Financial Finesse held a webinar on Friday previewing data that it will release later this week in a report on the gender gap in financial literacy.

“Over the last several years, the gap has been steadily increasing” although it’s beginning to level off, Diane Winland, the report’s primary author, said in the webinar.

“Women need to get ahead of men” in order to overcome barriers like longer lifespans and less time in the work force, Winland said. Women can live between five and 10 years longer than men, she said, and tend to make less over time. The National Commission on Pay Equity found women make about $11,000 less than men per year.

The gap is largest in debt and money management, Winland said. That’s surprising because women are frequently the money managers in their families, Winland said, referring to a Boston Consulting Group study that found in 73% of households, spending is controlled by women.

Financial Finesse found the smallest gap in long-term planning, and no gap in participation in employer-sponsored retirement plans. That parity in participation doesn’t translate to actual savings, though. Winland referred to data from the Employee Benefits Research Institute that found men have saved on average $114,000 in workplace retirement plans, compared with $56,000 for women.

“We need to do a better job of putting emphasis on women taking control of their finances,” Winland said in the webinar. Winland stressed that improving women’s financial habits isn’t the only goal; women need to have more confidence in their abilities and actions in order to see improvement.

Linda Robertson, a senior financial planner at Financial Finesse, pointed out that the gender gap narrowed with higher levels of income, especially between men and women in the $150,000-to-$200,000 income range. The reason why is a subject of further study, she said.

Winland referred to a study by Allianz that showed women have a “pervasive fear of being a bag lady. No matter what position we achieve, we still have that underlying fear.”

In some areas, Financial Finesse found, women are improving while men are actually pulling back. Women improved at fee analysis, rebalancing and allocating assets. “Women are better at following a plan,” Winland said, “while men tend to be more aggressive.”

The report found men are more likely to have an emergency cash fund, pay bills on time and manage their cash flow so they’re not spending more than they make. “In order to save for long-term [goals], we need to close the gap in money management,” Robertson said.

Men are also more likely to know whether they are on track for retirement, although less than a quarter of male respondents could answer positively. “The younger men and women are when they run estimates, the smaller steps they need to take to get on track,” Robertson added. Winland said that financial education should focus on empowering people. “The highly technical, narrowly focused lecture format of education may not be the best model,” Robertson agreed. The format suggested by Financial Finesse is life goal-based and holistic, and delivers information in a way that is engaging and encourages participation. The traditional model is “definitely not the best for women and maybe for all employees,” Winland said. “Women prefer a much more kinesthetic style.”

To design effective financial educational programs, Financial Finesse suggested using a holistic approach that ties together all the benefits an employer offers. They should also work to create “ah-ha” moments that women can relate to.

Another best practice is to “fold the financial piece into the wellness program so employees can see the connection between physical health and financial health,” Winland said.

Winland added that women respond well to coaching programs with multiple steps, like an online assessment followed by group workshops and a one-on-one coaching session or call.

“To close the gap, we have to make sure women are taking positive action,” Robertson concluded. She suggested making women active participants in their financial education and giving them concrete steps to take following educational sessions.

---

Check out Women More Likely to Have High Financial Stress on AdvisorOne.

Hosted by Marketfy

Hosted by Marketfy  $(function () { var dateToday = new Date(); var dateCheck = dateT

$(function () { var dateToday = new Date(); var dateCheck = dateT

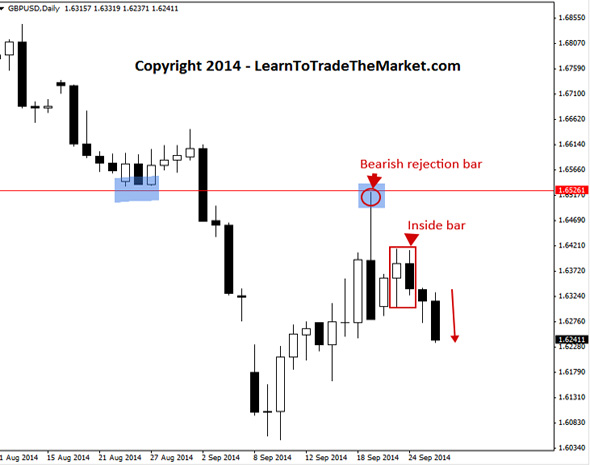

Copyright 2014 -- LearnToTradeTheMarket.com Must Read: What, Me Worry? 4 Reasons Why We're Not at a Market Top Yet This article is commentary by an independent contributor, separate from TheStreet's regular news coverage.

Copyright 2014 -- LearnToTradeTheMarket.com Must Read: What, Me Worry? 4 Reasons Why We're Not at a Market Top Yet This article is commentary by an independent contributor, separate from TheStreet's regular news coverage.