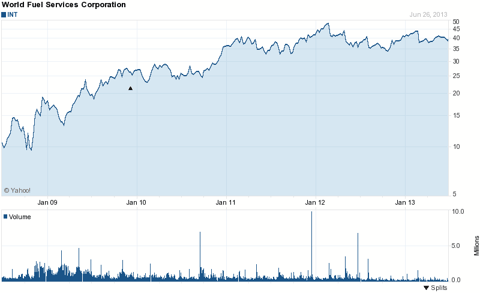

World Fuel Services (INT) may be one of the most underrated companies in the world, as in the last five years it has vastly outperformed Apple (AAPL) while demolishing the S&P 500. During that period of time, the share price of World Fuel Services has grown 230 percent, while Apple's has grown 131 percent. The S&P 500 has grown a paltry 17 percent over the period.

This isn't just an anomaly though, as the company has also outperformed Apple over the last decade as well, growing revenues at a rate of 39.8 percent annually, just beating out Apple's growth rate of 39.2 percent.

It's incredible that this type of performance has flown largely under the radar of investors in general, with few really knowing what it is that the company does and how it has performed.

(click to enlarge) Source:Yahoo

(click to enlarge) Source:stockcharts

What World Fuel Services Does

At the basic level, what World Fuel Services does is sell fuel and logistics services to companies transporting commodities, goods and people in the air, by land or by sea. Any business moving these types of products or people is served by the company.

While the general premise is easy to understand, it's an extraordinarily complex business. For example, in the aviation business it serves every type of airline available, including all the known passenger airlines, corporate airlines, charters, cargo airlines and also has the government as a client. Each of these is a different business and can include additional services like planning for global trips and ground handling. Some of these services may or may not be included in each terminal or company served.

Since each market is different, World Fuel Services must be! an expert in every local market it serves, which means it has to know the taxes and fees, among other things, associated with each individual market. "We deal with all of the tedious, unglamorous aspects of logistics involved with ships, planes, delivery of jet fuel, marine fuel, diesel, and gasoline," says Kasbar. "It's labor intensive. Huge amounts of paperwork. It's very retail and very local."

What this means is there are huge barriers to entry, and thus a big moat the company enjoys against potential new competitors, as well as some of its existing ones. The performance of the company confirms it's among the best in the business at doing what it does, and very few companies want to compete in the very unglamorous but vital business.

Secret Behind its Extraordinary Growth

The major reason the retail fuel market has soared in growth, along with World Fuel Services, has been the divestiture of downstream businesses over the years by the giant oil and gas companies. That's especially true in marine sales.

What evolved was a very fragmented retail fuel industry, which created the opportunity for World Fuel Services and others to step into.

World Fuel Services grew quick as it became an expert in learning and serving the myriad of local markets. Now the well-managed company has a terrific knowledge of the market and extended its reach to about 200 countries.

Even though that was the major impetus and thrust of growth, the company has also been making a significant number of acquisitions, totaling 17 since 1998. The most recent acquisition is an important one, as it acquired a number of the assets held by Multi Service, which is a transaction company targeting the trucking business. It has 3,500 truck stops across North America.

Aviation Segment

Next we'll touch on each major segment the company provides solutions in, and talk of its recent performance and where it is going. Aviation will be the first segment we look at.

Aviation i! n the fir! st quarter of 2013 was stable. The best performers in the aviation segment were in commercial and business. Overall, expectations are the rest of 2013 should be better.

The company sees the airline industry continuing to perform strong because of the relative stability of oil prices. That stability and projected strength in the sector will be a positive for World Fuel Services, which has a strong position in the market.

Revenues in the airline segment in the first quarter of 2013 came in at $3.9 billion, an increase of $21 million sequentially, but up $519 million, or 15 percent, year-over-year. The two major catalysts for the increase were a boost in volume and a rise in the average price of jet fuel.

About 1.1 billion gallons of fuel were sold in the first quarter, down by 23 million gallons sequentially; primarily the result of there being two less days in the quarter than in the fourth quarter. It was still up by 127 million gallons, or 13 percent, over the same quarter in 2012.

Gross profit in the first quarter was $77 million, up $1 million over the prior month, and $12 million, or 19 percent, over the same period in 2012.

Business aviation, strong deicing fluid sales, and revenue from a full quarter of multi-service solutions were the main drivers in this segment for the quarter.

Income Statement

(click to enlarge) source:ycharts

Cash Flow Statement

(click to enlarge) source:ycharts

Marine Fuel Segment

In the marine fuel segment, it has been a challenge recently, as the first quarter results were down sequentially and year-over-year.

The problem in the quarter wasn't volume, as it exceeded the previous quarter and last year's totals in the same quarter. What happe! ned was t! he mix shifted to a more blue chip clientele in major ports. The other key factor was the lack of price volatility, which is important in regard to margins and earnings. The more volatility in the marine market the better the company does.

Looking at the company's basic shift in the marine industry in the near term, results so far in the second quarter point to a sequential improvement in the numbers.

Revenues in the first quarter from the marine segment were $3.7 billion, up $268 million, or 8 percent over the prior month. Year-over-year it plunged $187 million, or 5 percent in the quarter. The drop in numbers was the direct result of lower average bunker fuel prices.

World Fuel Services sold 6.8 million metric tons for the quarter, an increase of 200,000 metric tons, or 3 percent sequentially, and 400,000 metric tons or 6 percent over the same period last year.

Gross profit for the unit in the quarter was $42 million, a decline of $13 million or 24 percent year-over-year.

While the weak marine market wasn't a surprise, the depth of the weakness was to the firm. Again, it was the shift in business mix which has produced these weaknesses, as it includes lower margins and risks, which are counter to the success of the segment.

Land Segment

The Land segment outperformed the rest of the segments in the first quarter, including Multi Services, which did well after a weaker fourth quarter.

It appears the Land business is the major growth segment of the company, as it targets the trucking and rail business, along with growing out its logistics business.

In the first quarter, gross profit from Land beat out gross profit from Marine for the first time, reinforcing it's the major growth engine of the company going forward. That's not to say the other segments aren't going to grow, because they are, it's just that the Land business is positioned to take off and it'll strengthen the company even as the other business segments rebound. This should allow the comp! any to co! ntinue to grow far into the future.

Revenue from the Land segment in the first quarter was $2.5 billion, dropping $41 million from the prior quarter, but jumping $373 million, or 17 percent from the same period in 2012. The boost for the year was completely from higher volume.

A total of 840 million gallons were sold in the quarter, dropping 34 million gallons sequentially, but climbing $136 million gallons, or 19 percent, year-over-year. The month-to-month drop was because of there being two less days in the quarter. Tough weather in the Midwest was another factor.

On a consolidated basis gross profit came in at $182 million, an increase of $19 million, or 12 percent over the previous month, and $25 million, or 16 percent over the same quarter last year.

Gross profit was $64 million, gaining $26 million or 71 percent year-over-year. That included the performance of Multi Service. Gross profit on the fuel side was $53 million, rising $15 million, or 42 percent over last year during the same reporting period.

Future of the Company

Now that we've looked at the basics of the company and its performance over the last year, the obvious question is whether or not World Fuel Services can keep up its torrid pace. While it will be difficult to grow at a 40 percent rate annually, World Fuel Services definitely has a lot of things going for it which could allow it to grow in the 30 percent to 35 percent range for years to come.

Part of the reason I say that is the company has a strong and liquid balance sheet, which allows it to make the types of deals which guarantee future growth. I also like how effectively the company incorporates its new acquisitions into the company, as growth has continued on without any major problems since 1998.

Balance Sheet

(click to enlarge) source:ycharts

Another strength is that even in a weak! market, ! the company can generate significant revenue, although it can be challenged on the earnings side because of the low margins the business generates. In 2012 the company generated just about $39 billion in revenues, making only $189 million in profit, or 0.5 percent.

Operating leverage is important here, as the company has only about $100 million in fixed assets, with net working capital of around $1 billion.

The marine business will continue to weigh on the company, although that is expected to improve as the global economy strengthens, and should be better as soon as the second quarter in 2013.

Aviation is also expected to continue to be strong, which should help the company grow that out after being somewhat flat in the first quarter.

Combine that with the Land segment which is expected to explode, and it is easy to see how World Fuel Services has the pieces in place to generate serious revenue and profits in the future.

One example of that is projected growth in the trucking sector. There are approximately 3.5 million trucks on the road, with about 500,000 different companies supplying them. Of those, close to 50 percent are owned by companies will 10 or fewer trucks, according to World Fuel Services CEO Michael Kasbar.

This is part of the strategy behind the acquisition of Multi Service, which specializes in providing solutions for small fleets. The bottom line according to Kasbar is it takes "complicated transactions ... creating order in the market."

While it's not known if the company will target larger fleets, that leaves about 250,000 companies with fleets that would benefit from Multi Service. That's a huge market. It would appear the company wouldn't stop there, but target the next level up as well, although there are no numbers to quantify what that would add to the bottom line of the firm.

Another growing area is the railcar business, which transports oil from various areas of the country. Now operating about 2,000 railcars in the Bak! ken Shale! in North Dakota, it only accounts for about 5 percent of the oil being transported from that one region. This shows the growth potential in that market when considering only one formation.

Not taking into account expected future acquisitions, World Fuel Services looks like it'll continue to grow out its Marine and Aviation businesses, while counting on its Land business to do the heavy lifting as far as future growth goes. Combine them together and this company will continue to generate terrific returns for its shareholders.

What's interesting to me is over the last three years the company has been trading flat, and with the pieces having been put in place, and the focus on growing out its Land segment, I see it poised to breakout in the near future, pushing towards the $50.00 a share mark or higher.

If the Marine segment continues to improve and Aviation grows some, then it looks like a surety that World Fuel Services will continue its trajectory because of its growing Land business.

Consideration has to be made for the fact the global economy has been very weak over the last several years, and for World Fuel Services to find support in a range of about $35.00 a share to $40.00 a share, testifies to its underlying strengths.

Add on the fact the company makes good acquisitions and has its eyes on more going forward, there is a continuing growth story here. It's getting close to the time when investors need to take a very close look at the firm, as one more dip may be the prelude to a nice upward run. The market appears to be waiting for an excuse to reward World Fuel Services again, and one significant acquisition, along with a good quarter, should be the fuel that provides it.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment