DELAFIELD, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for $10 a share or less don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

Just take a look at some of the hot movers in the under-$10 complex from Thursday, including InfoSonics (IFON), which is exploding higher by 42%; FreeSeas (FREE), which is ripping higher by over 30%; NewLead (NEWL), which is spiking higher by 17%; and North American Palladium (PAL), which is soaring to the upside by 16%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

One low-priced stock that has exploded higher since I featured it recently is defense and security products player Arotech (ARTX), which I highlighted in Nov. 21's "5 Stocks Under $10 Set to Soar" at $2.07 per share. I mentioned in that piece that shares of Arotech were spiking higher at the time back above its 50-day moving average of $1.84 a share with above-average volume. This move was quickly pushing shares of ARTX within range of triggering a major breakout trade above some near-term overhead resistance levels at $2.35 to its 52-week high at $2.71 a share.

Guess what happened? Shares of Arotech didn't wait long to trigger that breakout, since the stock started to take out those key overhead resistance levels in early to mid-December with strong upside volume flows. Shares of ARTX have done nothing but uptrend strong since I flagged the stock, with shares tagging a new 52-week high a few days ago at $3.91 a share. That represents a monster gain of close to 90% in a very short timeframe.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

I'm not as eager to recommend investing long-term in stocks that trade less than $10 a share because these names can be very speculative, and the odds for picking the long-term winners aren't great. But I definitely love to trade stocks that are priced below $10. I like to view them as a trading vehicle with lots of volatility and lots of upside when the trade is timed right.

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

Coronado Biosciences

One under-$10 biopharmaceutical player that's quickly moving within range of triggering a major breakout trade is Coronado Biosciences (CNDO), which is focused on novel immunotherapy biologic agents for autoimmune diseases and cancer. This stock has been hit hard by the bears in 2013, with shares off by 43%.

If you take a look at the chart for Coronado Biosciences, you'll notice that this stock has been uptrending strong since it double bottomed in November, with shares moving higher from its low of $1.25 to its intraday high of $2.58 a share. During that uptrend, shares of CNDO have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of CNDO within range of triggering a major breakout trade.

Traders should now look for long-biased trades in CNDO if it manages to break out above some key overhead resistance at $2.70 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action of 1.97 million shares. If that breakout hits soon, then CNDO will set up to re-fill some of its previous gap down zone from October that started near $7 a share. Some possible upside targets if CNDO gets into that gap with volume are $4 to $5 a share.

Traders can look to buy CNDO off any weakness to anticipate that breakout and simply use a stop that sits right around some key near-term support at $2 a share. One can also buy CNDO off strength once it takes out $2.70 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Active Power

Another under-$10 electrical components and equipment player that's starting to move within range of a near-term breakout trade is Active Power (ACPW), which designs, manufactures and markets power solutions that provide business continuity and protect customers in the event of an electrical power disturbance. Its products deliver clean power, protecting customers from voltage fluctuations. This stock has hasn't done much so far in 2013, with shares off by 6.7%.

If you take a look at the chart for Active Power, you'll notice that this stock recently formed a double bottom chart pattern at $2.82 to $2.80 a share. Since forming that bottom, shares of ACPW have started to uptrend and move back above its 50-day moving average of $2.94 a share. That move is quickly pushing shares of ACPW within range of triggering a near-term breakout trade.

Market players should now look for long-biased trades in ACPW if it manages to break out above some near-term overhead resistance levels at $3.14 to $3.23 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 87,166 shares. If that breakout hits soon, then ACPW will set up to re-test or possibly take its next major overhead resistance levels at $3.65 to $3.76 a share. Any high-volume move above those levels will then give ACPW a chance to tag its next major overhead resistance levels at $4 to $4.20, or even $4.50 a share.

Traders can look to buy ACPW off any weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average at $2.94 a share, or near its double bottom zone at $2.80 a share. One can also buy ACPW off strength once it clears those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

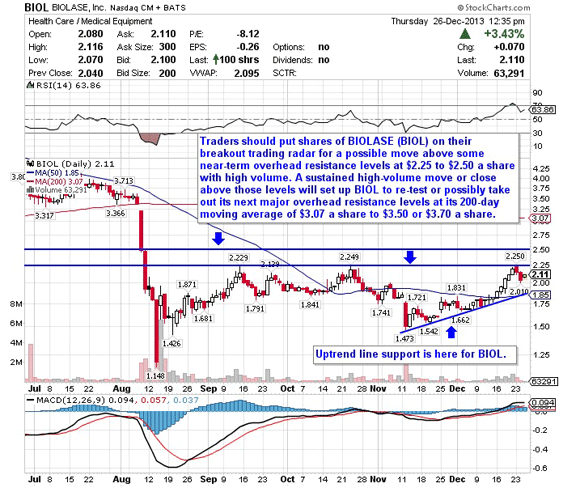

Biolase

Another under-$10 stock that's starting to trend within range of triggering a big breakout trade is Biolase (BIOL), which develops, manufactures and markets laser systems for dental and medical applications. This stock has been trending modestly higher in 2013, with shares up by 15.9%.

If you take a look at the chart for Biolase, you'll notice that this stock has been uptrending strong for the last month and change, with shares pushing higher from its low of $1.47 to its recent high of $2.25 a share. During that uptrend, shares of BIOL have been mostly making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of BIOL within range of triggering a big breakout trade.

Traders should now look for long-biased trades in BIOL if it manages to break out above some near-term overhead resistance levels at $2.25 to $2.50 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 311,533 shares. If that breakout hits soon, then BIOL will set up to re-test or possibly take out its next major overhead resistance levels at its 200-day moving average of $3.07 a share to $3.50 or $3.70 a share.

Traders can look to buy BIOL off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $1.85 a share. One can also buy BIOL off strength once it clears those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Neostem

Another under-$10 biopharmaceutical player that's starting to trend within range of triggering a big breakout trade is Neostem (NBS), engages in the development of proprietary cell therapy products. This stock has been hit hard by the sellers during the last three months, with shares off by 22%.

If you take a look at the chart for Neostem, you'll notice that this stock has recently spiked higher back above both its 50-day moving average at $6.41 and its 200-day moving average of $6.60 a share. This move has also pushed shares of NBS back above some near-term overhead resistance levels at $6.57 to $6.98 a share. That move is quickly pushing NBS within range of triggering another breakout trade above some key near-term overhead resistance.

Market players should now look for long-biased trades in NBS if it manages to break out above some near-term overhead resistance at $7.22 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action 327,514 shares. If that breakout triggers soon, then NBS will set up to re-fill some of its previous gap down zone from October that started just above $8 a share. If that that gap gets filled with volume, then NBS could easily tag its next major overhead resistance levels at $9 to $9.50 a share, or even its 52-week high at $9.89 a share.

Traders can look to buy NBS off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $6.41 a share, or near more support at $6 a share. One can also buy NBS off strength once it takes out $7.22 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

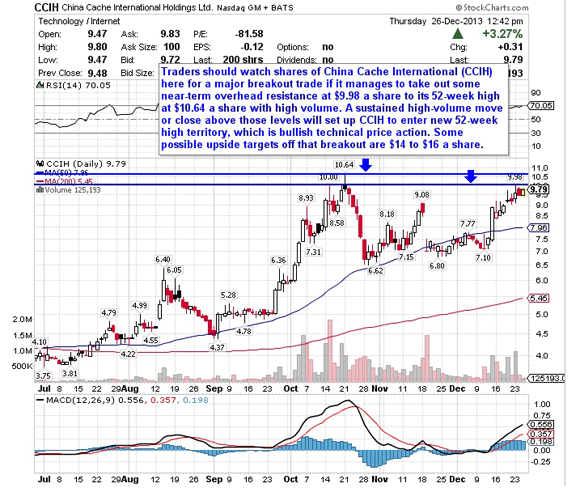

ChinaCache International

One final under-$10 stock that looks ready to trigger a major breakout trade is ChinaCache International (CCIH), a provider of Internet content and application delivery services in China. This stock has been on fire in 2013, with shares up huge by 160%.

If you take a look at the chart for ChinaCache International, you'll notice that this stock has been uptrending strong for the last month, with shares soaring higher from its low of $6.80 to its recent high of $9.98 a share. During that uptrend, shares of CCIH have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of CCIH within range of triggering a major breakout trade.

Traders should now look for long-biased trades in CCIH if it manages to break out above some near-term overhead resistance at $9.98 a share to its 52-week high at $10.64 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 503,461 shares. If that breakout triggers soon, then CCIH will set up to enter new 52-week high territory, which is bullish technical price action. Some possible upside targets off that breakout are $14 to $16 a share.

Traders can look to buy CCIH off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $9 or at $8.50 a share. One can also buy CCIH off strength once it clears those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Stocks Insiders Love Right Now

>>5 Cash-Rich Stocks That Could Pay Triple the Gains in 2014

>>5 Commodity-Drive Stocks to Trade for Gains

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment