Zacks Investment Research downgraded shares of ON Semiconductor (NASDAQ:ON) from a buy rating to a hold rating in a report issued on Tuesday.

Zacks Investment Research downgraded shares of ON Semiconductor (NASDAQ:ON) from a buy rating to a hold rating in a report issued on Tuesday.

According to Zacks, “ON Semi is an original equipment manufacturer (OEM) of a broad range of discrete and embedded semiconductor components. The company benefits from robust demand, adoption and favorable product mix. The company continues to gain from its strength in automotive and industrial end-markets. The addition of Fairchild’s offerings has expanded the company’s product portfolio. Synergies from acquisitions have given the company exposure to new end markets along with higher margin capabilities. We believe the recent acquisition of SensL Technologies, which is expected to be immediately accretive, is a positive. Notably, shares of the company have outperformed the industry on a year-to-date basis. However, intensifying competition and high debt position remain woes. Furthermore, restructuring activities limit bottom-line growth.”

Get ON Semiconductor alerts:

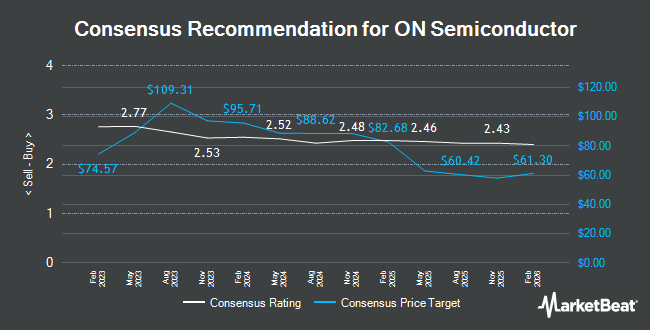

Several other research analysts have also recently weighed in on the company. ValuEngine cut ON Semiconductor from a buy rating to a hold rating in a research report on Monday. BidaskClub cut ON Semiconductor from a hold rating to a sell rating in a research report on Wednesday, June 27th. Craig Hallum upped their price target on ON Semiconductor from $28.00 to $31.00 and gave the company a buy rating in a research report on Tuesday, June 5th. Finally, JPMorgan Chase & Co. upped their price target on ON Semiconductor from $23.00 to $24.00 and gave the company a neutral rating in a research report on Tuesday, May 1st. Two research analysts have rated the stock with a sell rating, nine have issued a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the stock. The stock currently has an average rating of Hold and an average target price of $25.10.

Shares of ON Semiconductor opened at $22.15 on Tuesday, MarketBeat Ratings reports. ON Semiconductor has a 12-month low of $13.65 and a 12-month high of $27.10. The firm has a market cap of $9.66 billion, a P/E ratio of 15.17, a P/E/G ratio of 1.01 and a beta of 2.04. The company has a quick ratio of 0.93, a current ratio of 1.53 and a debt-to-equity ratio of 0.71.

ON Semiconductor (NASDAQ:ON) last announced its quarterly earnings results on Sunday, April 29th. The semiconductor company reported $0.40 earnings per share (EPS) for the quarter, topping the Thomson Reuters’ consensus estimate of $0.39 by $0.01. ON Semiconductor had a return on equity of 23.00% and a net margin of 15.90%. The business had revenue of $1.38 billion during the quarter, compared to the consensus estimate of $1.37 billion. During the same quarter in the prior year, the company posted $0.18 earnings per share. ON Semiconductor’s revenue was up 7.5% compared to the same quarter last year. equities analysts anticipate that ON Semiconductor will post 1.77 EPS for the current year.

In other ON Semiconductor news, EVP William Hall sold 3,000 shares of the stock in a transaction that occurred on Wednesday, May 2nd. The stock was sold at an average price of $22.14, for a total value of $66,420.00. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Keith D. Jackson sold 80,000 shares of the stock in a transaction that occurred on Wednesday, May 23rd. The stock was sold at an average price of $23.99, for a total value of $1,919,200.00. Following the completion of the sale, the chief executive officer now owns 3,107,401 shares of the company’s stock, valued at approximately $74,546,549.99. The disclosure for this sale can be found here. Insiders have sold a total of 130,929 shares of company stock worth $3,129,066 over the last quarter. Corporate insiders own 1.29% of the company’s stock.

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in ON. Blue Harbour Group L.P. lifted its holdings in ON Semiconductor by 114.4% in the 1st quarter. Blue Harbour Group L.P. now owns 5,508,908 shares of the semiconductor company’s stock worth $134,748,000 after buying an additional 2,938,900 shares during the period. Robecosam AG lifted its holdings in ON Semiconductor by 157.9% in the 1st quarter. Robecosam AG now owns 2,746,500 shares of the semiconductor company’s stock worth $67,179,000 after buying an additional 1,681,500 shares during the period. LSV Asset Management lifted its holdings in ON Semiconductor by 11.4% in the 1st quarter. LSV Asset Management now owns 8,085,228 shares of the semiconductor company’s stock worth $197,764,000 after buying an additional 829,500 shares during the period. Income Research & Management purchased a new stake in ON Semiconductor in the 4th quarter worth approximately $1,039,000. Finally, State of New Jersey Common Pension Fund D lifted its holdings in ON Semiconductor by 62.5% in the 1st quarter. State of New Jersey Common Pension Fund D now owns 1,950,000 shares of the semiconductor company’s stock worth $47,697,000 after buying an additional 750,000 shares during the period. Institutional investors and hedge funds own 90.39% of the company’s stock.

ON Semiconductor Company Profile

ON Semiconductor Corporation manufactures and sells semiconductor components for various electronic devices worldwide. It operates through three segments: Power Solutions Group, Analog Solutions Group, and Image Sensor Group. The Power Solutions Group segment offers discrete, module, and integrated semiconductor products for various applications, such as power switching, power conversion, signal conditioning, circuit protection, signal amplification, and voltage reference.

Get a free copy of the Zacks research report on ON Semiconductor (ON)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

KAZ Minl PLC/ADR (OTCMKTS:KZMYY) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a research note issued to investors on Wednesday.

KAZ Minl PLC/ADR (OTCMKTS:KZMYY) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a research note issued to investors on Wednesday.  bitJob (CURRENCY:STU) traded 10.3% lower against the US dollar during the 1 day period ending at 9:00 AM Eastern on July 6th. One bitJob token can now be bought for about $0.0130 or 0.00000198 BTC on cryptocurrency exchanges including Qryptos, Radar Relay, HitBTC and IDEX. bitJob has a market cap of $622,554.00 and approximately $46,621.00 worth of bitJob was traded on exchanges in the last 24 hours. In the last week, bitJob has traded down 3% against the US dollar.

bitJob (CURRENCY:STU) traded 10.3% lower against the US dollar during the 1 day period ending at 9:00 AM Eastern on July 6th. One bitJob token can now be bought for about $0.0130 or 0.00000198 BTC on cryptocurrency exchanges including Qryptos, Radar Relay, HitBTC and IDEX. bitJob has a market cap of $622,554.00 and approximately $46,621.00 worth of bitJob was traded on exchanges in the last 24 hours. In the last week, bitJob has traded down 3% against the US dollar.