The Gap (GPS) cratered after reporting earnings on Friday, May 25, largely due to disappointing sales momentum. Overall comparable store sales growth of 1% fell shy of the consensus 1.5% growth in comps that was expected. The company is also guiding for flat to slightly higher growth in comps for fiscal 2018 overall. According to the company:

Comparable sales by global brand for the first quarter were as follows:

Old Navy Global: positive 3% versus positive 8% last year Gap Global: negative 4% versus negative 4% last year Banana Republic Global: positive 3% versus negative 4% last yearWhile the quarter may have been disappointing, an almost 15% haircut in the share price now leaves shares trading at just a little over 13 times earnings, with a 3.45% dividend yield attached to them.

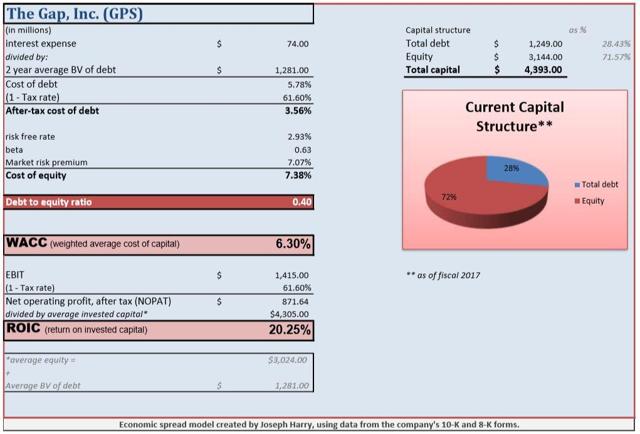

Return on invested capital analysisGoing back in time to the company's full-year fiscal 2017 results, we can look at the firm's strong "headline" balance sheet and return on invested capital.

Note: I am using the adjusted tax rate in my model below. According to The Gap: The effective tax rate for fiscal year 2017 was 40.4 percent. Excluding the net provisional impacts related to TCJA, the adjusted fiscal year 2017 effective tax rate was about 2 percentage points lower.

I am also using the "non-GAAP" operating profit figure given by management in the firm's 8-K, since un-adjusted EBIT: Represents the gain from insurance proceeds related to the fire that occurred in one of the buildings at a company-owned distribution center campus in Fishkill, New York and impact on percentage of net sales.

At first glance, the company earns high ROIC of over 20% with a debt-to-equity ratio comfortably below 1x, but like almost every other retailer, it also utilizes a large amount of operating leases. These leases are held "off the books" and are found in the notes to the financial statements in the firm's 10-K. They are long-term in nature and also noncancelable, so next I will theoretically capitalize these leases to bring them onto the balance sheet.

At first glance, the company earns high ROIC of over 20% with a debt-to-equity ratio comfortably below 1x, but like almost every other retailer, it also utilizes a large amount of operating leases. These leases are held "off the books" and are found in the notes to the financial statements in the firm's 10-K. They are long-term in nature and also noncancelable, so next I will theoretically capitalize these leases to bring them onto the balance sheet.

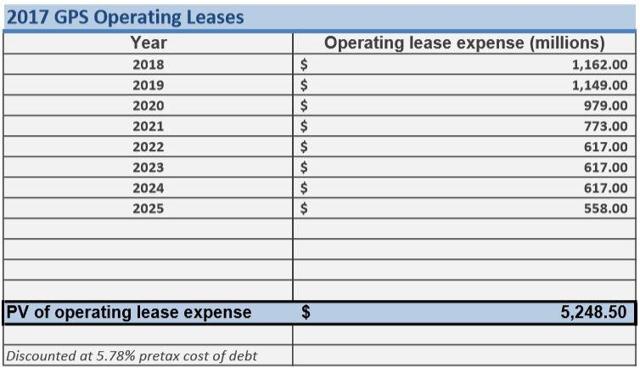

The first step involves determining an estimated value for the "off-balance sheet" leases, which I've done below using the company's pretax cost of debt as the discount rate.

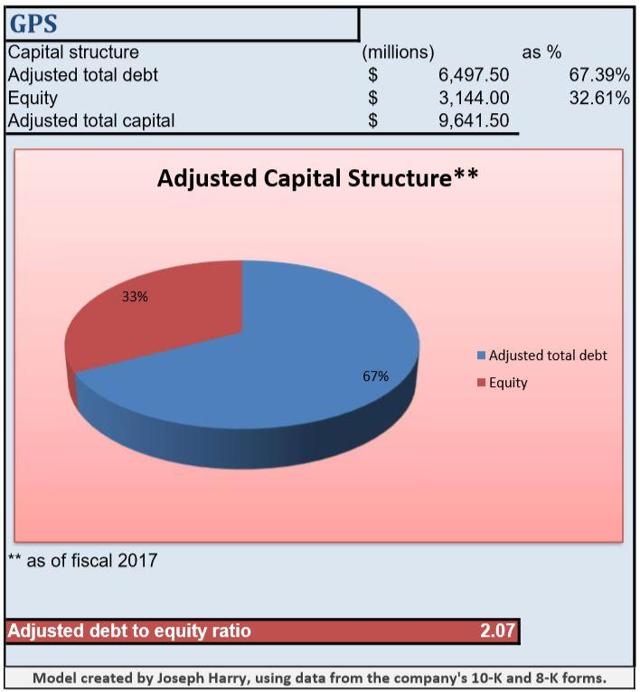

Now we can inject the leases into the company's overall capital structure to determine their impact:

The company's debt-to-equity ratio jumps to over 2x after accounting for the leases, a strong shift from the headline number of only 0.40x.

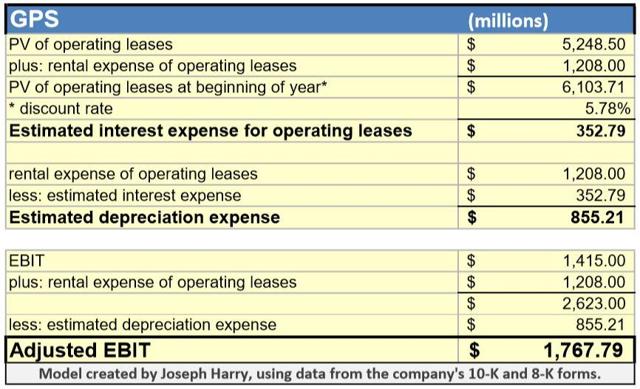

Deciding to theoretically capitalize the firm's operating leases also has an impact on its ROIC as well, but first, we need to adjust operating profit for lease-related interest and depreciation expenses.

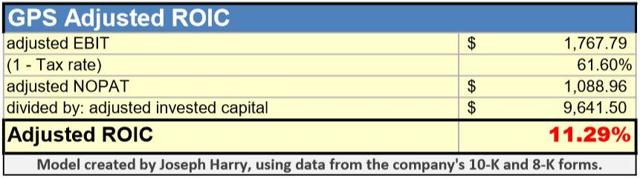

Now we can estimate an adjusted NOPAT (net operating profit, after tax) number, and divide by our previously calculated adjusted capital base to arrive at ROIC (roughly adjusted to account for the company's off-balance sheet leases).

The Gap's ROIC is nearly cut in half if we decide to bring its operating leases back into the mix. This also impacts its weighted-average cost of capital, however, which I've re-run below with a range of equity costs (due to the difficulty of discovering a true cost of equity):

The Gap likely out-earns its cost of capital, even with an extremely high cost of equity, so I'd put it in the "better-than-average" bucket as long as this remains the story.

ValuationsGPS shares have tended to trade at about 0.90 times sales in the past, judging by both the five-year average multiple and the thirteen-year median multiples. Shares appear undervalued at the moment when valued on fiscal 2017's sales, therefore, with GPS shares trading at only about 0.68 times sales after Friday's big fall. The company also got an extra week of sales in during fiscal 2017, however, so its price-to-sales ratio is likely understated.

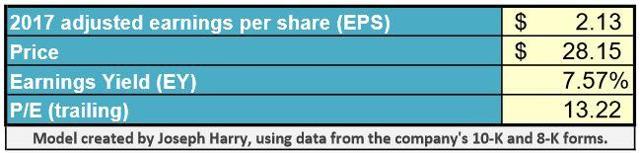

On an earnings basis, the five-year average P/E ratio is 13.77, while the thirteen-year median multiple is 13.79 times earnings.

Shares look slightly undervalued here, too, but not at as big of a deviation from historical valuations as when looking at the P/S ratio.

Shares look slightly undervalued here, too, but not at as big of a deviation from historical valuations as when looking at the P/S ratio.

Analysts expect a big jump in earnings-per-share for fiscal 2018 as well, with the average estimate coming in at $2.61 a share. That's good for growth of over 22%, which I'm assuming is an unsustainable growth rate, and is likely a result of lower taxes for the firm going forward. Fiscal 2019's EPS are expected to come in at $2.76, which is only about 5.75% expected growth year-over-year - and likely a more realistic growth rate for EPS going forward.

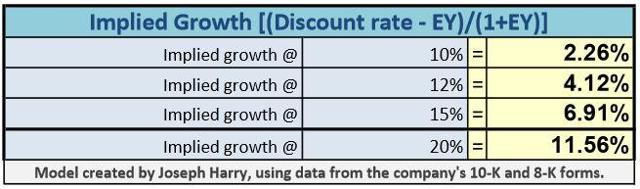

After the drop, the current implied growth embedded in shares (using a higher 12% to 15% discount rate to account for the firm's shakier prospects) is around 4.12% to 6.91%.

That's lower than the huge jump in growth for fiscal 2018, but growth from 2018 through 2019 falls right in the middle of what's baked into shares at the moment. I'd put shares in the slightly-undervalued range based on normalized earnings and growth prospects, therefore, especially if the firm hits the $2.61 mark this year, which puts GPS shares trading at less than 11 times those estimates.

That's lower than the huge jump in growth for fiscal 2018, but growth from 2018 through 2019 falls right in the middle of what's baked into shares at the moment. I'd put shares in the slightly-undervalued range based on normalized earnings and growth prospects, therefore, especially if the firm hits the $2.61 mark this year, which puts GPS shares trading at less than 11 times those estimates.

The Gap could be a solid turnaround story if it can boost comps and hit earnings estimates this year, but as long as sentiment is negative, multiples could remain in contraction mode. If sentiment turns and the market rewards the firm with a P/E of at least 13 at the end of 2018 (and assuming its earnings estimates are hit) - that's good for a share price of about $34 - or roughly 20% upside.

That's a pretty good margin of safety if you think Friday's drop was an overreaction, but GPS is far from a sure thing. If comps continue to be worse-than-expected, it could be a facing a "look-out-below" situation, and catching a falling knife doesn't usually end well - no matter how attractive the upside prospects are, along with a dividend nearing 3.5%.

Still, without basing judgment on only one quarter, The Gap still looks like a decent company to me, with decent underlying fundamentals. It just comes with a lot of risk attached, which is why it's trading at a relative wide discount to its historical valuation levels.

If you enjoyed this article and would like to receive further updates and articles in the future, please feel free to hit the "Follow" button at the top of the page next to my name.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Articles I write for Seeking Alpha represent my own personal opinion and should not be taken as professional investment advice. I am not a registered financial adviser. Due diligence and/or consultation with your investment adviser should be undertaken before making any financial decisions, as these decisions are an individual's personal responsibility.