The U.S. has been spending more than it makes for some time now, creating a significant deficit since the end of the Clinton administration (which grows on a daily basis and can be tracked to the penny). Just like any average American household, overspending can carry on for extended periods by rolling over debt and borrowing more and more money in what seems like a never-ending game of chasing our tail.

The government has become an expert at this process. Yet without its spending, some would say our economy could be in much worse shape - keeping the Keynesian theories alive that it's our government's responsibility to step in when needed. The battle rages between those who stand behind a balanced budget and those who tolerate massive amounts of national debt as part of our way of life, believing that financing it keeps our country moving along. While both sides argue, no one will really know the answer for many years as both spending and intake tug and pull at each other.

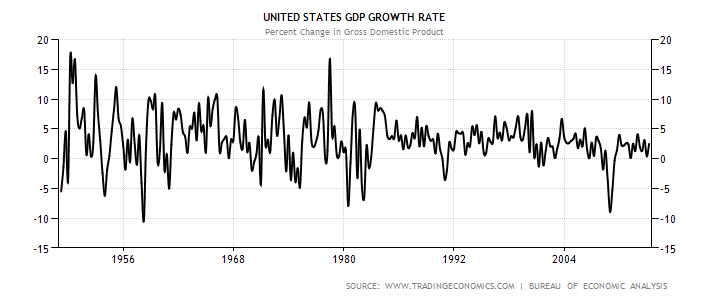

National GDP Growth Rate Has Slowed

When deficits start to reach historic highs, there is usually a strong push from Main Street to Congress to shift the deficit reduction process into high gear. Completely balancing the budget seems almost impossible, considering the heavy burdens in spending to which we have committed. But how did we get here so fast? In a nutshell, the economy has not been as healthy over the last 15 years as our historic numbers show. Historically, the U.S. economy has grown comfortably in the 4-5% range since the 1950s, yet we have only seen two such GDP growth years since the late 1990s. In the graph below, looking through the years, you can clearly see the tightening of the growth rates to a more narrow range and a higher frequency of recessions.

To encourage growth, among other tools, the government has been using deficit balances to push the economy forward with programs like the Bush tax cuts and government job programs, which are considered more elective. Costs that have been unavoidable are skyrocketing costs in Medicare, Medicaid and the tremendous military spending on what seems like never-ending wars in Iraq and Afghanistan. We have created quite a mess.

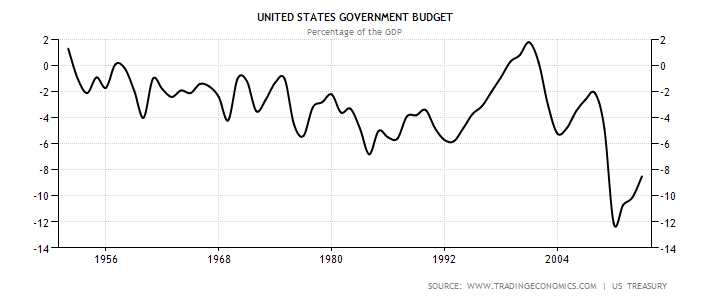

Shown below as a percentage of GDP, you can see that we have carried a deficit as it relates to GDP over long time periods, with only brief periods of nearly balanced budgets or an actual surplus. When we are at an 8.5% GDP level and the approximate average is around the 3% range, eyebrows start to raise.

Why Don't We Just Spend Less and Raise Taxes?

The main problem is that both options present risks and don't always offset each other like two moving targets. For example, simple spending cuts on government jobs could decrease the spending base of many government employees, which could create a slower-growing economy with fewer taxes to collect. On the income side, simply raising taxes can have the same effect by reducing disposable income for households and reducing corporate profits. This is exactly why the process of reducing a deficit is a delicate tradeoff, and politicians do a complex dance to get those results.

Imagine the pressure to begin spending cuts on so many vital services and programs. Where do you start, and what gets cut first? In 2012 expenditures exceeded revenues by over a trillion dollars, which explains how the cumulative effects contribute to the running total.

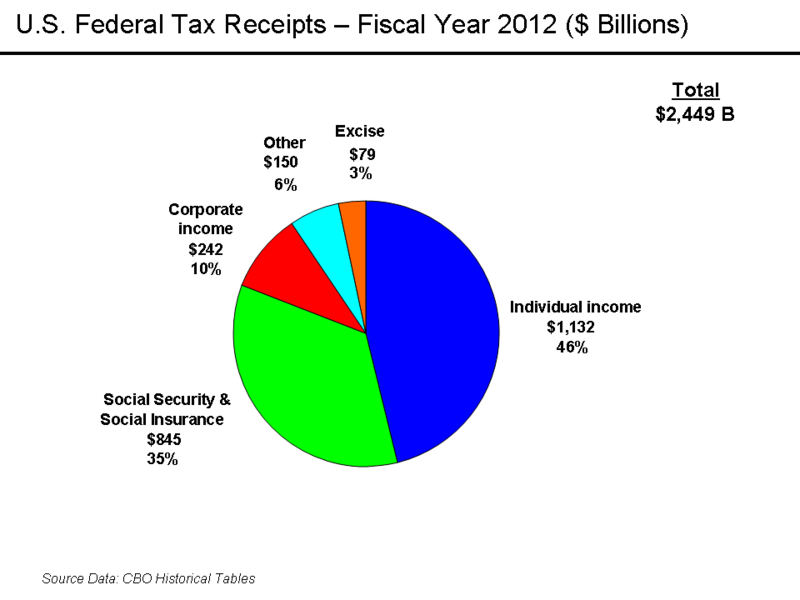

On the revenue side of the equation, individual taxpayers contribute nearly half of annual tax receipts and are usually the first group tapped for tax increases. Unfortunately, consumer spending makes up over 70% of our economic spending. This has become a very sensitive issue as our sentiment polls show, so taxing consumers first always presents risks.

So as we revisit the national debt growing every day, the question remains: Is it OK to run a deficit like we have for many years, or do we need to balance the budget?

Conclusion

The historical data tells us that for over 60 years, government has struggled to spend less than it takes in, making balanced budgets nearly impossible. Luckily, as a preferred borrower, financing government debt in the open market is effortless with the constant demand for U.S.-issued bonds around the world. Maybe this has made it too easy not to balance the budget. But over the last 15 years, the U.S. economy has reverted to a slower GDP growth path than we have seen in 60 years.

"Crowding out" private sector growth with government spending was proposed in the 1970s, but considering the anemic growth and high unemployment rates since the last recession, this is probably not a concern at this point.

It's a delicate task to balance the budget, as both sides need to meet in the middle. Just like someone stuck in credit card debt, kicking the can down the road is only a bandage repair. At some point, the credit collector calls and the game is up. In this case, we are our own collection agency watching over our debt. And we have had unpredictable rises in healthcare and military spending, making balancing spending nearly impossible. Maybe Keynes was on to something - we just never expected the intervention to cost so much.

No comments:

Post a Comment