WASHINGTON -- General Motors CEO Mary Barra on Tuesday told a congressional subcommittee investigating a widening recall that while she could answer few specific questions about what happened, decisions made in past years not to address the situation do not reflect GM's current culture.

The recall of 2.5 million Chevrolet Cobalts, Saturn Ions and similar vehicles worldwide in the last two months came after GM acknowledged a link between an ignition switch defect -- dating back to models more than a decade old -- and air bags not deploying in the event of a crash. GM has linked 13 deaths to the defect.

"It came to light on my watch, so I am responsible for it," Barra, who has been on the job less than three months, told the House Oversight and Investigations Subcommittee. "Today's GM will do the right thing."

She said she was troubled by reports that GM officials rejected a solution to the ignition switch problem because of the "lead time required, cost and effectiveness."

"I found that statement to be very disturbing," said Barra. "That is unacceptable. That is not how we do business in today's GM."

Barra said that "GM has civil responsibilities and legal responsibilities and we are thinking through how to best balance them." She said GM had hired lawyer Kenneth Feinberg to explore ways to compensate victims the crashes. Feinberg's previous projects include the Sept. 11 Victim Compensation Fund and the BP oil spill.

Barra acknowledged during questioning that the company in the past had been immersed in a "cost culture," but said GM was moving to a "customer culture."

Barra told the committee that the company knew early on the switches, which it purchased from another company, did not meet its specifications. Rep. Joe Barton, R-Tex., asked Barra why a company with "the stellar reputation" of GM would buy such parts.

"I want to know that as much as you do," Barra said. She said all GM parts meet safety standards, but would not say whether any GM parts fail to! meet its technical specifications.

"That's not an acceptable answer," Barton responded.

Rep. Henry Waxman, D-Calif. asked Barra why the company didn't recall models from 2008 and later until last week.

"The company was assessing," Barra said, adding that "it became very clear we needed to go with all those vehicles" because GM could not determine which cars might have faulty repair parts.

Some members of the committee did express empathy for Barra. Said Waxman: "I know you're taking this job at an inauspicious time. You're trying to clean up the mess your predecessors left for you." And Rep. John Dingell, D- Mich., said "I appreciate the lengths to which GM is going under your leadership."

Before Barra testified, Rep. Michael Burgess was among committee members expressing bewilderment that the problem dragged on for so long before the recall was authorized.

"With over 200,000 documents that have been produced, lack of information was not the problem. Instead, it is this committee's duty to figure out why the data was there but the analysis was egregiously off the mark," said Burgess, R-Texas. "We need to get to the bottom of this—and fast. The stakes are too high."

Rep. Diana DeGette, D-Colo., said that GM documents show the ignition switch could have been fixed as cheaply as 57 cents per vehicle.

David Friedman, acting head of the National Highway Traffic Safety Administration, testified that GM should have provided NHTSA with relevant data about the crashes, deaths and ignition switch failures far earlier. That, he said, could have set in motion a recall before now.

NHTSA, despite receiving hundreds of complaints and considering a possible pattern of air bag non-deployment in 2007, failed to act. Friedman said the cars were not "overrepresented" among other models in terms of air bag problems and that the data "did not indicate a safety defect or defect trend that would warrant .. a formal investigation."

JAIL TIME? Key questions GM faces!

ST! ORY: Loved ones of crash victims speak out

The exposure for GM -- its resurgent post-bankruptcy reputation and profitability at risk -- and for Barra is great. Lawyers are lining up to file class actions and liability suits, testing whether GM's bankruptcy shield from pre-2009 claims will hold.

Barra's defense brought little comfort to families of some crash victims, who held a news conference before the hearing outside the Capitol. Several members of Congress joined them.

"Corporate executives made a decision that fighting the problem was cheaper and easier than fixing the problem," said Laura Christian, whose daughter died in a 2005 crash.

In recent days, concerns that GM and NHTSA missed warnings that should have prompted an earlier recall have grown. House committee staff, meeting with officials of Delphi, the Troy-based company that produced the ignition switches, said suppliers told them in a briefing that GM accepted the part in 2002 even though it did not meet GM's own specifications.

The fault that triggered the recall allows the ignition switch to slip unexpectedly from the normal "run" position into "accessory." That shuts off the engine and kills power to a number of systems, usually including airbags.

GM's own chronology says the problem first was noticed at GM in 2001.The recall has emerged in three stages:

• Feb. 7, GM recalled 778,562 of its 2005-2007 Chevrolet Cobalts and 2007 Pontiac G5s, 619,122 in the U.S. to replace the switches.

