Since the summer, we've advocated transitioning out of overvalued defensive sectors such as consumer staples in favor of cyclical groups such as industrials and consumer-discretionary names that stand to benefit from a strengthening U.S. economy.

Although the length of the government shutdown will affect U.S. economic growth in the fourth quarter, recent data points reinforce our confidence in this weighting and macro outlook.

Consider, for example, the recent strength exhibited by the Institute for Supply Management's (ISM) U.S. Manufacturing Purchasing Managers Index (PMI), and indicator has a long track record of signaling major inflection points in the domestic economy.

(Click to enlarge)

Source: Bloomberg

This index is based on a survey of managers at manufacturing companies. Readings greater than 50 indicate an expansion in manufacturing activity; PMI values less than 50 correspond with a contraction. As a rule of thumb, investors should be wary of a recession when the manufacturing PMI drops to 45 or 46.

Although PMI often spikes to between 55 and 60 when the economy springs to life after a recession, readings in this range are rare this far into a recovery. In this light, the September PMI value of 56.2 suggests that the U.S. economy has finally accelerated after muddling through period of subpar growth in 2011 and 2012.

Revving Up for Growth

After suffering through one of the most trying periods in its history, U.S. automakers have emerged financially stronger and stand to benefit from a number of tailwinds in the domestic market.

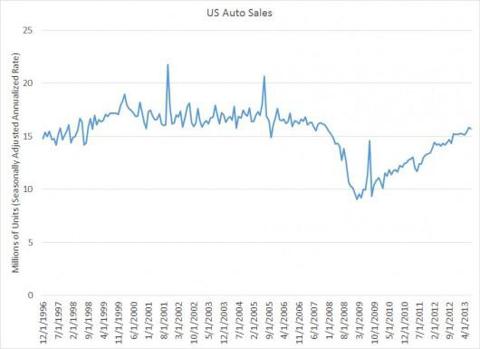

At the end of 2012, the median age of passenger vehicles still on the road in the U.S. touched a record high of 11.4 years, compared to about 9 years a decade earlier. This trend stems from the 2007-09 financial crisis and Great Rece! ssion, when sales of new cars and trucks collapsed from a pre-crisis range of between 15 and 18 million vehicles to less than 10 million at the height of the downturn.

(Click to enlarge)

Source: Bloomberg

Faced with the worst economic downturn since the 1930s, Americans put off purchasing new cars for a few extra years. Although total miles driven by passenger vehicles has declined by about 15 percent from pre-crisis levels, the average U.S. driver still puts between 12,000 and 14,000 miles on his or her car each year. Most vehicles have a useful life of 150,000 miles to 200,000 miles; the rising age of the U.S. automobile fleet implies that many of these cars will need to be replaced in coming years.

Not only should a strengthening U.S. economy and declining unemployment rate support the ongoing recovery in sales of new cars and trucks, but the rising price of used cars-up more than 20 percent since their 2008 low-should also encourage this trend.

(Click to enlarge)

Source: Bloomberg

The uptick in the price of used cars makes new vehicles more attractive to prospective buyers and limits the extent to which automakers need to discount the latest models to drive sales.

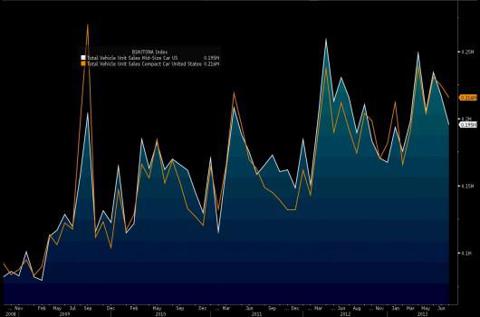

At the same time, a secular shift is under way in the types of vehicles that consumers prefer. Concerns about rising gasoline prices have boosted demand for fuel-efficient compact and midsized cars such as the Ford (F) Fusion, the Nissan (NSANY.OB) Altima and the Honda (HMC) Accord. All three models have sold well this year.

!

!

(Click to enlarge)

Source: Bloomberg

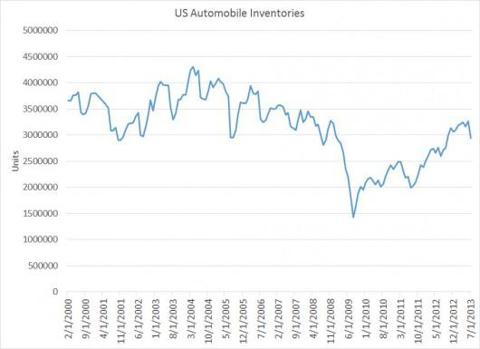

And although U.S. automobile inventories have ticked up from their 2008-09 low, the supply of new cars on dealers' lots is modest relative to pre-crisis norms. A glut of new cars usually forces dealers to discount aggressively, a trend that crimps automakers' profit margins. This headwind has yet to emerge in the current cycle.

