To tell the truth, I'm not the least bit surprised that I'm chiming in on Venaxis Inc. (NASDAQ:APPY) today. It was a stock I dissected just two days ago (on Tuesday - here's that chat), pointing out how all the telltale signs of bullishness were brewing. Sure enough, APPY popped on Wednesday, and as a result has gone from a mere potential big mover to an actual mover.

Just to get everyone up to speed, APPY had been getting squeezed into a narrower and narrower trading range. In fact, that range had been whittled down to a mere ten cents, which just isn't enough room for a $1.40 stock like Venaxis Inc. to comfortably move around in. Something had to give soon, and given that the market had been squeezing in on shares for a little over a month, there's was a lot of pent-up energy to unleash.

Well, as of yesterday, Venaxis has broken out of that narrowing range - bullishly - and at the same time has broken above the 100-day moving average line (gray), which had been a nagging resistance area since late July.

That 'unleashing' action alone was enough for me to go ahead and fall in love with APPY, but today's action seals the deal. Today, shares are following through, up five cents (+3.0%) so far, telling us yesterday's surge wasn't just a little volatility. Take a look.

Bolstering the bullish argument is the fact that volume poured into Venaxis Inc. shares on Wednesday. The 1.8 million shares that traded hands - most of it buying volume - yesterday was the most interest we'd seen in the stock in weeks, and in light of the multi-week buildup we've seen [APPY has been moving higher for months, in fits and starts] since June, it's the culmination of a lot of bullish undertows that have been working hard to finally converge at this point. Now that they're all converged, Venaxis is ready to go from good to great.

As for a target, well, this isn't necessarily a long-term call on APPY. Though we should get some good traction now that the taut slingshot has been released, the rally's apt to slow down, if not stop, around $2.25. That was a turbulent area earlier in the year. The $3.00 mark was a firm ceiling in the last half of last year if shares do manage to break past $2.25. Still, that's a pretty good move, and worth a shot.

If you'd like more trading ideas and insights like this one, become a subscriber to the SmallCap Network daily newsletter. You'll get stock picks, market calls, and more, FOR FREE! Sign up today.

FRT data by YCharts

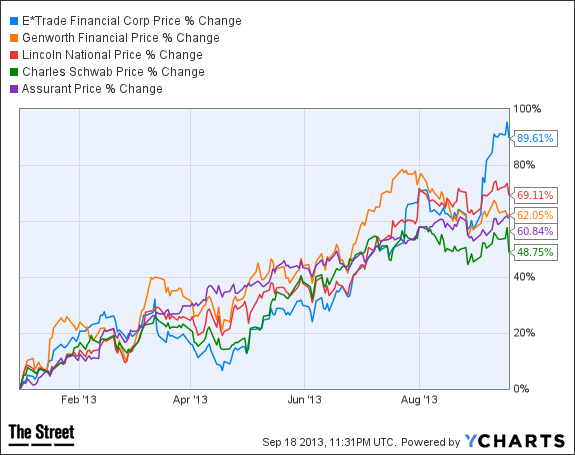

FRT data by YCharts  ETFC data by YCharts

ETFC data by YCharts  AAPL data by YCharts

AAPL data by YCharts  Getty ImagesStarbucks Chairman Howard Schultz (left) and William "Bill" Ackman, founder and chief executive officer of Pershing Square Capital Management. Oh, you thought everything would get back to normal at J.C. Penney (JCP) once Ron Johnson was gone? Just four months after Johnson was ousted as CEO, the struggling retailer once again finds itself embroiled in a leadership controversy. Activist investor Bill Ackman, who was responsible for bringing on Johnson in the first place, is now making noise about replacing current CEO Myron Ullman. Ullman had preceded Johnson as CEO, and was brought back by the board in April to stabilize things after Johnson's disastrous reign. Ackman's Pershing Square Capital Management represents one of the company's biggest investors, and despite the failure of his last hand-picked chief executive, Ackman hasn't hesitated to throw his weight around. Last week, he sent a letter to the board urging it to speed up it search for a new CEO; the board fired back, calling his efforts "disruptive and counterproductive" and calling Ullman "the right person to rebuild J.C. Penney." Ackman is also pushing for Allen Questrom, another former CEO, to replace Tom Engibous as chairman of the board. Ackman's efforts to undermine the current leadership have drawn sharp rebukes from outside the company. Most notably, Starbucks (SBUX) CEO Howard Schultz jumped into the fray late last week, blasting Ackman for trying to oust Ullman. "It is despicable of Ackman to leak a letter asking for [Ullman's] removal," he told the Wall Street Journal. "The irony is that Ackman himself has every step of the way severely damaged this company." Schultz also told CNBC that he thought the board should move to remove Ackman. Schultz isn't the only one weighing in on the controversy. Bloomberg reports that George Soros -- who owns a sizable stake in the company -- likewise told J.C. Penney that he supports Ullman and Engibous. But Ackman isn't without allies: Richard Perry's hedge fund, Perry Capital, another big shareholder, said that it agrees with Ackman that Ullman and Engibous need to go. The week of infighting has had the stock on a roller coaster ride for the last week. Indeed, it's rare to see such an ugly boardroom fight play out in the public eye. If and when it comes time to replace Myron Ullman as CEO, we have to imagine the board will have a hard time convincing a talented CEO to join this circus.

Getty ImagesStarbucks Chairman Howard Schultz (left) and William "Bill" Ackman, founder and chief executive officer of Pershing Square Capital Management. Oh, you thought everything would get back to normal at J.C. Penney (JCP) once Ron Johnson was gone? Just four months after Johnson was ousted as CEO, the struggling retailer once again finds itself embroiled in a leadership controversy. Activist investor Bill Ackman, who was responsible for bringing on Johnson in the first place, is now making noise about replacing current CEO Myron Ullman. Ullman had preceded Johnson as CEO, and was brought back by the board in April to stabilize things after Johnson's disastrous reign. Ackman's Pershing Square Capital Management represents one of the company's biggest investors, and despite the failure of his last hand-picked chief executive, Ackman hasn't hesitated to throw his weight around. Last week, he sent a letter to the board urging it to speed up it search for a new CEO; the board fired back, calling his efforts "disruptive and counterproductive" and calling Ullman "the right person to rebuild J.C. Penney." Ackman is also pushing for Allen Questrom, another former CEO, to replace Tom Engibous as chairman of the board. Ackman's efforts to undermine the current leadership have drawn sharp rebukes from outside the company. Most notably, Starbucks (SBUX) CEO Howard Schultz jumped into the fray late last week, blasting Ackman for trying to oust Ullman. "It is despicable of Ackman to leak a letter asking for [Ullman's] removal," he told the Wall Street Journal. "The irony is that Ackman himself has every step of the way severely damaged this company." Schultz also told CNBC that he thought the board should move to remove Ackman. Schultz isn't the only one weighing in on the controversy. Bloomberg reports that George Soros -- who owns a sizable stake in the company -- likewise told J.C. Penney that he supports Ullman and Engibous. But Ackman isn't without allies: Richard Perry's hedge fund, Perry Capital, another big shareholder, said that it agrees with Ackman that Ullman and Engibous need to go. The week of infighting has had the stock on a roller coaster ride for the last week. Indeed, it's rare to see such an ugly boardroom fight play out in the public eye. If and when it comes time to replace Myron Ullman as CEO, we have to imagine the board will have a hard time convincing a talented CEO to join this circus.