• Feb. 25, it expanded that by another 842,103, to include 2003-2007 Saturn Ion, 2006-2007 Chevy HHR, 2006 Pontiac Solstice, 2007 Saturn Sky. Of those, 748,024 are U.S.-market vehicles.

• March 28, it again expanded the universe of recalled cars, this time by 873,288 U.S. models, to include newer versions of the already recalled vehicles that had the redesigned – safer – switches from the factory, but might have gotten a faulty switch during repairs. Only about 5,000 of those are likely to have! gotten a! bad switch, but GM can't tell which 5,000 because some old and new switches have the same part number.

According to a timeline the automaker has filed with the National Highway Traffic Safety Administration in connection with the recall, GM first noted a problem with the ignition switch moving out of "run" in 2001, during development of the 2003 Saturn Ion.

An unidentified mechanic reported the problem in 2003 on a customer's car. And in 2004 a GM engineer finalizing the new 2005 Chevy Cobalt experienced the switch problem.

A new switch design was approved in 2006, the timeline says, but without a new part number. If that was done to fix a safety problem, but federal safety officials weren't told, it could be a violation of federal law. GM did not recall the cars in 2006 to install the redesigned part.

On March 18, in her first interview since taking over as CEO in January, Barra acknowledged, "Clearly, this took too long." Pledging to ensure there's never a repeat, Barra said, "We will fix our process."

She hired a global safety chief with access to her and other top executives, a first for GM and rare in the car business. And the automaker began to accelerate its own product and safety reviews.

GM's recalls in the first three months of the year haven't been limited to the ignition switches. On Monday, it recalled 1.5 million more vehicles for a power steering defect, bringing the worldwide total to 7 million vehicles.

Spangler writes for the Detroit Free Press. Contributing: Free Press reporters Alisa Priddle and Nathan Bomey

Mary Barra, CEO of General Motors, is sworn in to testify before the House Energy and Commerce subcommittee on Oversight and Investigation on April 1 in Washington. The committee is looking for answers from Barra about safety defects and mishandled recall of 2.6 million small cars with a faulty ignition switch that's been linked to 13 deaths and dozen of crashes. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

![Mary Barra testifies before the House Energy and Commerce subcommittee on Oversight and Investigation on Capitol Hill. Family members attending the hearing put photographs of crash victims on a railing at the back of the room.]()

Mary Barra testifies before the House Energy and Commerce subcommittee on Oversight and Investigation on Capitol Hill. Family members attending the hearing put photographs of crash victims on a railing at the back of the room. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

![Barra testifies on Capitol Hill.]()

Barra testifies on Capitol Hill. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

![Barra delivers her testimony about the ignition switch recall.]()

Barra delivers her testimony about the ignition switch recall. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

![Mary Barra listens to members of Congress speak before delivering testimony at a hearing on Capitol Hill in Washington.]()

Mary Barra listens to members of Congress speak before delivering testimony at a hearing on Capitol Hill in Washington. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

![House Oversight and Investigations subcommittee Chairman Rep. Tim Murphy, R-Pa., left, watches as the subcommittee's ranking member, Rep. Diana DeGette, D-Colo. holds up a GM ignition switch.]()

House Oversight and Investigations subcommittee Chairman Rep. Tim Murphy, R-Pa., left, watches as the subcommittee's ranking member, Rep. Diana DeGette, D-Colo. holds up a GM ignition switch. (Photo: J. Scott Applewhite, AP)View Fullscreen

![Barra prepares to testify.]()

Barra prepares to testify. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

![Photographs of crash victims are placed on a railing.]()

Photographs of crash victims are placed on a railing. (Photo: Evan Vucci, AP)View Fullscreen

![General Motors CEO Mary Barra arrives on Capitol Hill.]()

General Motors CEO Mary Barra arrives on Capitol Hill. (Photo: J. Scott Applewhite, AP)View Fullscreen

![General Motors CEO Mary Barra testifies on Capitol Hill.]()

General Motors CEO Mary Barra testifies on Capitol Hill. (Photo: Pablo Martinez Monsivais, AP)View Fullscreen

![Barra waits to be seated.]()

Barra waits to be seated. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

![Clarence Ditlow, executive director of the Center for Auto Safety, displays a GM ignition switch similar to those linked to 13 deaths and dozens of crashes of General Motors small cars during a news conference on Capitol Hill.]()

Clarence Ditlow, executive director of the Center for Auto Safety, displays a GM ignition switch similar to those linked to 13 deaths and dozens of crashes of General Motors small cars during a news conference on Capitol Hill. (Photo: J. Scott Applewhite, AP)View Fullscreen

![Mary Ruddy, left, holds a photograph of her daughter, Kelly, who died in a 2005 crash of a Chevy Cobalt, as she hugs Rosie Cortinas whose son, Amador, also died in the crash during a press conference on Capitol Hill in Washington. A House subcommittee questioned General Motors Chief Executive Mary Barra over why the company ignored a faulty ignition problem for a decade despite numerous accident reports and 13 deaths.]()

Mary Ruddy, left, holds a photograph of her daughter, Kelly, who died in a 2005 crash of a Chevy Cobalt, as she hugs Rosie Cortinas whose son, Amador, also died in the crash during a press conference on Capitol Hill in Washington. A House subcommittee questioned General Motors Chief Executive Mary Barra over why the company ignored a faulty ignition problem for a decade despite numerous accident reports and 13 deaths. (Photo: Jim Watson, AFP/Getty Images)View Fullscreen

![Jayme Rimer, left, and Daryl Chansuthus hold photographs of their children who died in GM vehicles during a news conference on Capitol Hill.]()

Jayme Rimer, left, and Daryl Chansuthus hold photographs of their children who died in GM vehicles during a news conference on Capitol Hill. (Photo: Michael Reynolds, epa)View FullscreenLike this topic? You may also like these photo galleries:Replay

AutoplayShow ThumbnailsShow CaptionsLast SlideNext Slide

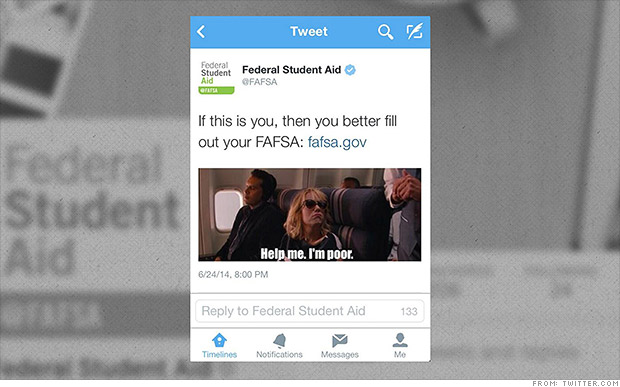

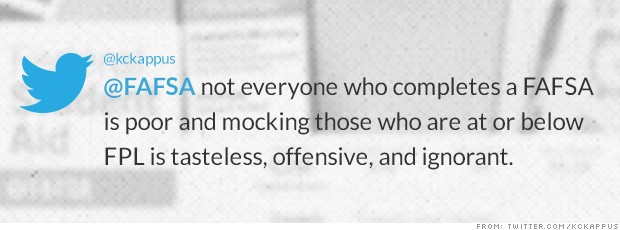

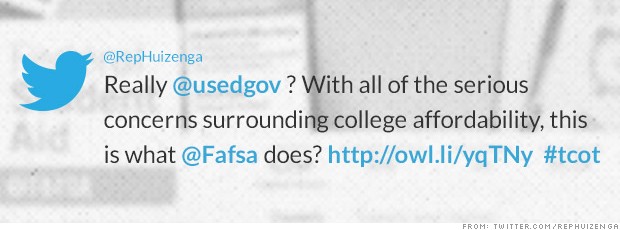

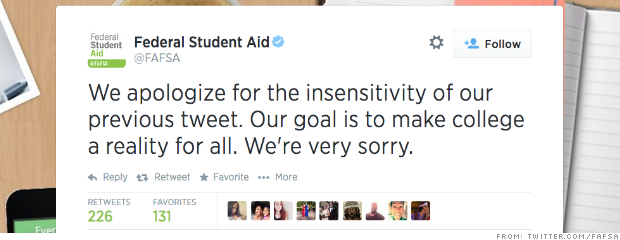

NEW YORK (CNNMoney) For social media managers, reaching young audiences with irreverent memes and tweets is a dangerous endeavor.

NEW YORK (CNNMoney) For social media managers, reaching young audiences with irreverent memes and tweets is a dangerous endeavor.

