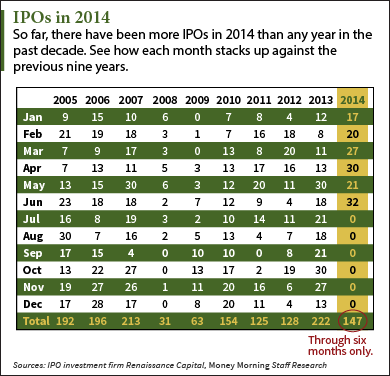

With 147 companies already going public this year, the U.S. market is on pace to see more IPOs in 2014 than any year since the dot-com boom of 2000 when 406 companies went public.

In fact, 2014 has seen more IPOs in six months than 2008, 2009, 2011, and 2012 saw all year.

In fact, 2014 has seen more IPOs in six months than 2008, 2009, 2011, and 2012 saw all year.

Last year, investors got a glimpse of the hot IPO market when 222 companies when public. But through the first half of the year, 2014 has seen a 60% increase in IPOs compared to 2013. Through June, 215 IPOs have been filed, which is up 92% from 2013.

Not only has the number of IPOs increased dramatically this year, the amount of money raised by IPOs is way up too. Through June, $31.5 billion was raised in initial public offerings. According to IPO investment firm Renaissance Capital, that's up nearly 53% from 2013.

For the most part, companies that have gone public this year have done well for early investors. Newly public stocks have averaged a gain of 14% on their first day and 20.4% overall in 2014.

Some of this year's biggest winners so far have been Zoes Kitchen Inc. (NYSE: ZOES) with a 129% return, Alder Biopharmaceuticals Inc. (Nasdaq: ALDR) with a 101% return, and Celladon Corp. (Nasdaq: CLDN) with a 100% return since hitting the market.

Most recently, action-camera company GoPro Inc. (Nasdaq: GPRO) has hosted one of the most exciting IPOs of the year. After pricing shares at the high end of its range, GPRO shares have surged as high as 108% from its offer price.

"As the recent GoPro deal underscores, the IPO market is white-hot right now," Money Morning's Executive Editor Bill Patalon said. "A brand-new report from Renaissance Capital says that IPO proceeds were up 42.4% in the second quarter on a year-over-year basis. Global IPO proceeds are up by the same amount year to date."

And the pace of the IPO market seems to be picking up as the year goes on. June 2014 was the biggest month for IPOs in the last decade, with 32 companies hitting the market. The fourth week of June alone saw 19 companies hold IPOs.

While many companies are riding the momentum of the "white hot" IPO market, some analysts are wondering if we're reaching bubble territory. Patalon addressed this question and broke down what investors can do to profit from 2014's IPO-heavy environment...

Is the IPO Market Reaching Bubble Territory?According to Patalon, the bubble speculation is justified at the moment - but not just because of the frenzied IPO market. The Federal Reserve's quantitative easing program has flooded the market with cash and is lifting the overall market.

"The bubble potential goes beyond just the IPO market," Patalon said. "You have a central bank that's pumped trillions of dollars into the financial system in the last few years. As I know from watching the markets for 30 years, cheap money always shows up somewhere."

But the potential for a bubble isn't a reason to flee the market. It's impossible to make money watching the markets from afar. If anything, the current market condition requires investors make smart choices and find the companies with strong business models, rather than just high flyers.

"You can't swim against the current. By that I am referring to the old adage 'You can't fight the Fed,'" Patalon said. "So you want to try and find a way to balance the two: the worry that, as the market goes higher and higher, the potential risks increase, as well. But you also don't want to just sit on the sidelines and get left behind."

"In my mind, that makes this very much a 'stock-picker's market.' You look to find stocks with real businesses, real brands, real customers, real markets, and real growth potential."

And while the IPO market has been "white hot" for the first half of 2014 - the second half will trump it. That's because one of the largest IPOs of all time is coming in the next several months.

Chinese e-commerce giant Alibaba is planning an IPO that some analysts estimate could raise $20 billion. That compares to the combined $31.5 billion that 215 companies raised in the last six months. Many projections have Alibaba valued at $168 billion, but recently, estimates have reached $221 billion.

And the best news about the looming Alibaba IPO is that it has created a major profit opportunity that most investors haven't yet noticed... It's happening now, months before Alibaba hits the market...

In fact, this could be your one and only chance to make the kind of gains normally reserved for the high-net-worth investors and bankers. You can learn more about this Alibaba profit play here.

Have you been investing in any IPOs in 2014? Join the conversation on Twitter @moneymorning using #IPOs.

No comments:

Post a Comment