaller Web-based retailers have little choice but to also team up with the Postal Service to keep up. Sunday is the New Monday Amazon and the Postal Service aren't disclosing the costs or the length of the contract. They also are not disclosing volume projections. Los Angeles and New York City will begin offering deliveries as soon as this Sunday. Other cities expected to be added soon include Dallas, New Orleans, Houston and Phoenix, according to The Wall Street Journal. Amazon will simply have to make sure that its packages are delivered to the Postal Service locations by Sunday morning, and the USPS will handle the rest of the fulfillment process. Amazon will not charge extra for the service if it's available. In fact, Amazon surely wants the Sunday business to take off because it could be a strong catalyst for Friday orders. Putting Friday Shopping In Play There are an estimated 10 million customers paying $79 a year for Amazon Prime, which offers free two-day deliveries of Amazon-warehoused goods. Placing an order on Friday used to mean waiting until Monday, and that may have been enough to dissuade some shoppers from just buying what they needed locally over the weekend. Sunday deliveries would alter that dynamic. Another important factor here is that it will set Amazon apart from the competition this holiday shopping season -- the most important time of the year for retailers. Analysts already foresaw Amazon ringing up more than $26 billion in sales during the quarter, and that number could inch higher with Sunday deliveries making Amazon even more popular than it already is with Web-savvy consumers. However, the U.S. Postal Service will be the big winner here. As long as it doesn't let Amazon down, it will enhance its reputation as a speedy parcel-delivery option for folks who often lean on FedEx or UPS first for package shipments. There's money to be made. There's an image to be spruced up. Something as simple as this could turn a money-losing service into a profitable winner. And that is first-class potential.

AP On Monday, investors learned that Amazon.com (AMZN) is beefing up its shipment schedules in key markets by offering Sunday deliveries to its Amazon Prime customers. The Postal Service was a surprising choice given that FedEx (FDX) and UPS (UPS) were also in the running for Amazon's extended parcel delivery service business. While the new plan nice for customers, the biggest beneficiary may be the United States Postal Service. So now let's get into what this could mean for the struggling Postal Service. Dead Letters It wasn't that long ago that the U.S. Postal Service system was doing so badly that it was entertaining massive layoffs and ending Saturday deliveries. Things are starting to get better for it as the economic recovery shows signs of strengthening, but the Post Office is still losing a lot of money. The Postal Service generated $16.2 billion in revenue in its quarter ending in June, but that was more than offset by $16.9 billion in expenses. The $740 million loss is actually a dramatic improvement, and it would have been an actual profit if it wasn't for Congress-mandated health fund payments. (And who knows what its P&L statement might look like if Congress allowed the Post Office to charge enough for postage to cover its costs?) It may surprise some to see that revenue actually increased by nearly 4 percent during the period, but the growth isn't coming from traditional first-class mail. That business continues to slide as folks use e-mail, smartphones, and faxes to communicate without having to deal with postage stamped communiques. However, if the lines at the Post Office don't seem to be getting any shorter, it's because e-commerce is keeping postal workers busy. Less Mail in Our Boxes, More Mailed Boxes Revenue from package deliveries climbed nearly 9 percent during the June quarter, and at $2.9 billion now accounts for 18 percent of the Postal Service's total revenue. Amazon's move to start to sending Sunday deliveries through the Postal Service will generate it some serious revenue. It will also likely improve the agency's employment picture, as the Postal Service had only limited Sunday operations in the past. Amazon's a leader, and it wouldn't be a surprise if smaller Web-based retailers have little choice but to also team up with the Postal Service to keep up. Sunday is the New Monday Amazon and the Postal Service aren't disclosing the costs or the length of the contract. They also are not disclosing volume projections. Los Angeles and New York City will begin offering deliveries as soon as this Sunday. Other cities expected to be added soon include Dallas, New Orleans, Houston and Phoenix, according to The Wall Street Journal. Amazon will simply have to make sure that its packages are delivered to the Postal Service locations by Sunday morning, and the USPS will handle the rest of the fulfillment process. Amazon will not charge extra for the service if it's available. In fact, Amazon surely wants the Sunday business to take off because it could be a strong catalyst for Friday orders. Putting Friday Shopping In Play There are an estimated 10 million customers paying $79 a year for Amazon Prime, which offers free two-day deliveries of Amazon-warehoused goods. Placing an order on Friday used to mean waiting until Monday, and that may have been enough to dissuade some shoppers from just buying what they needed locally over the weekend. Sunday deliveries would alter that dynamic. Another important factor here is that it will set Amazon apart from the competition this holiday shopping season -- the most important time of the year for retailers. Analysts already foresaw Amazon ringing up more than $26 billion in sales during the quarter, and that number could inch higher with Sunday deliveries making Amazon even more popular than it already is with Web-savvy consumers. However, the U.S. Postal Service will be the big winner here. As long as it doesn't let Amazon down, it will enhance its reputation as a speedy parcel-delivery option for folks who often lean on FedEx or UPS first for package shipments. There's money to be made. There's an image to be spruced up. Something as simple as this could turn a money-losing service into a profitable winner. And that is first-class potential.