Related BZSUM Mid-Morning Market Update: Markets Flat; Monsanto Earnings Beat Street View #PreMarket Primer: Wednesday, April 2: General Motors Investigation Underway

Related BZSUM Mid-Morning Market Update: Markets Flat; Monsanto Earnings Beat Street View #PreMarket Primer: Wednesday, April 2: General Motors Investigation Underway  Mary Barra, CEO of General Motors, is sworn in to testify before the House Energy and Commerce subcommittee on Oversight and Investigation on April 1 in Washington. The committee is looking for answers from Barra about safety defects and mishandled recall of 2.6 million small cars with a faulty ignition switch that's been linked to 13 deaths and dozen of crashes. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

Mary Barra, CEO of General Motors, is sworn in to testify before the House Energy and Commerce subcommittee on Oversight and Investigation on April 1 in Washington. The committee is looking for answers from Barra about safety defects and mishandled recall of 2.6 million small cars with a faulty ignition switch that's been linked to 13 deaths and dozen of crashes. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen Mary Barra testifies before the House Energy and Commerce subcommittee on Oversight and Investigation on Capitol Hill. Family members attending the hearing put photographs of crash victims on a railing at the back of the room. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

Mary Barra testifies before the House Energy and Commerce subcommittee on Oversight and Investigation on Capitol Hill. Family members attending the hearing put photographs of crash victims on a railing at the back of the room. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen Barra testifies on Capitol Hill. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

Barra testifies on Capitol Hill. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen Barra delivers her testimony about the ignition switch recall. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

Barra delivers her testimony about the ignition switch recall. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen Mary Barra listens to members of Congress speak before delivering testimony at a hearing on Capitol Hill in Washington. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

Mary Barra listens to members of Congress speak before delivering testimony at a hearing on Capitol Hill in Washington. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen House Oversight and Investigations subcommittee Chairman Rep. Tim Murphy, R-Pa., left, watches as the subcommittee's ranking member, Rep. Diana DeGette, D-Colo. holds up a GM ignition switch. (Photo: J. Scott Applewhite, AP)View Fullscreen

House Oversight and Investigations subcommittee Chairman Rep. Tim Murphy, R-Pa., left, watches as the subcommittee's ranking member, Rep. Diana DeGette, D-Colo. holds up a GM ignition switch. (Photo: J. Scott Applewhite, AP)View Fullscreen Barra prepares to testify. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

Barra prepares to testify. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen Photographs of crash victims are placed on a railing. (Photo: Evan Vucci, AP)View Fullscreen

Photographs of crash victims are placed on a railing. (Photo: Evan Vucci, AP)View Fullscreen General Motors CEO Mary Barra arrives on Capitol Hill. (Photo: J. Scott Applewhite, AP)View Fullscreen

General Motors CEO Mary Barra arrives on Capitol Hill. (Photo: J. Scott Applewhite, AP)View Fullscreen General Motors CEO Mary Barra testifies on Capitol Hill. (Photo: Pablo Martinez Monsivais, AP)View Fullscreen

General Motors CEO Mary Barra testifies on Capitol Hill. (Photo: Pablo Martinez Monsivais, AP)View Fullscreen Barra waits to be seated. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen

Barra waits to be seated. (Photo: H. Darr Beiser, USA TODAY)View Fullscreen Clarence Ditlow, executive director of the Center for Auto Safety, displays a GM ignition switch similar to those linked to 13 deaths and dozens of crashes of General Motors small cars during a news conference on Capitol Hill. (Photo: J. Scott Applewhite, AP)View Fullscreen

Clarence Ditlow, executive director of the Center for Auto Safety, displays a GM ignition switch similar to those linked to 13 deaths and dozens of crashes of General Motors small cars during a news conference on Capitol Hill. (Photo: J. Scott Applewhite, AP)View Fullscreen Mary Ruddy, left, holds a photograph of her daughter, Kelly, who died in a 2005 crash of a Chevy Cobalt, as she hugs Rosie Cortinas whose son, Amador, also died in the crash during a press conference on Capitol Hill in Washington. A House subcommittee questioned General Motors Chief Executive Mary Barra over why the company ignored a faulty ignition problem for a decade despite numerous accident reports and 13 deaths. (Photo: Jim Watson, AFP/Getty Images)View Fullscreen

Mary Ruddy, left, holds a photograph of her daughter, Kelly, who died in a 2005 crash of a Chevy Cobalt, as she hugs Rosie Cortinas whose son, Amador, also died in the crash during a press conference on Capitol Hill in Washington. A House subcommittee questioned General Motors Chief Executive Mary Barra over why the company ignored a faulty ignition problem for a decade despite numerous accident reports and 13 deaths. (Photo: Jim Watson, AFP/Getty Images)View Fullscreen Jayme Rimer, left, and Daryl Chansuthus hold photographs of their children who died in GM vehicles during a news conference on Capitol Hill. (Photo: Michael Reynolds, epa)View FullscreenLike this topic? You may also like these photo galleries:Replay

Jayme Rimer, left, and Daryl Chansuthus hold photographs of their children who died in GM vehicles during a news conference on Capitol Hill. (Photo: Michael Reynolds, epa)View FullscreenLike this topic? You may also like these photo galleries:Replay