(Click to enlarge)

Source: Bloomberg

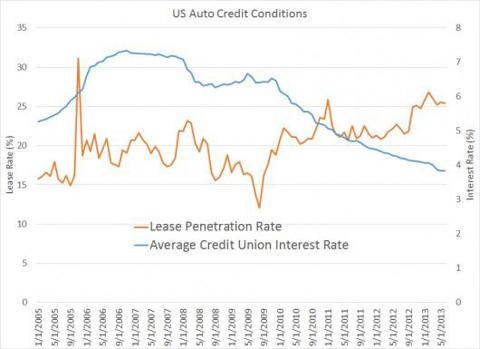

Credit availability and affordability have also improved dramatically, which should continue to fuel sales of new cars. Although interest rates have ticked up slightly this year, the cost of financing the purchase of a new vehicle remains near a record low. Favorable lease terms have also attracted buyers; leasing agreements now account for more than one-quarter of all new-automobile sales.

(Click to enlarge)

Source: Bloomberg

Whereas the U.S. media tends to focus exclusively on the domestic automobile market, growing demand for new passenger vehicles in China and other emerging markets represent an important upside driver for carmakers.

Despite slowing economic growth in China, sales of new cars and trucks have remained robust in the world's largest automobile market, growing about 12 percent from a year ago through the first seven months of 2013.

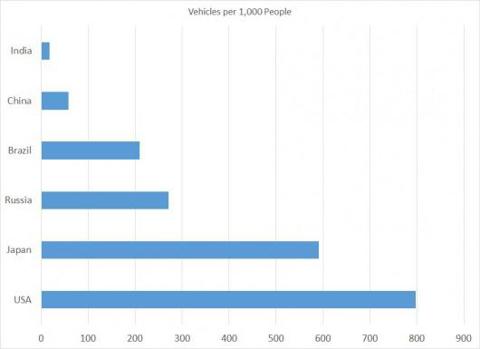

This powerful, secular growth trend appears to have legs. China, for example, averaged 58 passenger vehicles per 1,000 people at the end of 2010, compared to almost 800 cars per 1,000 people in the US.

(Click to enlarg! e)

Pole Position

The only major U.S. automaker to avoid bankruptcy during the Great Recession, Ford Motor Company boasts the best-positioned product lineup to take advantage of improving automobile sales in the U.S. and long-term demand growth in China and other emerging markets.

Up until a few years ago, the carmaker had faced unwieldy (and increasingly underfunded) pension obligations as the legion of retired workers grew. These other post-employment benefits (OPEB) included generous health care packages for retirees and their spouses that lasted for the remainder of their lives.

The Big Three U.S. automakers-General Motors Company (GM), Ford Motor Company and Chrysler-in 2007 inked a new collective bargaining agreement with United Automobile Workers (UAW), the union that represents industry workers. This contract enabled the carmakers to shift their long-term health care liabilities into Voluntary Employee Beneficiary Associations (VEBA), trusts managed by a board of independent and UAW-appointed members.

Not only did this deal protect retirees' benefits against potential bankruptcy among the Big Three, but the agreement also effectively shifted these unfunded OPEB costs from the automakers' balance sheets.

Subsequent negotiations paved the way for a series of deals that established a two-tiered compensation structure whereby Ford Motor Company's new hires are paid on a lower scale than veteran workers. Second-tier employees start at $15.00 per hour and could earn up to about $20.00 per hour, while the hourly wage of longer-tenured autoworkers tops out at about $28.00 per hour.

Many of the new workers that the carmaker has hired this year to ramp up production of the popular Ford Fusion model are entry-level, second-tier workers that earn a lower hourly wage. In aggregate, tier-two employees account for as much as 20 percent of Ford Motor Company's workforce-a significant cost saver that enables the firm to better compete with f! oreign ca! rmakers.

Ford Motor Company won't need to worry about renegotiating this advantageous contract until the current deal with the UAW expires in 2015.

Although playing hardball with the union has enabled Ford Motor Company to lower its cost structure, our bullish investment thesis reflects a number of other company-specific developments.

For one, the restructuring plan designed and implemented under CEO Alan Mulally has simplified the firm's operations dramatically by reducing excess manufacturing capacity and paring its extensive portfolio of brands.

This so-called One Ford initiative involved the US$2.3 billion sale of Jaguar and Land Rover to Tata Motors (TTM) and the US$1.6 billion divestment of Volvo to Geely Automobile Holdings (GELYF.PK). After selling the majority of its stake in Mazda Motor Corp (MZDAY.PK) and discontinuing Mercury, Ford Motor Company's portfolio consists of its eponymous mass-market brand and the higher-end Lincoln.

Under Mulally's leadership, Ford Motor Company has rationalized the number of production platforms-each of which included unique parts or were specific to individual countries-to five core platforms that account for 80 percent of the firm's models. Management plans to transition the company to nine shared platforms that represent about 99 percent of the carmakers' automobiles.

This strategic move should improve the auto company's economies of scale by enabling the firm to negotiate quantity discounts on parts and minimizing costly factory retooling. Equally important, Ford Motor Company will be able to adjust production to meet changes in consumer taste and demand.

The use of common platforms has also allowed the carmaker to accelerate the introduction of new models. Over the next three years, Ford Motor Company will update each of its major models, keeping the average age of the car designs in its showroom at about 2.3 years-well under the industry average of about 2.7 years. As newer designs usually sell better and co! mmand hig! her prices than legacy models, the carmaker's commitment to maintaining a fresh product lineup should also bolster the firm's profit margins.

And Ford Motor Company's new lines of fuel-efficient cars, especially the Fiesta and Fusion, have proved popular with consumers. In July 2013, the average Ford Fusion sat on a lot for only 31 days before selling, an impressive sales rate that prompted the automaker to add 1,400 workers to the production plant in Flat Rock, Mich., that builds the car.

Outside the US, the carmaker has a number of initiatives under way to grow its sales in China, where the company plans to double its product lineup by year-end and continues to remodel and refresh its showrooms. Management expects its dealer network in China to expand to more than 900 locations by 2015 from 600 by the end of 2013. Robust demand for Ford Motor Company's new models in the second quarter bolstered the U.S. automaker's share of this key growth market by 150 basis points from a year ago, to 4.3 percent.

Ford Motor Company has also put its financial house in order, using the free cash flow generated by its increasingly popular lineup of cars and light trucks to reduce debt and return capital to shareholders. The carmaker has amassed a about $25 million in gross cash and has access a $10 billion unsecured revolving line of credit-in line with management's goal of maintaining $20 billion to $30 billion in excess liquidity as a safeguard against another downturn.

This company's strong balance sheet and improving growth prospects prompted the firm to double its dividend in the first quarter to $0.10 per share, equivalent to an indicated yield of 2.4 percent at the stock's current quote.

Ford Motor Company has also deployed some of its excess cash is to pay down its unfunded pension liability. Management addressed these obligations in a July 24 conference call to discuss second-quarter results, noting that the company has completed about 60 percent of the lump-sum program and i! ndicating! the this funding shortfall could be eliminated as soon as next year.

The company continues to reduce the risk of its pension portfolio, reducing its exposure to equities in favor of steadier, fixed-income securities. Although Ford Motor Company doesn't update its pension liability each quarter, the firm contributed $2.8 billion in the first half of 2013 and plans to allocate $5 billion this year. The carmaker should also benefit from the recent uptick in the benchmark U.S. interest rates; the company can assume a higher return when calculating its liabilities, effectively reducing its need to contribute capital to the plan.

Unfunded pension liabilities have weighed on Ford Motor Company and have been the subject of considerable discussion during quarterly conference calls. Resolving the firm's unfunded liability would be a significant upside catalyst for the stock.

Valuation

With a price-to-forward-sales ratio of 0.46, Ford Motor Company has one of the lowest multiples in the S&P 500; however, the stock's current price-to-sales ratio is in line with the 0.44 times sales that the shares fetched in the 1990s.

Fortunately, several factors suggest that the company should command a higher valuation in coming years.

First and foremost, the complete transformation of the U.S. auto industry should find favor among investors. The unfunded liabilities, inefficient manufacturing practices, excessive debt and bloated cost structures no longer plague the Big Three.

From 1997 to 2000, U.S. automobile sales stood at similar level to today. At the time, shares of Ford Motor Company traded at roughly 11 times to 12 times earnings, compared to the stock's current price to earnings level of less than 10. At a valuation of 12 times next year's estimated earnings, Ford Motor Company would be worth $21.00 per share. Given the company's improving profitability and the recovery in U.S. car sales, the carmaker's shares could be due for a major rerating.

U.S. automaker! s aren't ! the only way to gain exposure to the secular trends that are driving car sales. Roger Conrad and I will host a free webinar on Oct. 15, 2013, to discuss our favorite stocks and investment themes for 2014, including an industrial name that stands to benefit from the resurgence in global automobile sales and the ongoing push for improved fuel efficiency.

Source: How To Profit From Resurgent Global Car SalesDisclosure: I am long F. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment