Finding successful emerging market investment ideas has been a tough slog over the past year, but a necessary one for anyone operating on a global market mandate.

Finding successful emerging market investment ideas has been a tough slog over the past year, but a necessary one for anyone operating on a global market mandate.And you need just such a mandate, if you want to maintain a healthy, well-balanced portfolio.

Our task has been complicated by massive valuation shifts as a result of the billions of dollars that quantitative easing has been pumping into the emerging markets. As the Federal Reserve intended, savers haven been forced to stretch their risk tolerances to realize higher yields on their investments, but stimulus has had the effect of pushing them farther afield then the central bank expected.

As a result of that unintended consequence, from the time the US markets bottomed the emerging markets vastly outperformed the Dow Jones Industrial Index, topping out at a 136.4 percent gain versus a 51 percent increase for the Dow by mid-2011.

But since talk of the Fed’s taper began in earnest, those leadership roles are shifting yet again.

Global growth is still nowhere near its pre-recession base line and the outlook has become even murkier. The International Monetary Fund (IMF) cut its world growth forecast for this year and next to 2.9 percent and 3.6 percent, respectively. While the IMF cited budgetary squabbling in Washington, DC as one factor affecting its outlook, it also cited the prospect of fund tapering as a damper on emerging market growth as a major contributor.

Consequently, while developed world economies are not growing as quickly as they once did, they are at least growing again. Investors are having less trouble meeting their baseline expectations in mature economies. At the same time, emerging markets are likely to suffer from the slowing flow of “hot money,” weighing on their growth and causing another shift in market leadership positions.

As investors have grown more comfortable with the deve! loped markets and the outlook for Fed tapering, they’ve begun reaching even further out on the risk spectrum in the search for superior returns.

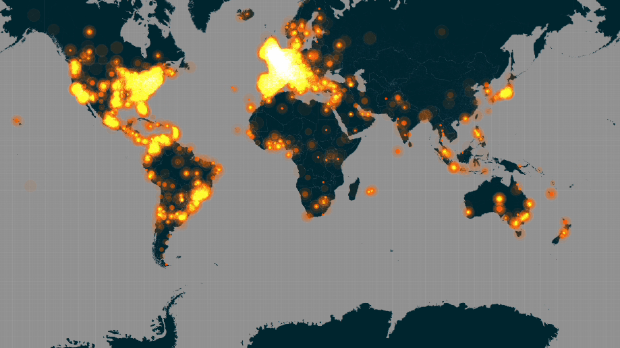

As you can see from the graph “Exploring New Frontiers” below, since early September the iShares MSCI Frontier 100 Index (NYSE: FM) has begun pulling away from the iShares MSCI Emerging Markets Index (NYSE: EEM).

The frontier markets haven’t been getting much respect for the past couple of years, as hot money has run up many emerging market indexes. Because of those attractive gains, there was little reason to take a chance on diving into what are generally perceived to be higher risk markets.

Paradoxically, though, the shifting economic tides are actually serving to make the frontier markets less risky. Since the frontiers haven’t attracted hot money in recent years, they won’t suffer from the reversal of those flows. At the same time, since they’re still relatively isolated in terms of global trade given their miniscule size, they aren’t as subject to the vagaries of global trade flows.

That makes frontier market investing more about domestic demand and growth in those countries, resulting in very different market performance when compared to the developed or even emerging markets.

While there is always the risk inherent in the fact that frontier markets are relatively small and illiquid, these markets show low correlations to emerging market indexes and even less to developed market ones. Those correlation gaps have also been widening over the past month or so, as growth expectations for both the developed and emerging markets have been declining while the frontier market outlook has been stable.

Prospects are increasing for the Fed to begin tapering sooner rather than later; the latest Fed minutes show that it is likely to begin in the next six months or so. As a result,! we&rsquo! ;ll start hearing a lot more from the talking heads about frontier markets in the coming months. That will contribute to a frontier market rally just as this “chatter” helped drive the emerging markets over the past few years.

For now, iShares MSCI Frontier 100 Index is both the easiest and purest play on the frontier markets. While it is heavily weighted towards the Middle Eastern countries of Kuwait (25.7 percent of assets), Qatar (18.7 percent) and the United Arab Emirates (14 percent) by virtue of their size and liquidity, it also provides exposure to several of the other frontier markets found in Africa, Eastern Asia and South America.

The fund’s top sector weighting is financials (55.6 percent of assets), since these holdings tend to be among the first listings on young stock exchanges thanks to their need for capital. However, it is closely followed by infrastructure plays such as telecommunication companies and industrials, which lay the groundwork for growing economies.

So while the fund will be more volatile than developed market plays, at this stage of the economic cycle it also offers more potential upside than emerging market ones.

For risk tolerant investors, iShares MSCI Frontier 100 Index is a good buy up to 41.

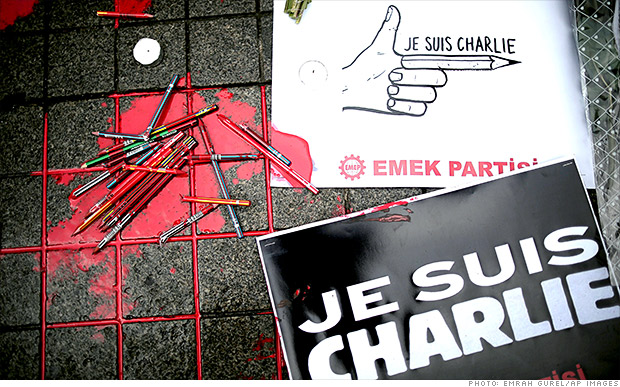

#JeSuisCharlie floods social media NEW YORK (CNNMoney) Many news organizations stayed away from the Charlie Hebdo cartoons depicting the Prophet Mohammed following this week's attack on the French satirical magazine.

#JeSuisCharlie floods social media NEW YORK (CNNMoney) Many news organizations stayed away from the Charlie Hebdo cartoons depicting the Prophet Mohammed following this week's attack on the French satirical magazine.

Boston Globe via Getty Images

Boston Globe via Getty Images

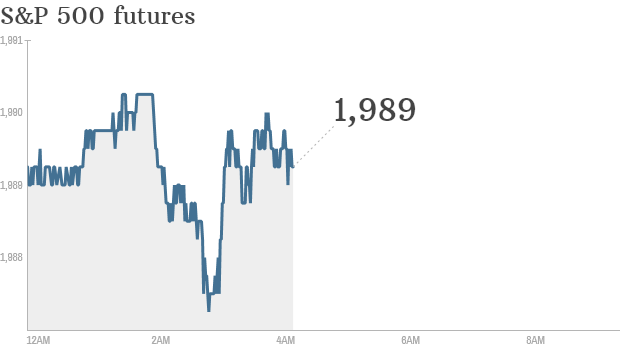

Click chart for in-depth premarket data. LONDON (CNNMoney) What does the market have in store today?

Click chart for in-depth premarket data. LONDON (CNNMoney) What does the market have in store today?