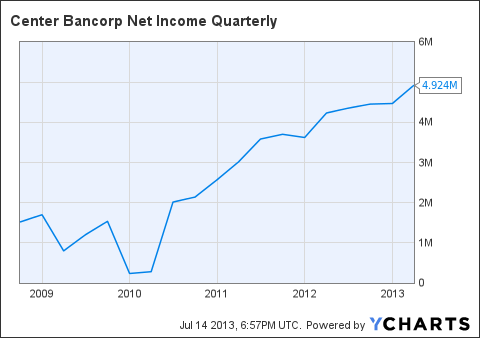

Center Bancorp (CNBC) has been bringing in a lot of money for investors over the past year and even-so, a big majority of it has yet to hit the company's bottom line. As you can see from the graph below, reported net incomes have consistently improved even though the bank has close to have a year's worth of net income tucked away in allowances. And, I'm only talking about the allowance balance after all nonperforming loans are subtracted. It is very necessary to put aside this money but 3.9Xs nonperforming loans puts CNBC at one of the highest coverage ratios I've found (more the result of quickly improving NPLs than management setting aside too much money).

CNBC Net Income Quarterly data by YCharts

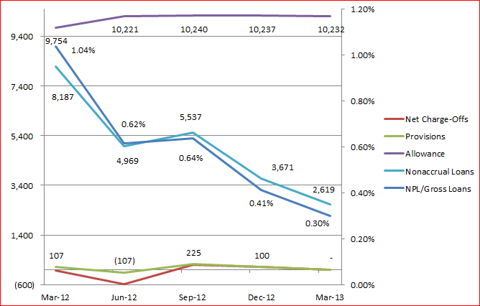

Year-over-year, nonperforming loans have declined 68% to a very low $2.619 million, ~0.3% of Center's $879 million gross loan portfolio. Along with this improvement, the bank has in some recent quarters actually recovered more NPLs than it charged-off and allowances now dwarf NPLs to the point that zero dollars were provisioned last quarter, and I wouldn't be surprised if they soon started to add dollars to the bottom line (negative provision expenses release allowances).

(click to enlarge)

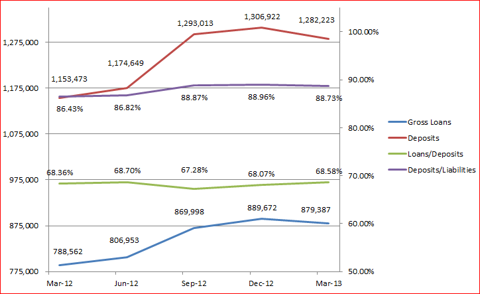

In addition to its nonperforming loan improvements, CNBC's loan portfolio and deposit accounts have both grown ~11% YOY. When last reported, L/Ds was 68.6% which is very low and/or indicates a very high capacity for new loans. Even though the loan portfolio above has been growing, the level its at has been held back recently by a large number of prepayments ($33.1 million last quarter) and scheduled payoffs ($41.1 million), which means the bank's new bookings are actually 2Xs what they would appear to be a! fter a cursory top-line inquiry. Close to 60% of CNBC's loans are backed by real estate with 49.1% of the total portfolio tied to commercial real estate loans, where virtually all of the loan portfolio growth has been realized.

(click to enlarge)

Moving forward, the bank continues to focus on growing business in its backyard with plans and recent approval to open a new office in Princeton. On that, President & CEO Anthony C. Weagley says the new addition will help the company's "strategic plan to expand the reach of our branch network." A big positive considering that CNBC's capacity is not likely to be filled by organic growth alone.

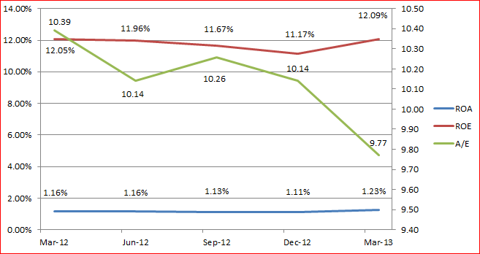

Net interest margins of 3.31% are right at the national average but under what the CNBC could be earning with a larger loan portfolio. With this in mind, I was expecting to find low returns but management appears to be on-top of expenses and a very low 48.5% efficiency ratio has helped consistently bring in an above average ROA of ~1.16% and ROE of ~12.7%. Even more impressive considering the reserves that didn't get added in.

(click to enlarge)

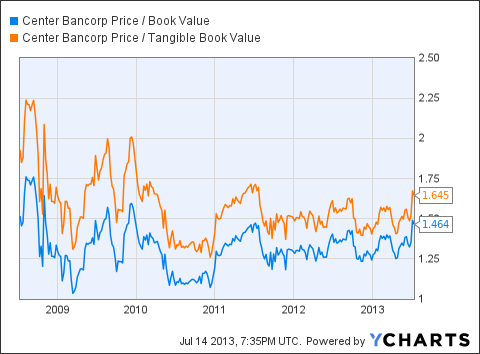

Before looking at the current valuation, I will say that most regional banks that have an:

ROA over 1ROE over 12 andDividend yield over 2%Trade between 1.4-1.6 times TBV. But, not all of them have:

Capacity for more loansSuch a low NPL balanceAny plans for expansion andAn efficiency ratio under 50%With that said, I consider Centers current P/TBV of 1.645 fair but would argue buyers were getting a lot more quality than most other regionals trading with that price tag.

Bottom Line

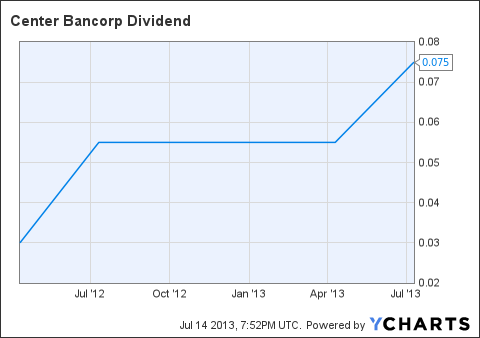

Center Bancorp is a small-cap bank with a management that is looking to expand while keeping costs as low as possible. Given the fact that loans have been hard to come by for all banks, and the fact that Center's loan balance has been growing organically, I'm not too worried about the pace considering that NPLs have improved so much that virtually all of the bank's loans are now performing. Recent announcements to raise the dividend and the already implied safety come with a pretty full price but anyone looking for a safe dividend in a growing business should definitely consider Center Bancorp.

CNBC Dividend data by YCharts

Note: Center Bancorp was upped to a strong buy from Zacks Equity Research after the announcement to increase its dividend by 36.36%.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment